What happens with a low rental vacancy rate?

Aka Yes, supply and demand applies to the Victoria rental market.

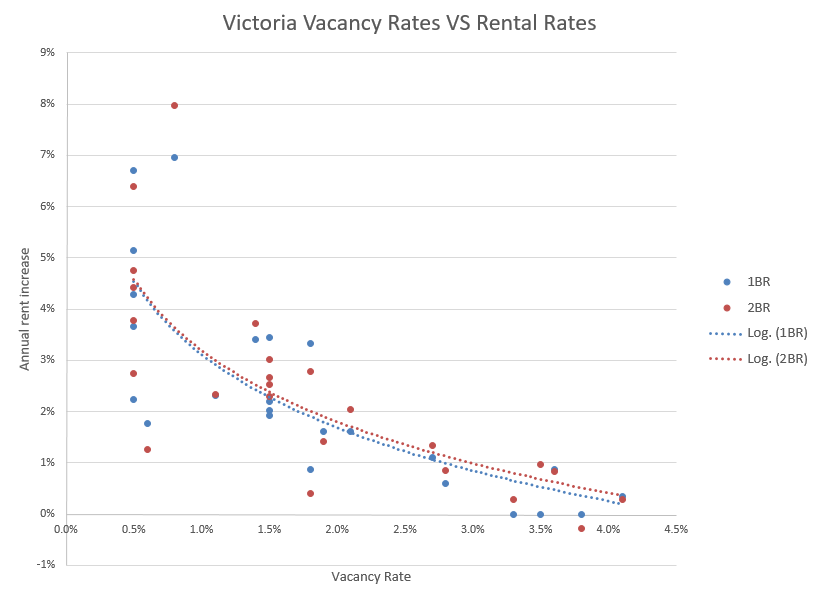

The apartment vacancy rate in Victoria for rental apartments with six or more units dropped down to 0.6% in 2015 after spending a couple years near 3%. What does it mean for rentals out there? You can still get one, but with this much demand, prices will be going up. At 0.6% vacancy rate you should expect rents to rise somewhere around 4.5% annually. Here’s some data from the CMHC’s Housing Market Indicators, which I’ve just discovered.

As expected, low vacancy rates lead to strong annual rent increases. Looks like all that new rental stock downtown is going to be needed to put some slack back in the market. By the way, I will collect links to useful data sources on the new Sources page.

Anyone else see the reddit thread on how you could afford to buy in Victoria? Some interesting comments in there.

@Marko thanks for your perspective on pricing strategy. There are definitely varying views on this. My suspicion [hope] is that with the overall low inventory in the core, my property in will get attention whether the pricing involves crazy 8s, lots of zeros, or what have you.

Victoria now ranked second least affordable in Canada. That will surely have the wannabe retirees from the rest of the country booking flights to compete with the HAM before the shelves are empty.

Those kind of rental prices are hitting the affordability level for incomes just like last boom peak in 2008. Then people left Victoria and renters were getting a free month of rent. How soon these landlords forget. I will gladly live barely five minutes from town with just as nice of views for a $1300, 2 bedroom.

Michael are you implying that an older suite would rent for the same as a renovated suite?

If you’re looking for a downtown condo to invest in. Why not a quarter ownership in a condo that you can put in the hotel’s rental pool? $65,000 is all it takes. Home owners association fees of $475 per month which includes everything.

12 weeks a year and one full month for you to use or put in the rental pool.

Most are listed at half the price the original purchasers paid in 2008.

Tired of that long commute back to Central Saanich or Sooke then spend a week each month in town. Buy four and never go home again.

I think you’re underestimating how fast rents are rising, even on the really old smaller stuff.

http://www.timescolonist.com/news/local/james-bay-seniors-fear-renovictions-through-upgrades-rent-hikes-1.2145646

These are all old 60s bldgs with nothing big or special about the units. Some of their 2 bdrms are now renting for $1885. We’ve been pushing our nicest almost as high.

I wonder if the entire building envelope would have to be stripped and changed with the rain screening?. The thermal pane windows will begin to fail in about year 20, same with the roof.

Hopefully a new type of window replacement is invented where you don’t have to put up scaffolding. Then the windows can be replaced as they fail and not all at once.

That leaves plumbing and electrical. At that point it’s more of a demolition issue than a renovation.

At what point does the strata council determine that it is no longer economically viable to make repairs? Can they make that determination? And that’s going to be the problem in the future. Who decides when to stop band aid repairing these complexes? Can the strata council indefinitely keep repairing the complexes for eternity.

As the building ages the more often it requires repairs. Does it make sense for a 1970’s wood frame condo complex to have strata fees at $900 a month for a building that should really be demolished. And if you raise those strata fees to $900 a month that will have a devastating impact on their market value. $900 a month is equivalent to $200,000 in financing.

I don’t think the BC government thought things out clearly when it came to Depreciation Reports. There will be a lot more problems arising out of these depreciation reports. Especially if they form a part of receiving financing. Suppose the report is unfavorable and the bank no longer will finance purchases in the complex. You don’t have to be especially gifted in the grey matter department to figure out that your complex being black listed will drive your investment to near nothing.

There doesn’t appear to be any more pre-sales available downtown in that price range for a 1 bed.

The Legato had units for $219,900 on the podium but those sold out in November. There is literally nothing interesting in the pre-sale market right now and nothing big and concrete in the works either. All you have downtown/close by is Escher, Legato, and Encore and all the good stuff has alreay been picked over. Encore sold out of one units under $400k in December.

Great opportunities in pre-sales from 2009 to early 2015. You use to be able to by pre-sales at a 10 to 15% discount in relation to finished completed units but that is no longer the case.

My friend bought a pre-sale unit at the Promontory for $210k in 2012 and we resold it in December for 260k

Based on the track record of leaky condos in this town I damn well would. With the Era’s 157 condos that’s still only a $20,000 average when it will cost upward of $100K when it inevitably leaks.

Inevitably it will need an envelope replacement in the next 30 to 40 years. Stats also support that I have less than 50 years of life expectancy left so not going to lose sleep over something that will most likely occur when I am in my 60s/70s.

Paying someone more than the market value of their home would end in legal action?

The contingency fund stays with the strata corporation. You can pay into the contingency fund for 20 years and not get a dime of that back when you sell.

I can give the owners of an older Fairfield condo complex an option at 10 percent over market value if they sell to me. Or buy a first option of refusal for when they want to sell for $10,000 today. Even better if its a leaky condo. They’ll all want to sell. Or if I have built a new condo complex but the market has tanked, I can do a swap with the owner. They get a smaller new condo without water problems and I get the old building that usually has much larger suites, that I can use for cash flow.

Buy them all out, collapse the strata, cash in the contingency fund, turn the building into a rental, never repair it and collect rents for the next 20 years or demolish and build.

Crowdfunding anyone?

To get $1,300 a month for a downtown condo, you’ll need the condo to be either newer or a lot square footage. That’s what renters pay for downtown – newness and size. It can be new and small or old and large. What it shouldn’t be is old and small. And you can’t buy anything new and large for less than $275,000.

So you are pretty much going to be looking for something that every other guy and his dog is wanting to buy.

And the Juliet. Monthly rents for a one-bedroom is likely $1,100 per month. But you can rent the suite out on a daily basis for say $100 for a 1-bedroom to $200 for a 2-bedroom. And just like condominiums and apartments, the vacancy rate for hotel rooms is not the same as apartments. Expect the suite to be empty half the time if you use a management company and most of the time if you’re doing it yourself. Then you’ll have to pay a company to clean and make the beds up between guests.

Actually you could buy one of your kids a job. They would do the house keeping and you would pay the bills. Think of it as a paper route where you have to drive them around in your car.

Lots of turn over in the building and that’s going to mean lower appreciation. The original buyers are mostly selling for less than their original purchase of 5 years ago.

https://youtu.be/tcliR8kAbzc

” I am all for having $300,000 in contingency but not for having $3,000,000 to ensure there are not special assessments for the next 30 years.”

Based on the track record of leaky condos in this town I damn well would. With the Era’s 157 condos that’s still only a $20,000 average when it will cost upward of $100K when it inevitably leaks. If you’re a long term holder then why not ? If you sell then the new owner can assume your 20K. Pass along some of the protection so to speak.

I get Jack’s conspiring theory but it could easily turn into instant law suits and not as easy to pull off as it sounds.

This is all excellent information! So JJ and MJ both seem to agree that a 1 bed condo downtown is the safest bet. However I would still want to be cash flow positive, and that would have to be around $1300-$1400 with a $275k investment (less the 20% down). This may be doable if it’s a newer building with parking included and a great location, like the Juliet? There doesn’t appear to be any more pre-sales available downtown in that price range for a 1 bed.

I guess a 2 bedroom would be easier to rent out, but then I’d have to go with an older building.

I can see why the person you are helping JJ is having a hard time!

I have a college that had to pony up 100k because they replaced all the windows in their building. One face was the glass wall style. I could replace all the windows in my house with top of the line product for 3/4 of that. I could replace them with good windows for half. Or I could choose to replace only certain ones for a fraction. Don’t underestimate the potential money bomb…

Depreciation Reports aka Financial Reserve Fund Study provides options for the strata council for normal repairs such as a roof, boilers, overhead doors, painting. The study does not allow for hidden or unapparent repairs such as a failure of the building envelope. Strata members would still have a Special Assessment for these events if they were to happen.

The contingency fund is effected by the low interest rate as it isn’t growing quickly. The strata council has to invest that money in safe AAA investments like a GIC. That makes the strata fees needed to be collected higher in a low interest rate environment than if the interest rate was say at 7 percent with the contingency fund doubling in size every ten years.

Another problem is if the complex amasses too much money in their contingency fund that they may be targeted for a hostile take over by investors. The investors could offer above market value price for all the units or an exchange of real estate. Then the complex is worth more if the strata corporation is dissolved and the building demolished sold as land value and the contingency fund divided among the investors. There are some choice 1970’s complexes on big lots with surface parking in James Bay and Fairfield that would make for a profitable hostile take over of the complex if they also had a fat contingency fund. If I were a condo developer and the market took a dive I would be looking at an exchange of a new unit for an old unit plus cash to get my hands on these choice older buildings. Collapse the strata corporation, cash in the contingency fund, turn the building into rentals, sever the surplus land and sell the building to a pension fund or rebuild.

I don’t think depreciation reports and higher strata fees is the proper way of paying for special assessment or large repairs.

Instead allow the strata to borrow money for repairs assigning a portion of the monthly strata fee as a repayment to the bank or an insurance company over the next 20 years. The building therefore doesn’t need to be 100 percent funded by its contingency fund. Perhaps the contingency fund has to be at 50%. That reduces the monthly strata fee and keeps condominiums affordable and the strata council can fight a take over.

If I worked for a pension fund, I would be looking at these condo complexes as a safe investment providing a solid rate of return to the pension fund. The pension or insurance companies are the ones that should be getting the reserve fund study to determine if they would invest in the complex. That would lead to a standardization of the study.

This is heck of a lot money waiting for some organization to capitalize on.

Not everyone has the cash to pay an emergency lump sum when the unexpected happens. You don’t know if that elevator motherboard system blows up tomorrow or the motor burns up because it was made in China on a Friday afternoon

Most strata corporations carry 50 to 100% of their annual budget in contingency for emergencies. For example, if I am the strata treasurer and the annual budget is $300,000 I am all for having $300,000 in contingency but not for having $3,000,000 to ensure there are not special assessments for the next 30 years.

“As a multiple strata owner I rather keep the cash in my personal bank account and pay via special assessment when time comes due versus having a bunch of volunteers (including myself) managing millions by investing in some crappy savings accounts”

Not everyone has the cash to pay an emergency lump sum when the unexpected happens. You don’t know if that elevator motherboard system blows up tomorrow or the motor burns up because it was made in China on a Friday afternoon. Where else would you invest money put aside for emergencies ? Teck Resources or First Quantum ?

This appears to be something that will continue to depreciate older condos and cause borrowing problems for some.

I’ve been on strata councils quite a few times, a couple of times as a strata treasurer, and currently I am on the council at the Era (157 unit building downtown).

I am a huge fan of special assessment versus increasing monthly fees. My belief is all the owners should be made aware of upcoming expenses in the future via depreciations reports, discussions at AGMs, etc., but why on earth would we start saving for an elevator that will need replacing in 20 years, for example? I am not saving for the roof on my house that will need replacement in 20 years.

As a multiple strata owner I rather keep the cash in my personal bank account and pay via special assessment when time comes due versus having a bunch of volunteers (including myself) managing millions by investing in some crappy savings accounts.

And if owners can’t put aside money for special assessments they’ve been aware of, too bad. Not responsibility of the strata to teach people financial discipline.

Also not sure why “special assessment,” is such a scary word. People forget that older homes have a ton of ongoing “special assessment,” broken drain tiles, roofs, heating system crapping out, etc.

At this time I’m trying to assist someone in buying an investment property. The person is going from listing to listing without a clear picture of what kind of investment they want. One day it’s a 3,000 square foot home in an upscale neighborhood, the next day a non-conforming triplex in a run down neighborhood. Constantly worrying if they will be paying too much for a property or if they’ll be outbid on a property.

The only thing that the properties have in common is the price range. And because of the limitation of their down payment, the more they have to pay the less they have for repairs. That makes them more likely to over pay for a recently renovated home.

They don’t know what they want – they just want to buy something. As they’re being driven by appreciation. These buyers are convinced the Chinese will be buying up all of Victoria. The thought that thousands of super rich Chinese will descend on Victoria frightens them that they will miss the opportunity of getting rich.

And that causes a problem, as an investment property that has good cash flow relative to price may back or front onto a heavily traveled street. But that property will likely have a lower rate of future appreciation.

The same with condos. Older condos, typically, have a better net income relative to price but are likely to appreciate at a much lower rate than say a 2 or 3 year old condo. Older 2 bedroom condos will generally have a better rate of return but they will need more costly maintenance and repairs than a smaller downtown condo.

Then there are vacancies. Every investor gets vacancies. Keep the rent under market and that may reduce the turn over of the suite but people are always moving for jobs or other reasons. Lower than market rent also lowers the rate of return and is symptomatic of the efficacy of management. Vacancy and bad debt rate assumes full market rents. If you are under pricing the $1,200 rent by $100 you are implying a vacancy rate of 1 month out of every 12 or 7.7%. That’s poor efficacy of management when the reported vacancy rate is under 1 percent. But small investors tend to accept those losses because of the small dollars lost. Ramp that loss up to a 100 suite apartment block and the manager gets fired.

You can not avoid vacancies, you have to plan for them. That means building up a reserve to cover the time the suite will be vacant so that it can be painted, carpets cleaned, repairs as needed and to allow for people skipping on the rent. And the longer the investment property goes without a vacancy, the more costly will be the repairs for deferred maintenance.

So what should you buy as your first foray into an investment property? I would say a small downtown condo. Not because you’ll make a reasonable cash flow but that it will be easier for you to sell when you are bored of being an investor and making little money for the risk. It’s the safer of the two not necessarily the better of the two.

Scary stuff for condo owners and potential buyers.

B.C. strata councils in ‘critical’ funding state

Owners ‘just don’t have the money’ for proper contingency funds

“Strata depreciation reports have unearthed an alarming situation for B.C. condo owners: The overwhelming majority of strata units are carrying monthly maintenance fees that are nowhere near adequate to keep up their buildings.

“This is really a scary situation,” says Jeremy Bramwell, of Bramwell & Associates Realty Advisors. “We are going to have a lot of special assessments being levied (on condo unit owners) in coming years.”

http://www.vancouversun.com/opinion/columnists/barbara+yaffe+strata+councils+critical+funding+state/11663067/story.html

Based on the bidding wars out there this weekend (I wrote three above asking offers over the weekend on three different properties, all three outbid) expect January to close out 475+ sales.

Mon Jan 25, 2016 8:25am:

Jan Jan

2016 2015

Net Unconditional Sales: 361 351

New Listings: 703 1,027

Active Listings: 2,435 3,283

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

Good article dasmo. With Vancouver getting to be the crowded trade, there are much better prices in Spain and other places in the warm sun that are still hurting from the last crash. Smart money looks for deals with prices at 40% off peak over there.

“”The yuan will keep depreciating as time goes by, so we should swap the money we have in hand into tangible assets,” Li Xiaodong, chairman of Canaan Capital, tells his audience, while exhorting them to pull their money out of China while the going is still good and pour it into property in Spain and Portugal.”

http://finance.yahoo.com/news/more-holes-fingers-beijing-struggles-025157786.html

Marko / landlords and landladies: do an inspection of the property now and then – the RTA provides for it – you don’t want a surprise grow-op going on and be responsible for the pricey clean-up (not to mention potential liability in a civil forfeiture scenario).

I personally don’t do inspections unless I have a gut feeling that I should. My approach is more along the lines of undercut the market by 10% to secure an ideal tenant. My most recent condo at the Era people were asking $1,300/month. I was $1,195 and had more than 10 applications. Went with a kid doing a medical residency in Victoria. The risk of a surprise grow-op probably does not out-weigh my time for doing the inspection.

In my real estate travels typically when I come across a beat up property as caused by former/current tenant often the problem stems for high market rent and the owner going with a less than ideal tenant.

and one of the more annoying things about renting, when I rented, was our landlord’s inspections. Annoyed me as I felt we had to scrub the floors and having everything looking tip top when he came through.

$399,900 makes a lot more sense as some databases are set up in a <$400,000 format (without the equals sign) for search functions so 400k wouldn’t be included when someone is searching under 400k.

“The best prospects are rundown bldgs with lower than market rents in transitional areas, often with retired or distressed self-managed owners who just want their headaches gone.”

So you’re saying you’re a slumlord Mike ? 😉

Marko / landlords and landladies: do an inspection of the property now and then – the RTA provides for it – you don’t want a surprise grow-op going on and be responsible for the pricey clean-up (not to mention potential liability in a civil forfeiture scenario).

Anyone have experience/opinions re: the ‘strategy’ around pricing a property – e.g. $399K versus $400K – does it really matter – what are the considerations here? I’m getting advice from my realtor that I have questions about, though I respect his experience and knowledge of buyer psychology.

You don’t buy a new condo as an investment for the pure return numbers; more so, the convenience. I literally have not had any communication in over 8 months now with any of my three current condo tenants. Two are medical residents and third one has been in the condo for years.

Elevator breaks down? I don’t get a call. Garbage room overflowing? I don’t get a call. Flood in the parkade? I don’t get a call. I am on the strata council right now at the Era (728 Yates) and every time I go to a meeting my thought is, “wow, a lot of crap happened in the last 6 weeks.”

Sure I could sell all the condos off and buy a triplex/fourplex/multiplex in the core with better returns but then you are dealing with a ton of headaches such as ongoing capital investments, maintenance, the reality of less than desirable tenants, etc.

If I was retired, maybe, but with a full time career/business not going to happen.

And it isn’t half the unit cost when you compare apples to apples. There was a recent whole building sale in Esquimalt for $711,000 (5 units) and you could pick 5 strata units in Esqumialt at under a million and I would argue the strata units would be on average nicer.

A whole building is a massive commitment and it isn’t very liquid in terms of unloading it when you are tired of it.

Better to buy a whole building (single-title) and hire professional management. There’s lots of private equity looking for RE returns. You find the bldg, crunch the #s, do up the business plan & financing and the partner puts up the money for their 50% share. The best prospects are rundown bldgs with lower than market rents in transitional areas, often with retired or distressed self-managed owners who just want their headaches gone. You can find whole buildings for half the unit price as you’d pay buying single units, and it gives you the future exit strategy of selling as strata units.

When it comes to investment condos my philosphy is it has to be concrete, has to be within walking distance of downtown, or downtown itself, smaller the better, don’t get sucked into emotional traps of the view, or paying more for the 550 sq/ft condo vs 500 sq/ft (probably rent for same amount), etc. I wrote an aritcle on investment condos last year.

http://victoria.citified.ca/news/stay-small-a-guide-to-buying-an-investment-condo-in-victoria/

Disclosure: I own three condos downtown/Songhees and have two more under pre-sale contracts.

What happens with a low rental vacancy rate is that people that would have NEVER considered an investment condo, suddenly start considering it… like myself. Now if I was tempted to go up to $275k, what’s better, a brand new 1 bed or an older 2 bed? (assuming the same location-ish)

303-2940 Harriet Rd vs. 101-317 Burnside Rd E? Just from a quick mls search. All comments appreciated.

well you have a point there. I do wonder if Costco is worth it.

I grew up on the peninsula so I understand the charm somewhat but I’m glad I’m not there now. We shop on week nights so we don’t have to do so on the weekend like all the people who “avoid the commute” to have more free time but end up spending their weekend going out to costco.

The anti-westshore sentiment is interesting to me. You can basically buy the same house in Langford or in Sidney for the same money. Both take about the same amount of time to commute to but one is twice the distance from downtown.

I am in Saanichton and I’ll take my longer distance commute any day; I have a manual car and the Langford commute would be brutal.

I quite enjoy it on the Penninsula. I go to the Saanichton Thrifties at 9:30 pm and there are 5 people in the store. Love that component, not a huge crowds person often seen in Langford.

The trend of where people are buying detached homes has changed dramatically since 2000 when sales in Victoria city were 70 per cent more than in Langford. Last year there were 30 per cent more sales in Langford than in Victoria City. And that will continue to increase as more and more people choose to live and work in their community.

If you don’t like to commute – then stop it.

https://youtu.be/EAlWBhohDp4

@marko, just what I’ve seen in the papers: “The Liberals have hinted they are willing to increase the exemption for first-time home buyers to the property purchase tax.”

The anti-westshore sentiment is interesting to me. You can basically buy the same house in Langford or in Sidney for the same money. Both take about the same amount of time to commute to but one is twice the distance from downtown. The distance between Sidney and Victoria will never change but it’s likely the highway will improve.

Another thing that I’ve always found strange in Victoria is the junk houses people are willing to live in to save driving 20 minutes. Look at that place on May st. That’s a “move-in ready house”? Seriously? I wouldn’t live in that place.

What are the rumours?

If the B.C. government unveils changes to home ownership incentives in the Feb. 16 provincial budget, as rumoured, would those changes usually come into effect at the start of fiscal (Apr 1)? Backdated to Jan 1? Is there a precedent?

We’re looking at buying in early spring, but would hate to miss out on taxpayer funded goodies.

If it was a good deal it would have had a bidding war in that hood. More signs of a market top.

A tear down potential property just doesn’t have the same market pool as a ready to move in home. Not many people have the time or know how to go about building a brand new home. The smaller the market pool the smaller the odds of a bidding war. It is kind of like listing a $7 million house for $5 million. It is a deal but will still take 2-3 months to sell (in Victoria that is, in Vancouver/San Fran it is gone in two hours).

Also someone made a full price very aggressive offer. Either it was unconditional or had a 1 day condition. Sellers give a lot of weight to the sure thing versus a higher offer with a bunch of long conditions.

“I said it was good deal in the previous thread”

If it was a good deal it would have had a bidding war in that hood. More signs of a market top.

Oil up 9%, whoo hoo. Sounds like big numbers after it’s been crucified 75%. Bear market rallies AKA sucker rallies.

http://www.zerohedge.com/news/2016-01-22/weekend-reading-bear-awakens

I completely agree with this person’s comment on the Reddit page:

“DO NOT make the mistake of forgetting the value of your time when considering the cheaper real estate values of the westshore. The traffic issue will very likely never get better, and you’re going to pay dearly for those marginal cost savings with your time and your health. An extra $100,000 in property costs peanuts over 10+ years. If you’re struggling over the extra 100k, don’t buy yet.”

1145 May Street just went for asking price in 2 days ($695,000).

I said it was good deal in the previous thread 🙂

Once in a lifetime deals this week… and I don’t just mean 1145 May St.

When she turns, she really turns. For instance, oil up over 9% alone today.

It’s noteworthy how US home sales jumped 14.7% in December after a sluggish Nov.

Our apartment block has had limited vacancies since September which is exactly what happened in fall of 2007. Have to go on a waiting list. By end of 2008 and into 2009 vacancies were wide open again til this past fall.

1145 May Street just went for asking price in 2 days ($695,000).

Not a lot of sales for a few years, people moving back from Alberta…. Millennials leaving the basement.

The vacancy rate went from 2.7 to 0.6. Which is an incredible drop in a very short time. The only thing I can think of that is different over that period is the opening of the Hudson with 120 rentals.

But that should have had the opposite effect??? Since 120 units is between a half to 1 percent increase in the total inventory of rentals.

Oil will recover eventually, after a pile of Canadian and US oil companies go bankrupt and their debt drags down the credit markets with it which equals several years. This so far from over. 2008 started out the same way, it’s not 1986 as some will have you believe. Markets may rally here for a few weeks then top, then roll over as the year goes on.

I don’t think CMHC knows how many illegal suites are in Vic, there must be a few thousand at least. How many streets do you drive down in Fairfield where you can’t find a parking spot and only one car can make it down at a time.

And as rental rates increase our buying affordability looks better to locals but also the international community. Price vs rents has been a big barometer and rents have been low. Thus I have been buying CAN stock. Even bought some shares in Genworth. The end is not happening and oil combined with hopes of a housing crash have brought that stock too low so the yield is over 10%! Same with the CAN banks. Bought a bunch of those last week as well. Yields high and way to many shorts. Oil will recover eventually, people will pay their mortgage and investors will come back to the market and all the shorts will have to cover…