Hot Local Money

Lots of chatter about foreign buyers out there these days. Not that this is a new topic by any means. Back when HouseHunt started there was already talk about the invasion of HAM (Hot Albertan Money) driving the local market. Since then it’s been alternately Americans, Asians, Aged, Australian, or anyone else that might scare local buyers into jumping in before we turn into Vancouver.

Recently it’s been over the news again, with some nice articles about how Vancouver drives out families, while Victoria is a true paradise ready to welcome them. Even the Oak Bay vanguard are trembling at the hordes supposedly coming from the east.

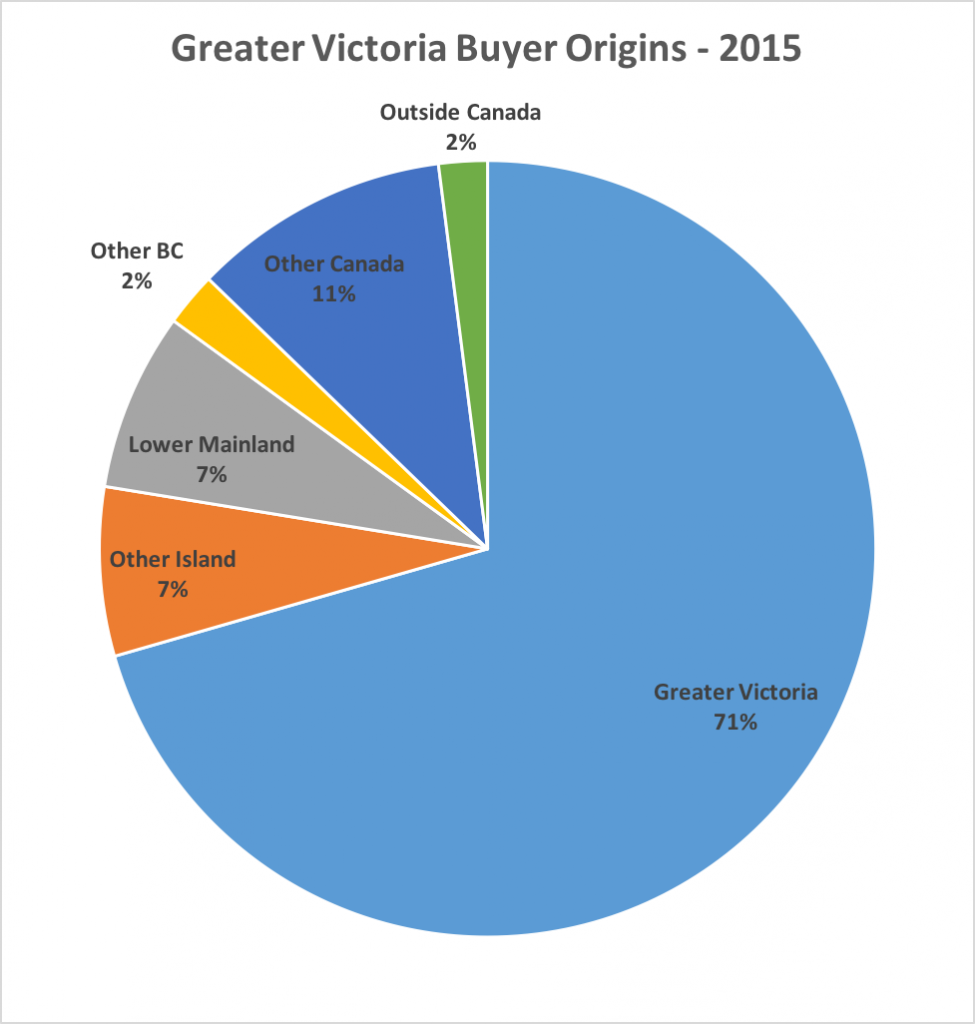

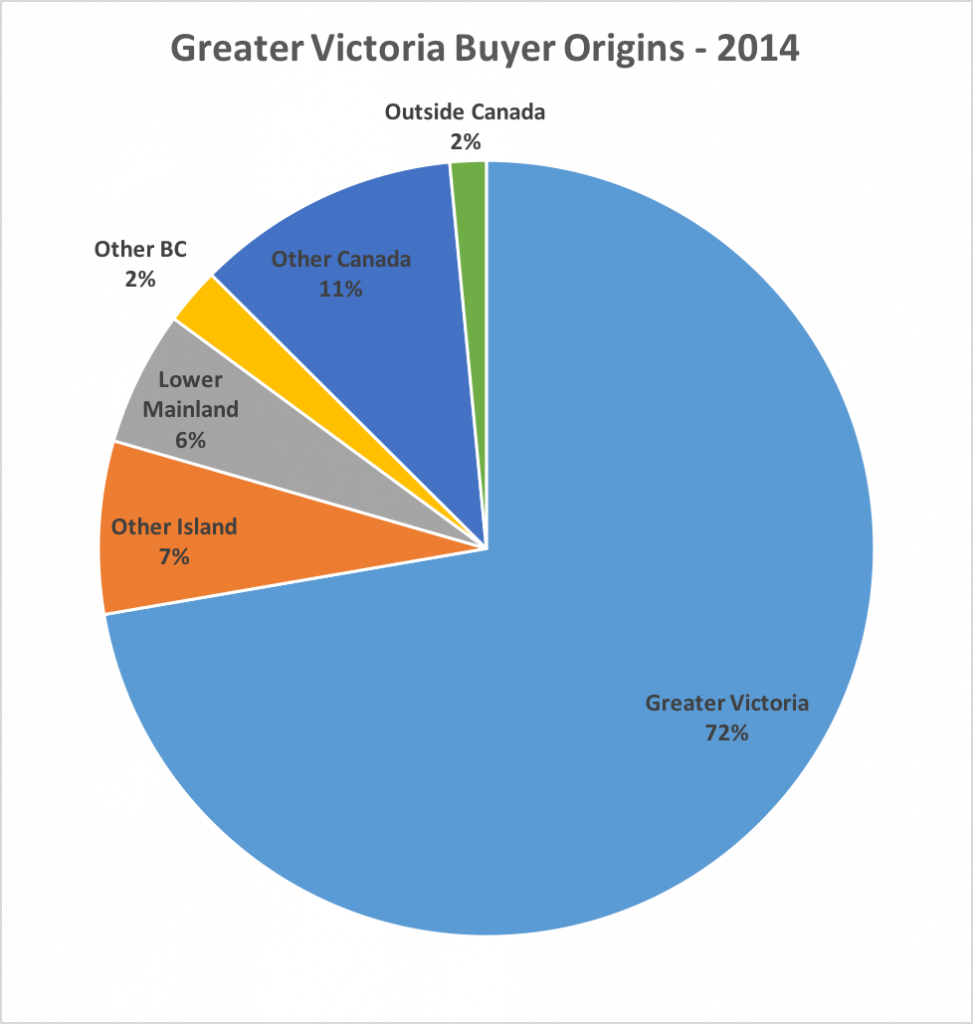

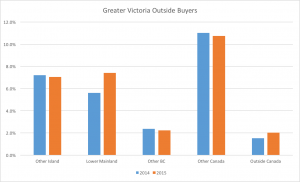

Data has been scarce so far, with only the Realtor’s buyers survey to go on, and that was quite spotty. However the VREB has recently compiled the statistics on buyer origin for 2015 and 2014* (coming to us via Marko Juras).

So Vancouver Islanders drive over three quarters of the market, and those from Greater Victoria account for the vast majority of those. So if anyone is concerned about buyers driving up prices, we know where to look.

But what of those… others? Well one might be concerned about those rich lower mainlanders. After all 7% of the market is nothing to sneeze at. But if we are worried about 7%, then we should be equally so about those north islanders selling their multi-million dollar houses in places like Cumberland, Gold River, and Port Hardy to distort our little market.

How are things changing? Well we also have data from 2014 and the answer is: hardly at all.

Despite a seemingly large jump in absolute lower mainland buyers from the 367 in 2014 (when the market was dead) to the 600 in 2015, the percentage isn’t that much different. If you’re a 100 mile diet kinda guy, you can rest easy in the knowledge that our market is entirely home made.

So the real question is. If realtors are collecting this kind of data, why in Vancouver do they have to resort to ridiculous methodologies like looking at how Chinese the names of buyers are?

*458 sales were not included because the buyer origin data was either incorrect or withheld by the buyer.

I tend to agree from what I’ve noticed lately. Hence this could be the year condos start to outperform or at least play some catch-up as some are predicting for Van.

http://www.vancouversun.com/opinion/columnists/barbara+yaffe+will+2016+year+condo/11698027/story.html

So if we’re presently at 1000 households per year, it’s a fair prediction that we’ll see an increase to 5000-6000 new households per year by 2020, based mainly on the increase in migration the last time we were in this situation 1986-1990. The one thing that could push it higher this time is the shear size of the retirement wave.

Thanks… so my rough estimate of 70-100 was correct (seasonally adjusted 😉 )… 1000/12=83

(BTW – that is only a 1% growth rate which has been the standard projection by the CRD since 1998)

You can get the stat for households too so you don’t have to guess at the number of additional renters/owners. It is approx. 1000 new households a year and there hasn’t been a huge increase yoy – as I posted below. Seems likely there are more singles and couples moving here than larger families – newly wed and nearly dead?

I wouldn’t put much faith in those gov’t projected numbers for Vic at ~1800/yr… “BC Stats applies the Component/Cohort-Survival method to project the population”.

A much better projection is to look back at annual net migration into BC from ‘86-’94 after the very similar oil crash of early ‘86 (many similarities to that time period)…

1986 11,518

1987 37,666

1988 54,533

1989 66,753

1990 68,673

1991 55,874

1992 69,055

1993 72,274

1994 77,116

Of course the numbers will be larger this time as populations are so much larger, but I suspect we get a similar acceleration of people moving here 2016-20 as 1986-90. The hard part is estimating what percent Victoria gets… ~1/10 (tenth)? 1/7th since boomers are starting to retiring? 1/6th because Van is getting too expensive? …tough to know for sure.

Do I have this right? Greater Victoria population growth is 2000 per year (or 200 per month roughly)? (or roughly 70 – 3person units or 100 – 2 person units)… that means increase in rentals/ownership requirements…

You can find the Greater Victoria actual and projected numbers here: http://www.bcstats.gov.bc.ca/StatisticsBySubject/Demography/PopulationProjections.aspx

For migration, just look to the quarterly numbers over the past year (Oct-Dec ’15 isn’t out yet)

2015

July-Sep +17,416

Apr-Jun +8,076

Jan-Mar +6,121

2014

Oct-Dec +308

That’s for all of BC, but I’ll give you a hint, there aren’t many people moving to our blue-collar interior. Quite the opposite, there’s been an extra flood of BC interior moving into Vic/Van.

No-one can predict exactly what will happen next. I’d say the best I feel confident with despite research is stating a guess about the next four months in Oak Bay and the adjacent areas. I also feel fairly confident that long-term a primary residence is a good investment in Victoria if you can ride out any downturns.

The earnest belief some people have in opinions based on nothing particularly solid or provable is wearing after time, particularly when facts that don’t fit are not addressed. I just skip these posts.

And part of the CL variation in housing wanted ads is likely due to the impact of affordability which is also influenced by vacancy rates and housing prices. Have kids or pets? Well, affordability just took another hit and you are more likely to end up on CL with a housing wanted ad. Unless you qualify for subsidized housing, rentals are not very affordable here. Less so in Vancouver.

I’m not sure about the migration theory JJ. There are stats on it. About 1000 households are added to Greater Victoria each year and the number does not appear to have dramatically increased. Of course students and military create some of the rental demand. Households who need to save up more money to buy may remain renters longer now – not sure.

You’re sounding like Ben Bernanke saying “there is no housing bubble”, there Mike. Everyone is wrong because it hasn’t happened, they just don’t understand us, we’re

different ! LOL

https://youtu.be/INmqvibv4UU

I feel sorry for the poor souls who listened to MacBeth’s 50% crash in 2014. If you did, you’re just another person in a huge crowd who missed the bottom. Meanwhile since he wrote his book, even his own city of Edmonton hasn’t budged for over a year now with recent signs of life.

Here’s an example of his 50% crash talk summer of ’14

http://www.mortgagebrokernews.ca/news/housing-crash-is-coming-says-portfolio-manager-182249.aspx

Sorry but Hilliard MacBeth is just another GT-like financial advisor who wrote a bubble book in 2014 who doesn’t understand our real estate markets. You’d think being an older financial advisor he’d see the similarities to the mid/late-80s how TO & Vic/Van can do amazingly well while the rest of the country stagnates. Nevertheless, I get why he has to keep banging his drum after writing his crash book.

You can’t have it both ways with CL.

The ratio of apartments for rent to apartments wanted in Vancouver (7125:1097) taken from Craigslist is 6.4 rentals posted for every 1 apartment wanted (source craigslist) during the time period that craigslist uses?.

Here are those ratios for BC’s largest CMA’s (source CMHC) compared to Craigslist.

Vancouver 0.8% Vacancy rate

CL ratio 6.4:1

Fraser Valley 0.8%

CL ratio of 4:1

Victoria 0.6%

CL ratio of 3.2:1

Kelowna 0.7%

CL ratio of 8.1:1

We don’t know the total number of rental units of all kinds. We do know the total given by CMHC for rental units

There are some 24,216 rental apartments in Greater Victoria City as per CMHC. A vacancy rate of 0.6% represents 145 vacant suites. Craigslist has 581 rentals listed today.

Compare that to Vancouver that has 106,945 rental apartments that would be 8,556 vacant rentals a 0.8% vacancy rate and Craigslist has 7,256 rentals listed.

The Fraser Valley has 3,978 rental apartments or 32 vacant suites and craigslist has 720 rentals posted.

The problem with CMHC canvassing, by telephone, owners and managers is that owners/managers are not paid for this information and basically just want to get off the phone and back to work. Anecdotaly speaking, the owners that I know say they have no vacancies even when they have them, as they feel this helps other landlords and they can get back to work sooner. Neither is CMHC contacting all apartment managers of the 24,216 units in Victoria, they are sampling the market so it would be nice to see how large the sample size was. Maybe they need a larger sample size in Victoria to be statistically correct.

There are people moving to Victoria and renting apartments and suites but there are also renters purchasing homes and leaving Victoria. And last year Greater Victoria had an increase in sales of 20 percent. Some of those purchases were made by renters. So there should have had to been a very substantial increase in migration to Victoria relative to previous years to account for the large drop in the vacancy rate.

That’s a piece of data I would like to see. If we haven’t had a very substantial increase in migration then there must be another reason.

https://youtu.be/o1nQi-uH1YA

One more just for LeoM and Mike.

When will the Vancouver real estate bubble burst?

Hilliard MacBeth thinks it might happen soon—and that it won’t be pretty when it does

“All bubbles burst,” he says, “and spectacular bubbles like the one in Vancouver burst in a spectacular fashion. It’s inevitable that there will be a correction.”

“The difference with this cycle is that there’s so much more debt around than there ever has been in the past. The debt levels in the Vancouver market are—at least for the local residents—much, much higher than anything that ever happened in Hong Kong in past booms.” And, as he points out, those past booms in Hong Kong’s housing market haven’t tended to end well for people who got in late. “There’s no way it doesn’t end badly.”

“Meanwhile, MacBeth thinks that the carnage that’s unfolding in Alberta’s housing market is almost certainly going to leak west across the Rockies. Because so many of their loans are starting to go sour in Calgary and Edmonton, Canadian lenders—the big five banks, basically—may have to cut back on their lending in other markets in the country. “It’s totally unfair, but this has happened so many times in the past. People that are actually in good shape financially and have good collateral and all that kind of stuff, they find it’s harder to get a loan because the banks screwed up in Alberta.”

http://vanmag.com/city/vancouver-real-estate-bubble/

MLS 359505 – 1321 George Street? Don’t see it on mls though the listing realtor still has it on his site. Curious about this one as I live close by and the asking price (initially 1.28 M, now 1.2 M) seemed excessive even for this market. I believe it sold 16 months ago for 980,000 which seemed steep at the time.

Geez LeoM, others can post several times a day but if they’re pumping it’s OK but opposite opinions aren’t allowed ? Maybe skip my posts if it upsets you so much.

Sorry to pop your bubble but everyone in Canada has wanted to move to Victoria for decades but only few do. Right now it’s a media ripple that happens all the time, just like people that leave Victoria which no one tracks.

Best you tell Mike you can’t use old historical trends to predict RE, he might get upset as he forgot about rising interest rates, HELOC’s and historical personal debt levels that will far offset price rise potential versus a handful of retirees buying a condo at the Hud.

How come they didn’t come here over the last 5 years while sales were down and prices flat and they had already made big money in Vancouver, Calgary, Toronto etc but only when prices rise ? It’s a short term trend hyped by the media. Times haven’t change LeoM, retirees come here, retirees die, it’s the cycle of Victoria life.

We all hear you Hawk, several time each day… And you’re right, we are not Vancouver; but we are Victoria; and it’s clear that certain demographics prefer Victoria over Vancouver. Now that the wave of retiring Canadian DINK baby boomers are selling their homes and selling their Arizona and Florida vacation houses, where will they go next? Victoria. And that’s just one demographic segment. There are thousands of Canadians who want to move to Victoria; times have changed Hawk; you can’t use old historical trends to predict RE in Victoria. It really is different this time.

“I mean all you really have to do is look to say Van‘s west side presently at 3.5M median where that shack in the media on the 33′ lot is listed at 2.4M, and the question becomes “why wouldn’t Victoria‘s median get to ~1.3M over the next ~8 years?””

Because we’re not Vancouver. We’re not a major city, and not flooded with billions of shady money that is gone to insane levels that are about to crash when the cash stops coming. We also have a completely different dynamic of our economy and incomes. You really want to live here with those numbers ? People will leave here in droves, the rents will never support the incomes with zero and one percent raises for most people these days.

Not to mention you’ll be making your own coffee at Timmy’s as $10/hr won’t cut it and your rentals will have cobwebs as your “transitional” tenants move down to the next tent city.

“It will correct here one day and these people that overpaid so much will feel like a bunch of chumps.”

Another voice of sanity. Overpaying the same percent (or more) as the annual price rise is financial suicide.

Winter is notoriously the tightest rental season, not sure what the big tadoo is. I see a slew of new rental listings came out yesterday as it does beginning of every month as people give notice. Listings will increase as people who plan to leave Victoria when school ends or they just got fed up with Victoria. Happens every business cycle peak.

Brown Bros. has 21 apartments/condos to rent, some with multiple suites. If you need somewhere to live you can find it.

It’s not just craigslist. It’s a combination of things. It’s the CMHC vacancy rate, which definitely translates across to private suites, even though it is not the same. It is driving around and seeing a bunch of “no vacancy” signs when there used to be lots of vacancies. It’s looking at craigslist and seeing rental prices increase along with want ads. They’re all indicators of a tight rental market. None of them individually are hard and fast, but all together we can pretty safely say what is going on out there.

I would hope that most reasonable people would understand that CL was not designed to be a measure of the vacancy rate in a town. Taking a snapshot of 4 different cities on the same day shows that there is no correlation with CMHCs published rates. If someone wanted to they could track the ads over a month.

It isn’t just that the vacancy rate is low, the question is why did the vacancy rate drop so much so quickly. No other city had this happen. Why Victoria?

The guess that has been put forward is migration. But we have had strong migration before and the rate did not drop like this.

Does a low vacancy rate also mean there is a high demand for housing? The two do seem to be diametrically opposed. A high demand for rentals also means a high demand for housing?

My opinion was that more empty nestors are selling their homes and are turning to renting and not buying. That would be a new trend and would drop the vacancy rate. But they are not renting the 1970’s apartments or basement suites, they now have an option of a new downtown apartment at rents over $1,300 a month in the Hudson, or another 200 units to be built by Bosa and another 135 units to be built in Uptown.

Now how about that high demand. Well Victoria’s volume of sales did increase but other cities had much higher increases in sale volumes and prices. So my opinion is that we should have done a lot better. And that could be that some home sellers were not buying a new home, as they did in the past, but moving to a rental instead and putting a ton of cash into their bank account.

And that’s it – that’s my theory. Home sellers now have an option to rent rather than buy. They could have rented a condo but I think they want the security of a rental. No condo owner is going to sell their home and make them move. Because the only thing that I see that has changed in Victoria is the trend to a high end rental market that began with the Hudson.

Is this really such an evil thing to opine?

People are rock stupid when they get into these bidding wars and pay $150k over asking etc. They probably think they’re being smart now by “getting in before they’re priced out forever”. I’m sure they thought that in the States as well.

It will correct here one day and these people that overpaid so much will feel like a bunch of chumps. Always happens. Happened in the US, Japan, Spain, Ireland, and now appears to be correcting in Hong Kong. It’s really no different here in Canada. You can see it correcting in other provinces like Alberta, and it will come to BC eventually.

Often people can’t see a bubble until it pops. I’d be very wary buying a house in the current market. Look at the following link which lists off the various housing bubbles that have happened worldwide. We’ll be on the list sometime down the road as well.

https://en.wikipedia.org/wiki/Real_estate_bubble

For individual countries, see:

Australian property bubble – 1994–2015

Baltic states housing bubble

British property bubble

Bulgarian property bubble

Chinese property bubble

Danish property bubble

Indian property bubble

Irish property bubble – 1999–2006

Japanese asset price bubble

Lebanese property bubble

Polish property bubble

Romanian property bubble

Spanish property bubble

United States housing bubble – 1997–2006[28]

I still can’t see why it would be different this time…10yrs up, 4 down since at least 1971 (about as far as we have data). Bearishness is definitely what you want to see at this stage of the 2013-’23 up cycle.

As I’ve been following our ‘80s repeat’ in lockstep past few years (currencies, RE, oil, migration…..) I think we could see something similar to the ~160% gain between ‘85-’95. I mean all you really have to do is look to say Van‘s west side presently at 3.5M median where that shack in the media on the 33′ lot is listed at 2.4M, and the question becomes “why wouldn’t Victoria‘s median get to ~1.3M over the next ~8 years?”

Vacancy levels and sales numbers were similar as back in 2007 and 2008 when financial markets started tanking but apparently the owner experts don’t see any correlation. Go figger when you live inside the bubble.

As the Vancouver agent on Global said, sooner or later people stop paying atrocious over bids,(eg. 75K over asking for a Victoria 50’s blase stucco box) and say “I’m out”.

CL is the place to go for housing in Gatineau. Look at the posted ads JJ. Loads. I posted the link.

The rest of your theory does not appear reliable to me. If you don’t believe there is low vacancy and high demand for housing in Victoria after reviewing CL and CMHC maybe you are right – you will just never be able to estimate what is going on.

Monthly price and sales numbers are highly variable and should not be used as a point of comparison. Similarly daily postings to craigslist are highly variable and should not be used for anything.

You’re concentrating on the noise, not the signal.

I don’t think Craigslist is reliable information because you have no idea of how many of those want ads have been filled.

Here’s a thought. Craiglist gives you the option to find out how many want ads were posted for that day. You can compare that to how many rentals were advertised for the same day.

Vancouver posted 1477 rentals today and 2,735 want ads for housing

Victoria posted 90 rentals today and 9 want ads for housing.

The Fraser Valley 80 rentals today and 10 apartment want ads

Kelowna 9 rentals and 1 apartment want ad

Vancouver has a higher vacancy rate that Victoria but according to Craigslist there are twice as many want ads as rentals posted today. Victoria had 10 times more rentals advertised than apartments wanted today which is similar to the Fraser Valley and Kelowna.

As for Gatineau the answer could be as simple as knowing that few people use Craigslist in Quebec to buy, sell or rent.

There are people in the world that believe in astrology and the Romans used chicken entrails to guide their life decisions so why not craigslist for investing.

It’s not just Vancouver core that’s insane. Looking at a mediocre rancher in White rock: bought in 2004 for ~$280,000. Sold in 2010 for $440,000, now valued at $650,000 with a $100,000 increase last year.

It seems even the people in outlying areas are getting very squeezed.

Vacancy rates are relevant to both rents and home prices and imo JJ.

A strong rental market supports RE investment. A poor one the reverse. Low vacancy rates also increase motivation to purchase.

CL data demonstrating more than 140 wanted ads for housing in the Victoria core is evidence of extremely strong demand and low vacancy rates. Go to Gatineau – one of the higher vacancy rate areas in Canada and you find a lot of places posted on CL for rent and exactly zero want ads.

I would use this type of data when making investment decisions, along with other factors.

http://ottawa.craigslist.ca/search/hou

Ditto on the same for your Craigslist data – Totoro

And your point being? I’m not sure how your allegation that people in Victoria aren’t paying income tax on rental income has any relevance to the discussion or to you personally unless you are doing this. You know what, a lot of servers don’t claim all their tips. Some people work for cash under the table. All of them run the risk of an audit that results in penalties and interest. None of it is relevant to the discussion at hand. If you’d like to discuss tax fraud then I don’t think this is the right place unless you can tie it in with some trend in the housing market that has significance to house prices or vacancy rates.

“Not paying tax on income is illegal”

Now you’re catching on.

I didn’t say that, I said vacancy rates will move together because apartments can be substituted for private suites. They are not independent.

If vacancy rate in apartments drops from 3% to 0.5% we can be certain that the vacancy rate in private suites also dropped. It might be very different maybe it went from 6% to 2% but it forms part of the same market.

“We’ll never know”. Good grief. The problem is not lack of data imo. The CMHC data appears statistically valid from my perspective and applicable to non-registered housing units. This is borne out by those who are currently looking to rent and if you want data just look at the 160! want ads on craigslist for apartments/suites/houses in the core area. 143/160 are looking in the area between downtown and Jubilee hospital.

http://victoria.craigslist.ca/search/hou

I think CMHC includes structures with as little as 3 rental units.

I guess we will never know if that is true or not. No one has the data.

I don’t consider a one-bedroom apartment to be the same as a one-bedroom basement suite. For those that own a pet try to rent an apartment. Anyone that has a pet will tell you how difficult it is to find a place. And the rents are not the same either. Older apartments are generally less expensive than basement suites.

Vacancy rates can vary greatly from one location to another. Low vacancy rates for downtown condos and much higher rates for apartments in Esquimalt.

The vacancy rate will be lower for homes near the university and higher for those away from main bus routes.

There is no reason for vacancy rates to be the same for all properties in all locations.

CMHC only looks at apartment buildings not suites or houses. But as Totoro said, they are all part of the same market. It is not possible for vacancies to change radically in apartment buildings while remaining unchanged in private suites.

Again, you are confused. To be clear, renting your whole house out is legal and this has nothing to do with cra. Not paying tax on income is illegal and has everything to do with cra. Most people renting their homes out who have purchased in the last 10 years in Victoria will owe little in the way of taxes from rental income but they do need to fill in the form for this. Those owning rentals longer may wish to borrow against equity to invest to increase deductions or just pay tax.

I haven’t read the details of that case but if you are alleging Canadians are obtaining mortgages by fraud en masse I’d say the percentage is very low. The requirements to substantiate income include, among other things, notices of assessment and proof of assets. And you don’t get to walk away from mortgage debt Canada.

I’ll bet whatever occurred in the Ponzi scheme will lead to some policy changes.

“How are there any “illegal” whole house rentals? You are allowed to rent your house out in all the municipalities as far as I’m aware.”

Never heard of Rev Canada ? I thought you knew it all being a landlord.

“As far as mortgages go, Canadian banks have very different lending criteria than the US system had. I’m not concerned about a meltdown there.”

Yeah sure, they miss this guy and every single joe average gets scrutinized ? I highly doubt it.

TD missed ‘warning signs’ about notorious fraudster, lawsuit alleges

“Allen Stanford, the Texas-born ex-billionaire responsible for one of the world’s largest Ponzi schemes, is serving a 110-year sentence in a Florida prison. But outside those walls, other legal battles over his massive fraud are still being waged and involve one of Canada’s largest financial institutions: Toronto-Dominion Bank.”

http://www.theglobeandmail.com/report-on-business/industry-news/the-law-page/td-missed-warning-signs-about-notorious-fraudster-lawsuit-alleges/article28467721/

How are there any “illegal” whole house rentals? You are allowed to rent your house out in all the municipalities as far as I’m aware.

Stats are what they are – they use sampling. If unregistered secondary suites are not sampled it does not mean they are experiencing some radically different vacancy rate than condos, duplexes or houses are.

I think there will be more inventory in the core in spring but most likely prices will be up as well. I have no idea for how long.

I don’t believe the substitution effect sees a decline in the number of purchasers for higher end homes or homes in the core at all.

There are more than enough buyers to go around for anything under a million as far as I can tell. At least in Oak Bay and bordering areas. The “affordability ceiling” should exist in Vancouver but it has had no effect. People very motivated to own a house in a rising market – even getting loans and co-signers from family. In Vancouver there are even mixer mortgages that allow families to buy a home together.

As far as mortgages go, Canadian banks have very different lending criteria than the US system had. I’m not concerned about a meltdown there. I’d be more concerned about the impact on new purchasers of a significant increase in rates than anything else.

It’s just a reality of Victoria City that there are not many older homes suitable for young families in the City to rent. Most homes are small two-bedroom houses with unfinished basements built for retirees.

And Victoria City is kind of special in that so many homes were built with just two-bedrooms on the main living level. Probably unique relative to other cities in Canada.

A lot of our housing was built with economy in mind having a small finished floor area to save on construction costs. And that frugality continues today as people rather renovate than demolish in order to save on costs.

Generally the contributory value of the vacant lot has to be 90 percent or more of the total value before a builder would consider the home to be a knock down. But someone else looking for a home would renovate the house with paint, laminate floors and home depot cabinets. Spending a lot of money but not adding much to the value of the property as a whole.

If people had more money then I would expect to see a lot more construction in the City. That happened to Vancouver in the eighties when entire city blocks were being bulldozed to build “Vancouver Specials” that maximized every square inch of the land with a house and made it into the city it is today with over 45% of the houses having basement suites. Which is the highest number of any city in Canada. I think Victoria has around 15% to 20% of the homes with suites. The higher percentage of homes with a suite the higher the home prices in the core districts.

Of course anyone of you could do that sample right now. Walk down your street and count the houses with suites relative to the total number of homes. Best to do the sample on recycling day and then you can judge if the home has a suite by the number of blue boxes or garbage cans.

I wonder how much the Canadian banks will have to pay out when all is said and done.

Wells Fargo to pay $1.2 billion over bad government-backed mortgages

“Prosecutors alleged the bank “engaged in a regular practice of reckless origination and underwriting” of FHA loans, which are backed by federal insurance and aim to help first-time home buyers.”

http://www.latimes.com/business/la-fi-wells-fargo-settlement-20160203-story.html

“It sure seems like 1980 again with the current frenzy…

Feb 1986 to be more precise”

Now there’s a window you can drive a truck through. One is a year before a 50% crash and the latter is during a gradual market upswing. Sounds like you’re throwing darts with a blindfold.

I’ll take 1981, just before the market started a slow painful drip. Same scenario, low inventory, houses snapped up before the signs went on the lawn. By summer the well of buyers had ran out and down she went as the economic reality all of Canada was suffering hit Victoria.

I’m convinced everyone’s going to be so far off in their predictions now. We were probably swayed by all the fear in the financial markets mid-Jan.

I wouldn’t be surprised at all if we post a Van-like number this year. Perhaps even a 40% y/o/y for average similar to what Van just posted.

Whoops that was someone’s quote below that I was responding to…

Feb 1986 to be more precise. Anyone notice how much the loon is up lately?

“Yeah, they like to make stuff up.”

So CMHC knows every illegal rental in Victoria ? I bet there are as many illegal whole houses as basement suites or condos, a lot of sleazy landlords in this town. Funny how you have full faith in the authorities to always know the truth on a bunch of rentals when they can’t keep track of billions of dirty money flooding this province.

If you need a 4 bedroom rental and you can’t afford $3000 to rent one then you made a serious planning mistake having your brood. If you cash out with $700K you can easily afford it. Who says everyone has to stay here ?

I find it interesting agents don’t track whose leaving Victoria only coming in, unless they keep it top secret which wouldn’t surprise me.

It sure seems like 1980 again with the current frenzy…

Feb 1986 to be more precise. Anyone notice how much the loon is up lately?

Another reason for the vacancy rate to drop substantially is that empty nestors are selling their homes and renting rather than buying.

And that drop in the vacancy rate coincided with the opening of the Hudson for rentals. Modern, well located suites for rents starting at $1,300 for a one-bedroom. Which is affordable and desirable for someone that just sold their home.

But not affordable for someone who has just moved here for a job. They would be renting in an older apartment building built in the 1970’s or early 80’s. and those rents are still under $900 for a one-bedroom.

This high end rental market might become over saturated with rentals when Bosa opens up their 200 rental suites and another 135 rentals become available in Uptown.

That has happened in the past in other niche housing markets. Such as Care-a-miniums. Where you buy a condo for grand dad and it has nursing staff and kitchen dining facilities in the complex. The first few to open up sold out quickly at high prices. As more care-a-miniums were built the market was saturated and prices dropped. The developers over estimated the size of the market probably relying too much on CMHC data.

I suspect that “hotter” means in relation to 12 months before. That is going to change when we catch up to the increase in volume and prices that started in the spring of 2015.

In my opinion it is better to watch the month to month increase or decrease.. To see if the volume and prices are accelerating or decelerating.

In December of 2015, the core districts had 105 house sales and a median at $675,000

In January of 2016, the core districts had 121 sales and a median at $656,000.

Volume went up by 15% and the median went down by almost 3% During the last 90 days that median has continued to decline to $650,000.

I can break the core districts into two sub markets markets comprising housing that is mostly comprised of starter homes to middle income and from middle income to upper income.

Vic West, Esquimalt, View Royal and Saanich West have historically been the starter to middle income hoods.

In December there were 28 house sales in these districts. In January that number increased to 40. A 43 per cent increase

In Victoria, Oak Bay and Saanich East there were 77 sales in December and that number increased to 81 in January. A 5 per cent increase.

In my opinion what we are seeing is the substitution effect. As prices become too expensive in some neighborhoods, buyers are switching to less expensive hoods. I don’t think that will translate into higher median prices for the core as buyers are switching to less expensive housing.

This suggests to me, that we have reached or are near the maximum that the majority of the buying public can finance/afford. Anytime that we over reach that maximum, buyers switch to less expensive hoods and the median price for the core declines.

In the second quarter of 2015, the median price for houses in the core reached $630,000. If the median remains stable at $650,000 then we are back to a 3% increase relative to a year ago. If the buying public continues to switch to less expensive hoods then the median for the core could fall below $630,000 and then we are back to a zero increase.

Well, you must know better than CMHC: http://www.cbc.ca/news/canada/british-columbia/victoria-apartment-vacancy-rate-1.3369121

Yeah, they like to make stuff up.

The other part of the equation is demand right? You have given no measure for the demand. If 60 families are seeking a 3 bedroom place under $2500 in a month and 35 are available not everyone is going to be in luck.

I was surprised to see that there were only two four bedrooms under $2500.

Does anyone know of any stats as to how many SFHs in the core are rentals?

Don’t see any shortage of rentals, all smoke and mirrors.

I’ve followed the house rental market here for five years as a tenant and it does feel a lot tighter than ever before. I haven’t seen one whole house we’d consider renting yet, although admittedly our focus is narrow and it’s early in the year.

People are asking $2500 for uppers, when that used to be a common whole-house price. The UsedVictoria rental section is flooded with Wanted ads too.

It looks like we won’t need a new rental after all, which is a relief. I’m sure we would have found something before our lease was up, but it was going to be a tough search.

“My only prediction is in the form of a question: Why would anyone sell their house now when prices are going up fast and there is nothing else to buy or rent?”

Because it’s the top of the market cycle when real estate is the #1 topic for like a year now and turning into pandemonium. Look at the Vancouver chart, it’s a hockey stick which will go down like a rock fast when it does finally break. Victoria has only followed because of the Vancouver panic buying.

According tororo and Marko, there are many families that should be able to live in a condo quite comfortably while they save the world.

Doing a quick search there are 56 listings for 2 bedroom suites in the core between $1000 and $1500.

33 listings from downtown to Gordon Head for 3 bedrooms under $2500. Don’t see any shortage of rentals, all smoke and mirrors.

First of all 8.2% in a year is a very significant increase and can in no way be characterized as ‘arthritic’. This is a whole year’s income in tax free equity for many folks. People will, imo, put their homes up for sale because of the rising market and generally accepted idea that spring is the time to do it. There will be more inventory to choose from all around – I’d be more concerned about another big jump up in prices. Tough market to be in as a buyer.

It sure seems like 1980 again with the current frenzy, but without the rapidly rising mortgage interest rates or inflation or big wage increases.

I’m really curious to see what happens throughout 2016. Great entertainment to watch the crazy unsustainable furor and listen to the irrational explanations of why it will continue unabated until small shacks in Fernwood go to bidding wars for over one million.

My only prediction is in the form of a question: Why would anyone sell their house now when prices are going up fast and there is nothing else to buy or rent?

They are getting worried.

“Premier Christy Clark said Monday that B.C. has been researching the impact that foreign investment might be having on the local housing market for about a year.”

http://www.theprovince.com/business/Premier+Clark+changes+tune+impact+foreign+investment+Metro+Vancouver+real+estate+prices/11690668/story.html

Lots of frustration in the comments there.

Despite my current bullish outlook, I don’t think we are the next Vancouver. Vancouver is completely detached from any local economic fundamentals, and despite what Garth thinks, can really only be driven by a ton of foreign capital.

I have some new charts about the relationship between MOI and prices in victoria. Subject of a future post, but I think it’s quite interesting to look at for a certain MOI, what kind of price change can we expect.

Yep, although looking at past years, the market as measured by MOI is usually weakest in December and improves quickly in the spring. Notable exceptions being 2010 and 2008. Overall though it is more likely to get hotter in the spring than cool off unless we have a big market turnaround.

CTV News Vancouver Island: When it comes to real estate, is Victoria the next Vancouver?

http://vancouverisland.ctvnews.ca/when-it-comes-to-real-estate-is-victoria-the-next-vancouver-1.2762420

I suppose what I’m saying is that the market for homes in the core is doing okay but it should be doing a lot better.

If you were the only Toyota car dealer in town and the cars were selling fast as they are now would you say an 8.2 per cent increase is good? When the car dealer in the next town with similar inventory problems gets a 27.9 per cent increase?

My guess is Jimmy Pattison will be coming to see you and don’t expect him to be telling you how good you’re doing.

So why do we think the market is so hot in the core? Because agents are getting multiple offers in a short time period. Half of the homes selling in under 16 days. That keeps agents busy listing and selling in a short time period.

Are prices flat? Nope, and I didn’t say they were either.

….”Average of core medians from March – Aug 2015: $629,233

Average of core medians from September – Jan 2016: 653,760

So between the two periods we are up 3.9%. Doesn’t seem flat to me.”…

Well here are the actual quarterly numbers for house prices in the core.

Q1 Median 2015 $600,000

Q2 Median 2015 $630,600

Q3 Median 2015 $639,000

Q4 Median 2015 $654,950

NOTE: For the last 90 days until the end of January the median is now down to $650,000.

But what happened in Q3 to Q4 to make the median jump by 2.4%? (not really a jump is it)

There were 65 sales over a million dollars in those 3 months. A 132% increase to that of the same period in 2014. That caused the median and the average to be skewed to the right with a big fat tail, but the mode still remained centered around $600,000. Then their is the error in each of these figures which can be a couple of per cent.

If your question is how much have prices for houses increased from 2014 to 2015, then we would have to look at the years in total and that’s 8.2%. That’s not a flat market, but relative to the MOI it isn’t a spectacular achievement either. When you look back to the years 2006 and 2007 when the increase was 11.7% Our biggest gains over the year before were made in the first 6 months of 2015 and then prices petered out.

And as some like to compare our market to Vancouver. What did their market do in the same time period? Well it JUMPED 27.9% (now that’s a jump ours was more an arthritic limp in comparison)

Are house prices collapsing as Michael is forever insisting I am saying in my posts?

-Nope.

Will there be more houses for sale in the core come spring.

-Yup

The winter months are tough to call because of the low level of sales spread out over different price ranges and a large geographical area. The Spring market usually is the most telling of the rest of the year. So you’ll just have to wait to see what happens to the Tulips this Spring. Hopefully it won’t be another Spring of 1637.

Depends. If you are selling a house it would be critical to look at the local submarket to determine how to price the place, what offer to take, and how demanding you can be about conditions.

If you just want to know where the market is headed, the overall stats are fine.

Factoring out the Gulf Islands which is a totally different kind of market, I hope we can agree about some statements:

To me the most logical areas to outperform are those in the core where the MOI is the lowest. Given it is not the outlying areas there really are no other options.

I suppose one of the weakest areas for housing in the Greater Victoria area is the Malahat which includes Shawnigan Lake, Mill Bay and Cobble Hill.

103 listings and only 17 sales in January. This January had fewer sales than the previous January in 2015 at 23.

Sooke also is under performing with 23 sales last month and a current inventory of 131 houses which is 5.7 Months of Inventory.

There is also the Gulf Islands with 16 sales in January and 194 active listings for 12 Months of Inventory

Langford had 35 sales in January or about 3.6 Months of Inventory.

Then there is Victoria with 21 house sales last month and currently 35 listings or 1.5 MOI.

Or Oak Bay with 25 current listings and 13 sales or 2 Months of Inventory

Now that you see how diversified our market place is would you still rely on general market indicators for all areas combined?

I think it shows how well the core tracks the overall market. First peak in 2008, small dip in 2009, second peak in 2010 followed by 3-4 years of slow decline, followed by a big jump in 2015 for a new peak.

Agreed. Although I do think the overall market gives you a very good idea. The core is hotter than the westshore, but if the overall market improves, both will go in the same direction generally.

Can you give an example of a category/location of home that is as of today still weak?

What I find more entertaining than Jack trying to make us believe Vic house prices aren’t rising, is the people who were brave enough to buy in say Vancouver after seeing the Maclean’s magazine with the burning house on its cover (mid ‘12), will soon be ahead a million dollars!

http://bc.ctvnews.ca/average-home-sale-price-in-metro-vancouver-hits-1-82-million-1.2762037

Fair enough. I don’t have data for subregions so all I can go on is the total market.

However, if you are asserting that the core is more or less flat, and we know the total market has appreciated at about 6-10% in the same period, then the only conclusion we can come to is that the non-core areas have appreciation by 20+%. Given they have the weakest market, it just makes no sense.

Also let’s look at the numbers you posted for the core. There are only 11 months of data, so we can’t look at the 12 month trailing average. However we can compare the beginning of 2015 to the end.

Average of core medians from March – Aug 2015: $629,233

Average of core medians from September – Jan 2016: 653,760

So between the two periods we are up 3.9%. Doesn’t seem flat to me.

The median price for home in the core in January was $656,000. The first time we ever broke a median over $600,000 was in April 2008 at $625,000. Prices have see sawed back and forth since then hitting a low of $500,000 in January 2009 and a high of $677,250 during the election last year.

That’s almost eight years now

On an annual basis this is the median price in the core since 2006

Primary Year Sale Price, Median

2006 $479,000

2007 $535,000

2008 $560,000

2009 $555,000

2010 $601,000

2011 $595,000

2012 $578,000

2013 $572,500

2014 $582,000

2015 $630,000

The way I look at it, this isn’t a clear win for either Bear or Bull since 2010.

Speaking of info she is still posting up a storm on Garth’s site complete with the good ol’ ascii charts. And her conclusions about the current Victoria market: “Failure is the only conclusion that can be drawn here”. And worse to come of course.

“According to a report in the Australian Financial Review, those selling real estate in Australia could be the ones to pay the price for the recent poor performance of the Chinese share market and efforts by the Chinese government to halt the underground flow of capital from the Asian super-power.

Richard Yuan, head Australia China Entrepreneurs Club told the AFR demand for Australian real estate remains, but investors may no longer have the means to go through with purchases.”

And so goes Vancouver????

“If you’re not a seller in this market than you are an idiot.”

Hawk you are starting to sound like Info. Why on earth would most people in Victoria want to sell? There would have to be a truly dramatic drop in price to justify selling and then buying back in at some future date. The transaction costs and hassle are just not worth it.

So why won’t Nanaimo prices ever catch up to Vancouver then? Or Surrey?

Or how about the Gulf Islands. Last year there were 54 home sales to Vancouverites on Salt Spring Island compared to 25 in Oak Bay.

There is a lot of distance between here and Vancouver and most of it is water.

When you say the market is hot, that’s a relative statement. The market is hot compared to…

In January there were 21 house sales in the City of Victoria. In December of 2015 there was 46. A year before there was 20 sales in January 2014.

So were house sales in the City of Victoria hot or not?

Add in Langford where the year over year sales for January increased by 35% and does it become a hot market for Victoria City?.

If you want to determine the value of your home then you’ill select comparable sales within a small geographical area of where you live. If you live in an urban area that may be within a half kilometer radius of your home. If you live in the country then comparable sales will be within a few kilometers of where you live. Using general statistics isn’t going to help you very much. You have to center in on your location and some of the physical aspects of your home before you can definitely say you are in a hot market.

Vancouver benchmark prices are out for the past year…

SFH +27.9%!

Apt +19.4%

TH +16.4%

Did I mention those are benchmarks, and sales were up 35% over last January!

Definitely time for Vic to play catch up with Van over the next few years.

Lol… I just noticed below Jack conveniently leaving out Jan 2015 so it doesn’t look like prices are up over 17.6% in a year for the core.

As I showed, this data is for the core districts only, which is our strongest market with almost 50% of all sales that happened. This seems to be the area that most people on this blog are looking to buy in. The data you’re looking at is for all areas including the Gulf Islands and the Malahat.

Prices in the core for houses has been mostly level since August.

If you are considering buying in the Western Communites I can break that down into

Month Sale Price, Median

Mar 2015 $480,000

Apr 2015 $477,500

May 2015 $469,000

Jun 2015 $459,950

Jul 2015 $439,900

Aug 2015 $490,000

Sep 2015 $468,000

Oct 2015 $489,900

Nov 2015 $455,000

Dec 2015 $524,900

Jan 2016 $495,000

And if you’re looking for houses in Sidney or acreage in the Peninsula including several 5,000,000 to 8,000,000 water front homes then…

Month Sale Price, Median

Mar 2015 $595,000

Apr 2015 $598,500

May 2015 $612,500

Jun 2015 $580,500

Jul 2015 $560,000

Aug 2015 $622,000

Sep 2015 $627,450

Oct 2015 $612,500

Nov 2015 $561,250

Dec 2015 $682,900

Jan 2016 $704,500

And all three combined areas

Month Sale Price, Median

Mar 2015 $580,000

Apr 2015 $565,000

May 2015 $575,000

Jun 2015 $571,000

Jul 2015 $558,500

Aug 2015 $603,000

Sep 2015 $594,950

Oct 2015 $617,431

Nov 2015 $555,000

Dec 2015 $602,500

Jan 2016 $601,500

There may be a potential growth in prices for the Western Communities but that is doubtful as the months of inventory is higher in the WC than in the core. But if you are looking to see where prices cap out, then you would be looking at the strongest market with the lowest months of inventory and that would be in the core. And the answer to why half of all buyers are capping out in the $625,000 to $675,000 range is the ability to get financing.

If the HAM are getting slaughtered in real estate and they are business people then they many won’t have time to cash out as their business are suffering . Loans to businesses in China are tightened up big time if you read the charts and data. They may have to sell their Vancouver real estate to prop up their businesses.

As well many HAM’s borrowed money here to buy houses against their overseas businesses. Can’t see Canadian banks lending to businesses in a crashing market. The end of Hong Kong HAM looks near.

I just don’t see that. Look at the 12 month running average chart of median price here: https://househuntvictoria.ca/stats/printsummary.html

It’s up every month once you flatten out the month to month and seasonal variations by looking at the entire trailing 12 month period.

For example, like you said the median is down from December, but look at the 12 month median, it is up almost $4500 from December. The trailing 12 month is up about 3.6% since July.

I think it’s impossible for buyers to be maxed out and the hot market to persist. If buyers are maxed out, the market will cool. It cannot be both hot and at a price ceiling at the same time. I have never seen an example of a market behaving in such a way.

If you’re not a seller in this market than you are an idiot. You will never see a market like this for another decade where they are lined up like sheep to the slaughter.

Media pumping the agents pump of 15 people at every showing with cash ready to buy ? This is a seller’s wet dream. Buy now or risk losing out on another 10% ?? Pure salesman bullshit. As Cramer would do: hit the SELL!! SELL !! SELL!! button.

The median price for houses in the core hasn’t changed much since August. It actually went down from December’s $675,000

Month Sale Median

Mar 2015 $625,000

Apr 2015 $631,200

May 2015 $620,250

Jun 2015 $629,450

Jul 2015 $610,000

Aug 2015 $659,500

Sep 2015 $640,000

Oct 2015 $677,250

Nov 2015 $620,550

Dec 2015 $675,000

Jan 2016 $656,000

That’s quite amazing when you consider how low the Months of Inventory in the core has been for the last six months.

The good news for prospective purchasers is that historically February brings on more listings, So we may see active listings for houses in the core almost double by early March. And more selection is good for the buyer and the seller as it stimulates interest in the market that has historically led to higher prices.

Active Listings

Month 2014 2015 2016

Jan 579 493 347

Feb 651 567

Mar 718 626

Apr 815 706

May 882 715

Jun 874 691

Jul 805 657

Aug 727 598

Sep 710 547

Oct 632 467

Nov 550 437

Dec 465 341

But will higher prices eventually stifle demand as it has many times in the past?

Sales,

Month 2014 2015 2016

Jan 90 90 121

Feb 125 164

Mar 150 231

Apr 216 235

May 218 284

Jun 207 260

Jul 199 201

Aug 171 184

Sep 167 179

Oct 175 204

Nov 113 151

Dec 86 105

While we may continue to get shockingly high prices for some of the better properties in Greater Victoria, the mass of buyers seem to have reached their economic limit as median prices continue to bounce around the $625,000 to $675,000 level for detached houses in the core.

Prospective purchasers can only afford to pay up to the amount they have been qualified by the bank.

That some are paying 3, 4 or 5 million dollars for a property is entertaining only. Those purchases have no significant impact on what the majority of buyers will pay.

10% price drop certainly could happen here and at some point in the future most likely will.

Most definitively will happen, but the problem is timing. Prices could go up another 15% and then tank 10%. Still better off buying today in that scenario, for example.

Could be a there/here connection that partly explains why we’re surging past few months (thru Van). There’s likely a greater push lately in both HK & China to get their money to safety before a feared devaluation.

Or I guess it could just be their world’s highest price-to-income (20-30?) needed an adjustment.

Hong Kong prices fell ~70% from ‘98-’04 while Vic/Van did very well.

http://www.macrobusiness.com.au/wp-content/uploads/2013/04/ScreenHunter_09-Apr.-22-17.04.gif

One has to enjoy Zerohedge use of the words collapse, spectacular, plunge & crash all for a “whopping” 10% price correction.

@CS

10 % price crash as quoted in that article isn’t all that spectacular (though admittedly it has happened very quickly). Plus they have only gone back to the price level of one year ago. 10% price drop certainly could happen here and at some point in the future most likely will.

http://www.zerohedge.com/news/2016-02-01/hong-kong-housing-bubble-suffers-spectacular-collapse-sales-plunge-most-record-price

Why there, but not here?

Residential – 1742

@Marko Could you post the residential inventory for January please?

Thanks Marko

That is more or less the advice I have given the seller except that mere posting won’t work so well as he no longer lives in the condo or even Vancouver

I guess I shouldn’t have dialed back my guess. But I do think it will become a little less insane in the latter half of the year. Not sane, but less insane.

Re;Hopesmore, the seller you are all high fiving is now the smart market timer which you pumpers keep saying ad nauseum, is never the right thing to do. I guess that means the buyer is the dummy as the smart money sells. Now that is very revealing.

Sounds like a case of more gloating about your own paper wealth and not truly about the so called smart seller. Sellers are brilliant, buyers are even more brilliant over paying by 50K, LOL. Classic mass market psychology.

Your family just needs to use basic common sense. Call three REALTORS® that “specalize” in Kitsilano. BTW, don’t feel bad about doing this as everyone has “free market evaluation” splattered all over their website and marketing material.

Take the three opinions (I would say five if you had a SFH but a condo shouldn’t be too difficult to evaluate), draw some conclusions based on that. Maybe hire an appraiser as a 4th person? Can’t hurt on a 500k+ condo I am guessing. Call a mere posting company and throw it up at a realistic price and just let REALTORS® parade through with their buyers. Any offer you get add “subject to sellers’ lawyer reviewing and approving by such and such date. For the sole benefit of the seller,” and pop over to a lawyer’s office and pay a $100 to have it reviewed if you don’t feel comfortable just signing off.

Or go with a lower commission full service company if you don’t feel comfortable with a mere posting. There are quite a few in Vancouver. In my opinion it is important to offer a reasonable cooperating broker fee. I am a huge fan of what I’ve named the hybrid lower commission (the bulk of the commission is lowered on the listing portion while the cooperative is kept attractive and not lowered as much as the listing portion, if that makes sense).

Don’t call me :), I don’t do mere posting across BC anymore….too busy with greater Victoria.

Marko or anyone else care to comment on discount brokers available in Vancouver. Family member is wanting to sell a condo (Kitsilano) ASAP.

You make a good point on commissions, Marko. In a strong seller’s market like this, if you have a solid property in a very desirable location, that you know will sell fast, then why wouldn’t you negotiate a lower commission with your realtor?

“NOW NOW, if I can’t negotiate my own commission how am I going to negotiate $100k above asking for you in a multiple offer situation?”

I could list off another 25 arguments that the average person sucks up like a sponge.

The answer is rather simple; the average person has almost zero financial common sense.

Friends, aquintances, etc., are always like, “You know Marko, you need to get the word out there in terms of lower commission full service packages, mere postings, etc,” I’ve tried before and failed. Often it is like talking to a brick wall in trying to explain to the consumer how they benefit via lower commission structure.

Let me put it this way. Someone calls you (an electrical company) to wire a house to code and they give you the details of exactly what they want in terms of plugs, fixtures, etc. You quote this individual $15,000. You show them you wired 90 houses last year.

Next company comes in and quotes $21,000 for the same job. They show that they wired 20 houses last year. Consumer gives this company the job.

Impossible to explain. Only in the world of real estate. I am betting 99.5% of individuals in the electrical example are going with the $15,000 quote.

Some funky stuff come across my live feed sales sheet….860 Beckwith bought in November 2015 for $655,000 and just resold today for $675,000.

You make a good point on commissions, Marko. In a strong seller’s market like this, if you have a solid property in a very desirable location, that you know will sell fast, then why wouldn’t you negotiate a lower commission with your realtor?

I am still thinking things might slow down as we exit 2016 but no sign yet.

Things have to slow otherwise we’ll be breaking 10,000 sales for the year and the median would be pushing 650k by the end of the year with an average well over 700k. I can’t see that playing out given that most of the market is local buyers.

but all of a sudden I keep running into friends and acquaintances talking about investing in Victoria real estate.

I’ve had more emails about investment properties in January alone than all of 2012+2013+2014 combined.

The problem is rents haven’t gone up as much as price appreciation so investment properties were a way better buy a few years ago versus now. A good example is the Bayview Promontory. 2011-2013 the developer was selling, and slowly, studios in the low 200ks and rents were $1,150-$1,175. I just sold my friend’s investment studio for $260k ($45k more than her purchase price) but the problem is rents are maybe $1,175 to $1,225 for the studios now.

$131,000 in 3-4 years on a primary residence tax free is pretty good ROI.

If they put 10% down plus closing costs that is over 130% return plus principal pay-down amount of approx. $60-80,000 – assuming they would have otherwise rented something for the approx. $2500-3000 a month it cost out of pocket to own. And again assuming no major repairs.

So approx.$200,000 ahead of renting less LOC (investment income less taxes) on the down payment?

Works like that with stocks too – as soon as the market moves up people invest and out when it declines. Should be the opposite logically but consumer confidence follows the price trends from what I can tell.

If this keeps up my predictions (and others) will be way low especially for sales numbers. I am still thinking things might slow down as we exit 2016 but no sign yet.

Very anecdotal, but all of a sudden I keep running into friends and acquaintances talking about investing in Victoria real estate. Not folks who are seasoned real estate investors. Why are these folks suddenly thinking it is a good time to invest?

Sweethome, house was renovated in 2008. I cross referenced the photos from the 2011 sale and the current sale. Everything I can see done prior to 2011.

I wouldn’t have posted the example if I didn’t think it was pretty much all market uplift.

Re: house Marko mentioned yesterday on 4028 Hopesmore. It appeared to have significant recent updating (kitchen, flooring, bathrooms, etc.). Do you know if this was done prior to 2011 sale? If not, then the current owners really didn’t make much, if anything.

We’re finally into the double digit increases across the board…

Average 23.4%

Median 17.6%

Benchmark 10.1%

Everyone’s 2016 predictions could be too low again, not that anyone will be too upset about it.

Looks like for the first time in the history of the VREB we had a month with a median SFH price of $600,000.

wow….highest monthly sales since 2002; lowest new listings since 2005. These are some insane numbers. To put things into perspective we had 294 sales January 2013.

Mon Feb 1, 2016 8:30am:

Jan Jan

2016 2015

Net Unconditional Sales: 539 351

New Listings: 934 1,027

Active Listings: 2,471 3,283

Please Note

Left Column: stats for the entire month from this year

Right Column: stats for the entire month from last year

It has become clear to me that I’m the same as Marko except for the determination, ambition, and talent.

I don’t think I have a “talent,” I think I simply have some common sense.

For example, just look at the 98% of people out there right now listing their properties at 6%100k+3%balance (commissions may vary :)) to have the property sell in a day or two in a bidding war. I honestly don’t know what so say….every day I just log into my system, watch the properties going over asking, and shake my head at the commission structures.

For me it is kind of like a bunch of other common sense things in life, for example, like prescription eyeglasses….I bought my first pair of glasses online in 2008 for 1/10th of what brick and mortar places where charging. It just made so much common sense. Why on earth are two pieces of plastic and a crappy metal frame $600? I haven’t spent more than $600 on multiple eyeglasses combined since 2008.

Mutual funds….I took a few 1st year university classes on probabilty, statistics, etc., basically enough to be like, “hmmmm, I am pretty sure that paying a 2% MER equals no way that a mutual fund can outperform, on average, me picking some half decent reputable large caps over a 10 year period in a market returning 7%”

When the average person has almost no common sense financially it is fairly easy to come across as “talented.”

@Introvert I would expect Victoria to have a slightly larger percentage of outside buyers than most similar sized places.. It is a retirement destination after all. Data seems very scarce though. Our real estate board is pretty good compared to anywhere else.

It has become clear to me that I’m the same as Marko except for the determination, ambition, and talent.

4028 Hopesmore purchased for $820,000 in 2011; just resold today for $951,000 – $101,000 over asking. 16% uplift.

As for out-of-town buyers, wouldn’t it be helpful to compare Victoria’s 7% to that of other major cities in Canada? (I personally don’t want to do the research, but someone should.)

Too bad they didn’t go back to 2013…

“Haha. I swear I only did about 6 months of research before buying that car.”

I, too, research the shit out of my purchases, especially the bigger ones.

Sure, the buyers as a whole are definitely significant. But we already had 5.6% of the buyers come from the lower mainland in 2014, and the market was dead, so it isn’t really fair to subtract out all of them.

The jump from 5.6% to 7.4% gave us approximately 150 extra buyers. Not nothing, but overall if we had had 150 fewer sales last year it would still have been a hot market.

What will be interesting is whether this is a trend or a blip.

I think the 7.4% is fairly significant. If it wasn’t for that 7.4% the market would be around 7,600 sales for 2015 which would be pulling towards a neutral market and flat prices. The 7.4% takes the market deep into sellers’ territory.

I just don’t have that kind of time.

Time is such a big factor in all of this….when I had time I pulled off some awesome car deals. When I was 20 I bought a used 1991 Integra from an old lady in Oak Bay for $4,300 then sold it a year later for $4,500. Then found a newer Acura “lease take over,” where the guy gave me $1,000 cash back to take over a pretty good lease with 18 months left. I bought out the car at the end of the lease for $13,900 and drove it for 18 months or so and sold it for $14,500.

Then came by best deal ever. Found a 2008 Honda Civic Si on Cordova Bay Road that was 1.5 years old with only 10,500 km and another very favorable lease (60 months @ 0.9%) and I managed to negotiate $4,000 cash back which pretty much covered payments for the first year 🙂 Also because he had barely driven it in the first 1.5 years it allowed me to pile on the mileage without going over the lease limit.

It is time consuming doing lease take overs (the best deals out there in my opinion as the average Joe doesn’t understand or search for it) and then having to sell the other car privately, etc. Last two cars I’ve gone brand new just because of the convenience. Don’t have the time to deal with usedvictoria flakes and don’t want to worry about whether their certified cheque is legit or not 🙂

5.6% of the market to 7.4%. Hard to tell if it’s a big jump or just noise. 5% of sales were not classified correctly so a good chunk of opportunity for noise there. Also with only 2 years of data, we have no idea what kind of variability is normal. 2016 data will be interesting though, if there really is a migration going on we should see it big this year.

I’m actually surprised Van buyers are increasing that quickly.

Garth used these graphs in his latest post.

Haha. I swear I only did about 6 months of research before buying that car. One of the reasons I’ll never buy a BMW, I just don’t have that kind of time.

“@Introvert It was one year old when we bought it. Let someone else eat that first year depreciation.”

Yeah, I didn’t peg you as a guy who’d buy a new car, but I just thought I’d check.