Your house increased in value, here’s why it doesn’t matter

So as you’ve heard by now, property assessments are out in BC. Here in Victoria that brought increases nearly across the board. I’d link to a local news story about it, but they were all contentless garbage this year. BC Assessment has their summary of Vancouver Island assessment changes and you can look up individual properties on eValueBC.

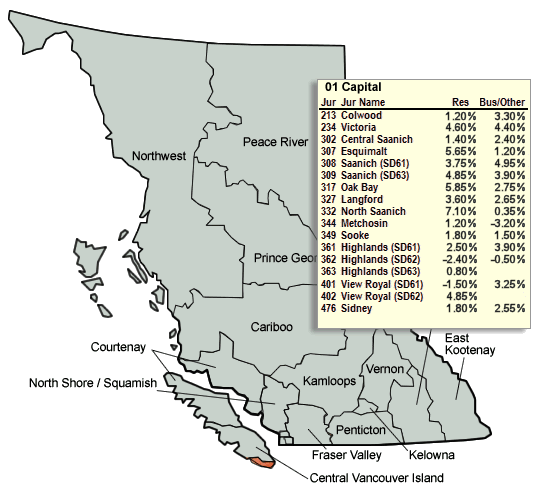

So what happened in Victoria? Here’s what BC assessment has to say.

If you have a house in the core, chances are your assessment is significantly up. Now before you succumb to the wealth effect and buy a sixpack of tablets, consider if that really makes a lick of difference.

Sure your house increasing in value increases your net worth, but that’s just a number with no real world impact, and it’s rude to talk about to boot. If you upgrade, downgrade or sidegrade your house in Victoria, an increase in value does nothing for you other than making the transaction more expensive. You could cash in and move to Tumbler Ridge, but really, will you? Yeah me neither. Unless you’re a real estate investor, the market value of your home is largely immaterial.

So what is the value? Well without getting into the exquisite homeowner-only pleasure of painting your wall a slightly different shade of beige on a Sunday, a house can be equivalently rented. So the value of a purchased house is actually set by the rent on an equivalent accommodation, or the imputed rent, minus the additional ownership costs.

I turn this into home value by considering what amount of invested money would be necessary to pay the rent on the equivalent place. For example,we paid $1800 to rent our previous house, which is now assessed at $523,000. The annual rent of $21,600 minus at least $5000 in ownership-only costs gives an annual rental value of $16,600. To generate that amount requires a $415,000 portfolio of invested assets using a 4% Safe Withdrawal Rate.

The practical value of your house is dictated not by the housing market, but by the rental market

So the value in your home is really about how much rent you can replace by purchasing it. Which means even if you own, the practical value of your house goes up with rising rents. And the return on your investment is reduced when you pay down your mortgage!

Want to know what your house is really worth? Just use the simplistic calculator below.

[body][/body]

You might be right on that, I‘ll check… regardless, Victoria would be very similar and what we know for sure is we have the best employment growth in the country (for ‘real’ cities over 130k). Only tiny Guelph has us barely beat.

Vancouver and Fraser Valley are doing great, but Vic is doing far better… 10,900 more jobs in 2015 will put a lot of pressure on our housing market this year.

Employment Growth 2015

Vic 6.4%

Van 4.5%

FValley 3.7%

http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/lfss04l-eng.htm

Posted by Mike:

Actually, the top 4 growth occupations were:

Management (9.4%)

Health (7.9%)

Natural and Applied Sciences (6.9%)

Occupations Unique to Processing, Mfg & Utilities (6.7%)”

These are for BC not Victoria – fail!

https://youtu.be/HzsnbKqIp4g

There is only one current poster I’ve observed consistently handing out questionable advice and opinions while claiming to wear the invisible clothes of an expert and it is not Marko.

And I agree it is the fees that get you with investing in the market. Making an instant 2% – or more – by learning to do this yourself is the way to go imo.

Mon Jan 11, 2016 8:20am:

Jan Jan

2016 2015

Net Unconditional Sales: 103 351

New Listings: 254 1,027

Active Listings: 2,379 3,283

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

“Every industry has dodgy people that give bad advice, especially real estate agents who take a 3 month course then can troll chat boards for business handing out bad advice with no repercussions.”

I have a tad more to draw on beyond the three month course – http://markojuras.com/about-markojuras/

“I have family who switched to an Edwards Jones guy years ago and have done extremely well when their previous advisors weren’t very good.”

Doesn’t Edward Jones have a 1.5% plus MER?

The reality is if anyone commenting/reading could consistently outperform the market with their “research” they wouldn’t be here worrying about the prices of homes in a relatively cheap real estate market. What’s a couple of million if you can consistently beat the market, not much once you start compounding.

I managed all my own RRSPs/TSFAs and the most important thing one can do, in my opinion, is avoid MER/fees. Paying a 2% MER on a market that returns 7% on average is just as smart as paying 6%100k+3%balance to sell a house.

Years of watching BNN has thought me that “experts” rarely make good calls, let alone the average Joe.

If you’re invested in mostly equities you should expect to lose 30% every 5 years or so. Has nothing to do with CCP or indexing

What he says is be prepared for up to 30% losses or more as the bear market kicks in which Canada is already in and US stocks are just entering. The ending of mass market injection of QE and higher interest rates is now kicking in and you best protect yourself.

So he says the people that get good returns are the ones that are disciplined and don’t panic. He also says “Just two examples of how the truly skilled investors are not the ones who are able to make shrewd economic forecasts. Rather, they’re the ones who recognize the futility of trying.”

In other words, that article is pretty much a ringing endorsement of passive index fund investing. Keep your fees low, don’t stray from your allocation, and you will do well over the long run.

Obviously don’t expect the 9% annualized returns to last. The 20 year return is just over 7%. Going forward I expect that to trend a bit lower.

Food for thought. Hope you Potato heads can stomach a 25% to 35% loss when 2008 repeats itself. They have a liability clause I noted which recommends you see an investment advisor for your own particular situation.

Waiting too see them update last year’s numbers, still using 2014 on the Tangerine funds. I wonder if they get a kick back ?

http://www.moneysense.ca/invest/etfs/9-couch-potato-returns-wont-last/

Every industry has dodgy people that give bad advice, especially real estate agents who take a 3 month course then can troll chat boards for business handing out bad advice with no repercussions.

I would use a fee based broker who someone you know has had a positive experience. They charge an hourly rate or plan your portfolio balance per how much value per account. From $100 up to a few hundred but they never touch your cash, you manage it.

I have family who switched to an Edwards Jones guy years ago and have done extremely well when their previous advisors weren’t very good.

If some website is for free then you get what you pay for when markets turn south and your portfolio is out of balance.

Re: Overbuilding

What we need are buildings like this, to provide the offshore investment opportunities that panicking Chinese are apparently anxious to find. Maybe they could be located in some picturesque mountain valley, where they would not clutter up our cities with largely unoccupied buildings. Without some such development, much of our better quality housing could become priced beyond the means of virtually all Canadians, a tiny population in relation to Asia’s teeming masses of millionaires (one million of them added in 2014 alone) and billionaires.

You can see the average price is up about $600,000 since Ben told everyone it was going to crash. I honestly don’t know how he gets published in the media with his analysis track record.

http://www.yattermatters.com/2016/01/vancouver-average-home-prices-record-busting/

More Rabidoux rubbish IMO… 15yr-olds don’t buy houses. He completely avoids mentioning how the eldest millenials are only just now reaching their average FTB age of 36 this year. That buying trend will accelerate for the next 10 years as the “peak” millennials (greatest number) are only turning 26 this year. I feel sorry for the crowds of people at the World Moneyshow in Vancouver early 2013 (I was there) that were told we’re going to crash at what turned out to be the exact bottom!

http://www.huffingtonpost.ca/2013/04/20/canada-housing-crash-economy-ben-rabidoux_n_3123312.html

If you need investment advice your best bet may be to go to a Chartered Financial Analyst (CFA), who charges a fee for advice without taking a percentage on your trades. The CFA program, According to Forbes Magazine,

TD bank e-series is one of the best ways to go. For smaller amounts Tangerine has a good option if you don’t want to set up the TD accounts.

Worrying overbuilding on a national level http://www.theglobeandmail.com/report-on-business/economy/housing/canadas-housing-boom-has-no-demographic-legs-to-stand-on/article25523999/

Not true. We have 4 different self directed accounts (RRSP, 2 TFSAs, RESP) with TD waterhouse, containing mostly e-series funds. No sales pitch, no account conversion.

The worst of the worst are bank ones. TD bank, home of the e-series low MEF index funds used (still does?) make you open a mutual fund account in branch and then convert it over to e-series later. So you’d have to endure the pathetic sales pitch from the just got out of being a teller “financial adviser”. So lame.

Exactly. I have a similar history with financial planners although I switched to DIY passive investing rather than active as you have.

I have low respect for financial planners. To give you an example of what you are paying for, my first spouse was looking for new work. She stumbled upon the notion of becoming an Edward Jones financial advisor. Just a month of training and bam! Ready to go! I find most are just salespeople with fancy titles. I’m sure there are real ones out there but they probably don’t work with anything less than a million. I had one for years. I would buy his crap sometimes but mostly ignore his advice to sell apple which only increased as it increased in value. More money to buy his crap if I sold it I assume. This was in my RRSP. Didn’t perform well for a decade until I fired him, sold all the mutual funds he sold me and got active myself. Doubled it in a few years….

Following some website is not a sure fire way to lower your profitability when that website is run by professionals with the track record that the CCC. The blog’s author is Dan Bortolotti, CFP, CIM, an investment advisor and financial planner with PWL Capital in Toronto, where he and his colleagues provide portfolio management using the same strategies in the blog. However, the CC teaches you to buy and sell without the “professional fees” which substantially increases the returns.

And there is no substitute for your own research on matters. For me, I understand the local RE market in the SFH segment in certain areas well. I’ve done years of research. I am comfortable that I’ll make profitable decisions long-term. I understood investing less well but two years ago I began the learning curve. I am not at Dasmo’s level but I’ve realized I’m not sure I’m interested enough to get there – and probably won’t be until I stop working. I am interested enough to figure out a system that works without as much time put into it and is DIY and I have.

What I discovered is that the financial planning “professional” industry in Canada is unregulated. Anyone can hang up a shingle. You don’t even need a high school diploma. You can be one. Just print some business cards. And FPA largely make their money from fees associated with selling the investments that many buyers don’t understand. Very few planners are flat fee upfront as it is harder to market. Only approximately 150 of the 90,000 financial advisers in this country are advice-only financial planners selling only financial advice and not products. The hidden fee approach is more profitable. This creates an incentive to sell certain products that give planners higher kick-backs.

So if you want “professional” advice on your 100s of thousands go ahead, but the stats say that the CCC approach is going to bring you a higher ROI and it is easy to DIY.

This guy is in the US but his advice (and the math/stats) holds for Canada and it is a good place to start:

http://jlcollinsnh.com/stock-series/

Whatever the cause, there is an inflow of workers here in Victoria. You see it in employment growth, you see it in the rental vacancy, and you see it in housing demand. Backflow from Alberta seems like a good explanation.

Mike, can you post a link to those numbers ? Having to put a sign in the window of a bookstore shows desperation when there is supposedly higher levels of unemployed out there and makes it look like they all quit because of the shitty wages. When has retail management paid more than $17 an hour or so ?

Toss in the high volume of restaurant jobs with the 40% retail and that would make 60% at least in the low paying category under $20 per hour.

nan,

No, the ex Dallas Fed president but a voting member and was involved in the 2008 bailout process, he knows. You mean Bernanke the one who kept the blinders on in denial til it was too late and everything crashed ?

http://www.businessinsider.com/richard-fisher-fed-comments-2016-1

Well LeoM, you must be the amateur here to not read the Ontario Teachers Pension Plan motto and that is to trade stocks as well as indexes, sell high and buy low, and not be passive. How do you think they make 10% ?

Following some website without a professional guiding you with hundreds of thousands in this kind of market is a sure fire way to lower your profitability chances but again, to each your own, it’s always worked for me. As the OTPP does, buy low, sell high.

From the OTPP website:

“We engage in active management with a global perspective because we do not believe that passive investing through market indexes alone can generate the risk-adjusted returns plan members require. Also, as stated in our Investment Beliefs, because markets can be inefficient, active management allows us to capitalize on opportunities.”

Yes, sorry Can Couch Potato. You can go to the site and they post the historical returns for each type of risk profile for the funds they recommend.

Ex fed president? You mean the Bernank?

http://www.marketwatch.com/story/ben-bernanke-makes-the-case-for-passive-investing-2015-12-17

@totoro

CCC balanced fund? Google didn’t assist me in learning what this is – can you elaborate? Do you mean the CdnCouchPotato?

You don’t need a professional advising you if you have 100s of thousands to invest. CCC or an equivalent will do just fine and it is almost a sure bet that after fees the ROI will beat the professional. The CCC balanced fund 5-year return is 8.4%. The 20 year is 7.74%.

Hawk, you’ve exposed yourself as an amateur investor. The long term strategy used by the Ontario Teachers Pension Fund has earned them the envy of every stock broker in Canada. In fact they have achieved an average annual rate of return of over 10% since 1990. Compound that Hawk!!! How did they do it? Long term strategy to buy and hold quality companies. Their senior people don’t even read the daily stock quotes because they are irrelevant to their long term strategy.

Actually, the top 4 growth occupations were:

Management (9.4%)

Health (7.9%)

Natural and Applied Sciences (6.9%)

Occupations Unique to Processing, Mfg & Utilities (6.7%)

Hence the TC picture of the sign in the window advertising management positions.

The job openings forecast is calling for a 31% rise from 2015 to 2021. Of course a lot of factors could make that better or worse over the next 5 years.

The big job numbers increase for Victoria are mainly in the retail sector at $10/hr jobs. Hardly what you call mortgage worthy in a town with stores that are struggling to stay open in the core. Now that is what you call journalistic sensationalism with a job hiring sign on a book store window which pays minimum wage.

Passive or an active investor is your choice but also depends on how much cash you are talking about. Hundreds of thousands, or under 50K ? If it’s hundreds you best have a professional advising you, not a Couch Potato dude. Active investing takes time and studying fundamentals and charts, it’s work. Dasmo has the right method if you want to be active.

I have little faith in the over all markets right now, especially when the ex Fed president just told us he helped rig the markets the past 7 years and there is no savior when the next crash hits. Smells like August all over again, maybe worse.

I can also admit to failures. Liquid Audio was a big one. I did not see the powers that be fighting digital music distributions. I held on until this company vanished. Even when the fight began I didn’t believe it would last. Turns out I was right but it took a little longer. SDRL is another one. I should have jumped ship on that one (pun intended) problem is living here in rotterdam you see some of their big shiny boats in the harbour so that gave me confidence in them. I didn’t think the oil crash would last. Now I see it as lasting a while longer since it is now clear it’s a weapon being used by Saudi Arabia against Iran. Speaking of luck vs skill. The insiders figured this would probably happen when the inklings of sanctions being lifted off Iran first started bubbling. I violate my rule. Invest in what you know. I know shit about the oil industry. This is why I sold Teekay Tankers (which I profited from) and bought LuLu Lemon. I also feel better investing in the Vancouver company that gave us men the yoga pant 🙂

And if you can beat the market by a lot over 10 years you should really quit your day job…

ya I know but iTrade doesn’t go back that far with this new tool.

@dasmo Yes you have some credibility because you actually post your returns. Although I think 10 years is about the minimum period where beating the market is good evidence of skill rather than chance.

I dunno. I’m still beating the market… I wouldn’t say I’m buy and hold except for maybe Apple. even then I have take profits out of it a few times. I like to take my original investment out when the stock doubles and put it elsewhere (although I wish I didn’t with apple). The only stock I haven’t done that with is FB. I will also exit stocks. BABA is one. So was GoPro, I have bought back in (which might be a mistake). I have taken hits this year for sure. But this is why you don’t go all in with a single stock. I think the term periodic investor is better then buy and hold. For the exact reason Leo S pointed out. You can gain from ups and downs Like buying in 2008. Hopefully my buying activities now will have a similar outcome. There are just more falling knife in this round… You can see this in my chart….

http://i.imgur.com/CCtVnYs.jpg

You might enjoy individual stock picking but I find it extremely hard, if not near impossible, to believe that on the long term you have outperformed someone following something like the Canadian Couch Potato strategy (low cost index investing) which does not involve individual stock picking.

Look at the returns on the site, and as Nan has said, “There is simply too much evidence out there that supports that it is unreasonably unlikely to beat the market on purpose with the same information as everyone else. Even if you get lucky over a short period of time, you simply can’t do it with enough reliability over a long enough time horizon to beat a 30 year low cost buy and hold investor.”

http://canadiancouchpotato.com/

I also agree with Leo that for most people who believe they are beating this strategy based on their own smart choices focus on the gains and don’t do the math carefully, including trading costs, over the long-term.

See this is what’s concerning. When people who claim to be able to beat the market don’t understand some market basics.

Find me the investor that dumped all his money into the market at once in 1929 and then waited for it to recover, Doesn’t exist. Even if it did, that investor would have made a 400% return over that period you say was flat. That’s 6% per year real return.

However in reality someone doing buy & hold would have bought in over time at $X/year before 1929 and after. Sure some investments were bought at the peak, but then others were bought at the bottom.

So let’s say the buy & hold investor starts investing in 1929 with $5000 and then puts in an additional $1000/year every year from 1929 to 1955 into US equities. His return over that period using buy and hold is 9.5% per year. That’s over a period where the market index went nowhere.

Check it out yourself: http://dqydj.net/sp-500-dividend-reinvestment-and-periodic-investment-calculator/

“The only pattern I see between amateur active traders and passive indexers is that the indexers are 100% transparent about their returns, while the traders only talk about their big wins. They either don’t know or don’t want to disclose their actual long run return.”

In Mike’s case he always wins and never loses, and always buys at the absolute bottom tick of the year. Truth ! 😉

I never said I haven’t taken losses, I’ve taken some doozies, but also made some very big ones back. I find investing fun and like the challenge, and not sit back and wait decades to see what happens,but I also pick my spots and don’t invest at certain times of the year as well as some years more than others.

History shows there has been huge generational era’s where buy and hold hasn’t worked. It took 11 years for the markets to get back to even from the 2000 top.

Here is a prime example of buy and hold not working for major parts of nan’s 140 year history factoid.

“Proof of the fallacy of buy-and-hold as a strategy is easy enough to find. In the 1929 crash and its aftermath the market lost 86% of its value and did not get back to its 1929 level until 1955, twenty-six years later. That was 26 years of waiting for buy and hold investors (if there still were any) for the market to ‘come back’.

“In 1965, just 11 years later, when the Dow reached 1,000 for the first time, the long 1965-1982 secular bear market began. For the next 17 years the Dow cycled between cyclical bull markets and cyclical bear markets, but did not manage to rise above its level of 1965 until late in 1982. It was another 17 years in which buy and hold investors (again if there were any left) waited for the market to come back. Seventeen years of whipsawing heartbreak for buy and hold investors, but wonderful opportunities for market-timing.

“That made a total of 41 of the 53 years between 1929 and 1982 that buy and hold investors were waiting and hoping for the market to get back to previous levels.”

The only pattern I see between amateur active traders and passive indexers is that the indexers are 100% transparent about their returns, while the traders only talk about their big wins. They either don’t know or don’t want to disclose their actual long run return.

“He believes that is due to workers returning to B.C. from Alberta as that province’s economy slowed considerably.”

seems like a sensible theory

Further to Michael’s post yesterday: http://www.timescolonist.com/business/victoria-tops-province-in-employment-growth-1.2147510

@ Leo, I think you mean hawk…

Mike, I’m sure you’ll let us know when the LNG plan gets the other several permits needed. Still a Christy pipedream with a long way to go, especially with gas prices still in the tank and only where it was a month ago.

When early spring temps come in a month or so it will head back down. All these gas deals went in the tank at prices of a year ago.

Can you show us the job sector stats too,not the ones you made up ?

Pretty funny fawning over Buffet and a Pension plan. Both buys and sells stocks all the time, not buys and hold indexes. As I said that is two different things. He’s also not some hero and has people sucked in.

No need to get out of joint Nan, market timers make more money by working harder. If you want to sit back and mold and diss any market crash as if it’s another day at the beach, then as I said to each your own, but my system has worked great for me.

http://www.jamesaltucher.com/warren-buffett-is-not-your-grandpa/

Nan, you make some blunt negative assessments of investors who ‘buy and mold’. Very odd opinion when two of the most successful investors in modern times use that strategy. Do some research on the strategies used by Warren Buffett and also the Ontario Teachers’ Pension Plan, both of whom have done amazingly well at beating the market year after year with the ‘buy and mold’ strategy. I know Buffett just had a bad year, but only one bad year out of forty ain’t bad. Of course, you need to pick exceptionally good, large companies, for this strategy to work; for example it won’t work with 99% of small company mining stocks.

For Victoria they’re mostly high-paying tech & scientific, health professionals, shipbuilding, film industry, engineering & construction and retirement financial planners. There’s no sub category for it, but I still wonder if it’s those darn RE investors that are making the most 🙂

Natural gas up ~40% in last 3 weeks has got to be looking good for the big LNG licence that got approved yesterday. Christy & gang must be smiling.

What you are referring to on the TSX as far as I understand it is caused by a supply side shift in the oil market that affects demand for Investments in Oil companies and Oil production, which puts negative pressure on the $CAD which puts further negative pressure on the willingness of folks to invest in anything denominated in CAD for fear of losing on the currency or lend to our banks, all rolled in to a big black cloud of “negative sentiment” for Canada. We have a large part of our economy in extraction industries, so bummer for us on all fronts, for now.

That being said, oil consumption has not decreased over this period and you shouldn’t have all your eggs in any basket anyways. It is cheap and it works and the emerging markets are still emerging. I expect great things from the Canadian market over the next 5 years. The total return on my portfolio was just under 6% this year, even with all the losses in the 20% of my portfolio invested in Canada. Not bad for a pretty terrible year all around. What was your return?

Whenever I hear someone say “Buy and Mold”, I know 3 things:

you are either a vested investment professional or someone who is either ideologically or financially invested in expensive investment strategies,

you don’t want to (or can’t) understand basic financial mathematics & have an aversion to studying history and/or believe “it’s different this time”

As a consequence of 1 and 2, instead of using a simple, boring, proven method that works, you trick yourself and your clients/ friends or whatever into believing you can beat the market by doing “something” (trading, strategies, timing, currencies, whatever). This assertion is based on no evidence whatsoever, since it has never been done by anyone other than the luckiest investors, whose results were so rare that they may as well have been playing the lottery.

There is simply too much evidence out there that supports that it is unreasonably unlikely to beat the market on purpose with the same information as everyone else. Even if you get lucky over a short period of time, you simply can’t do it with enough reliability over a long enough time horizon to beat a 30 year low cost buy and hold investor.

The combination of selective bias and opaque measures of investment success may keep you promoting otherwise but the buy and holders won’t notice because we’ll need all the time we can get to spend the money coming out of our ears (and everywhere else).

Wealth accumulation is relative. I don’t need to endeavor to have a limitless supply of money by hitting it big in the markets. All I need is the ideological guarantee that on a given income, I will accumulate far more than you will with far less risk. This might not fuel a fantasy of retiring in a castle to wade through beautiful women and fast cars, but it will definitely put me into a better position at retirement (on average). When it comes to wealth, that is all that matters.

Where are the jobs Mike ? No one seems to know, they keep them top secret in Victoria. Restaurants, janitors for the condos, tourism and other low paying jobs seems to be the only growth area judging by all the hoopla about the low loonie.

7900 full time jobs lost last month in BC, part time jobs don’t qualify for mortgages.

Today’s job numbers show we’re leading the way in employment growth (Dec’14-Dec’15):

Victoria 5.8%

Toronto 4.7%

Vancouver 4.2%

Fraser Valley 4.5%

BC average 2.3%

National average 0.9%

Kelowna -0.5%

(don’t buy Okanagan, too many Albertans/no industry)

http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/lfss03l-eng.htm

Usually around a year after people get jobs, they start buying homes. With our affordability, Victoria is a nobrainer. Million median core by 2020 should be a slam dunk and we’ll still be half price to Van.

I don’t buy the “buy and mold” theory nan. Since most Canadians are mainly invested in Canadian index funds (which your article refers to but in US indexes) then you haven’t made squat since 2006 when then TSX is at the same level it was then. If you are talking individual stocks then that is another ball game entirely and can’t be measured in the same percentages as so much comes into each company and sector and entirely different risk level.

Seeing THE worst start to the year in history and ignoring it completely is setting yourself up for failure. Markets may bounce back but over all we are clearly entering a global slowdown where index gains will be minimal and also high risk to the downside, especially if earnings seasons disappoints. Apple already said Iphone sales to China are slowing down, that’s huge for a market leader.

I never said buy bars of gold, I bought a junior gold stock for a trade or maybe longer if things change, high risk, high reward but I can handle it, most can’t. If the US dollar crowded trade fails then it will be even more sweeter but it’s not for everyone.

Overvaluation in the US market is now showing up, and wouldn’t want to be holding all my eggs there either. Cash and a few small, but well researched, stock positions with stop losses in place, is the way to go for me but to each their own.

What you call sensationalism is to me called staying on top of your investments and listening to all sides of the story from many financial experts, bulls and bears, not journalists as you say. Even Poloz just said it’s going to take 3 to 5 years to get out of this mess. Buying and holding through that is a scary proposition, just like the last 10 years of holding the TSX index that has done nothing. Economic numbers don’t lie, manufacturing is sketchy in the US and Canada, and even the DOW can’t go up today on surprise job numbers.

Boomers have tons of retirement money at risk as well and as Dasmo says may pull it out if things go south. I’d rather have cash then worry about a percent or two of inflation lost.

If you can wait 140 years then good on ya, but most smart people want to make short term trades/investments and lower their risk with less money involved when the markets have never been more high risk.

http://stockcharts.com/h-sc/ui?s=$TSX

@ Hawk – if your investment horizon is only 5 days, you are either a lot older than me or just have a short term perspective. In 2 weeks, the market will have digested this and be onto something else.

Hold cash, the governments will steal it via inflation with absolute certainty. Invest in debt and you suffer low cash flow and give up any capital upside especially at these rates. Gold? purely speculative, no investment value. Real estate? Everyone needs a house but your investment portfolio needs to be 1%er sized to justify two or more in a adequately diversified portfolio.

Also, this: http://www.businessinsider.com/cost-of-missing-10-best-days-in-sp-500-2015-3. If you want to miss out on what may be some of the best days over your 30 year horizon, be my guest.

Everyone is interested in sensationalism – especially those that have nothing else to talk about in their jobs as news reporters. What doesn’t make the news are the vast numbers of people that simply buy, hold and become millionaires by doing nothing other than balancing their portfolios & managing the risk they are willing to accept over time.

Buy, hold & prosper. It has worked for the entire existence of the stock market, without exception. Or, run around like the sky is falling every time some news comes out, completely ignoring the last 140 years of stock market operation. Your choice I guess.

The peak boomer births were 1959/60. Which makes them currently 56 years old.

Vic retirement buying will accelerate for at very least 10yrs.

The wealthiest ones will move here from Van, TO along with a steady increase from US, Europe & Asia.

Half the Baby Boomers are now retired, have taken early retirement or have transferred to Victoria in the last ten years of the careers to be with their children that moved away for economic advantages, such as construction jobs, and their grand children.

Now as the number of baby boomers is nearing its apex, there will be fewer boomers each year. The boomer generation ending with the wide use of the birth control pill in the early 1960’s. The federal government has selected March 15, 1958 as the half way mark for the boomers. Those born before get benefits at 65. Those born after that date have to wait to age 67.

A boomer taking early retirement or moving to be with family are now born in 1961 with the boomer generation ending about 1964 with the wide use of the birth control pill.

Not much time left for the boomers to move to Victoria. My guess is that most of them are already here having bought between 2000 to 2007 when we had the big run up in prices when the boomers were turning 55.

If you’re waiting to age 65 or 67 to retire to Victoria and then expect to move away from family, friends, communities and your family doctor you have waited too long.

The China exodus should pick up steam this year. Victoria is a nobrainer for the Chinese with our 70 cent dollar. You can’t blame them for wanting to get their lifesavings out before their yuan is de-pegged and devalued.

Jan 8, Financial Post

http://www.financialpost.com//business/china+stock+market+crash+going+send+more+money+into+vancouver/11636340/story.html

At the same time boomers will liquidate real estate to free up cash to live on. Will be an interesting balance.

Recent NASDAQ performance has less to do with how those companies are doing then investor sentiment. This China stuff is spooking people. Oil is spooking people. Saudi Arabia VS Iran is spooking people. Stock prices don’t represent how a company is performing anymore. Just compare Apple to Amazon….

Will be an interesting year market wise. I must admit I was feeling a little invincible these last few years. Anything I bought simply went up. I’m not feeling so tough so anymore. My hands are too bloody from catching a few falling knives. I’m still beating the market but there are some big red numbers in my portfolio let me tell you. In the past ten years I’ve never had a singe double digit red. I simple had no concept of covering or stop loss. I do now… but maybe not quite since I am still holding a few (Etsy for one). I’m glad I dumped a few and thankfully I have more big green numbers 😉

More money is going to exit If it doesn’t turn around soon. Too many boomers close to retirement. That money might move into RE if it’s deemed to be safer.

https://www.movieposter.com/posters/archive/main/149/MPW-74528

Selective memory there Mike, that was the same chart you posted a few weeks back claiming it was indicative of Tectoria. Same goes with FM, you posted a couple of times I should hurry up and buy it when it was peaking with all your other commodity boom picks like Teck etc back in October. Get it straight will ya.

Gold came off a bottom with some strength and out of favor dirt cheap juniors make great moves at this time of year. Shall I post every time I make a buy from now on ?

Gold is definitely back on the radar when the ex Fed chief spills the beans they rigged the markets since 2008 and now you’re on your own. Not a time to buy over priced assets like lemmings running off the cliff. Chicken little my butt.

FORMER FED PRESIDENT: ‘The Federal Reserve is a giant weapon that has no ammunition left’

In an incredible interview on CNBC, Fisher said the Fed “front-loaded” a market rally after the financial crisis with its quantitative-easing stimulus program, but he warned that the fallout was coming — and that the Fed didn’t have anything left to help markets.

http://www.businessinsider.com/richard-fisher-fed-comments-2016-1

Agreed. There is a lot of desperation out there due to the lack of inventory and a quality listing would get snapped up quick.

Best time to sell is February. Beat the rush. You’re still low in days on market in march and you get the early birds. Trust me February is the time to do it.

lol… I didn’t know that was Tectoria’s chart. Mine says we’re up over 100k in the last two years.

Peak boomer births were in 1959/1960, which if my math is correct makes them currently 56 years old. Your last comment on gold was you didn’t own any and now you’re suddenly up 70% on a gold stock…I mean I hope you are, but don’t forget about the gold vs. RE relationship I showed you. If you’re bullish gold, you may as well buy a house… and where did this recurring FM fascination come from? I’d gladly show you my account histories, I’ve never owned it. Do yourself a favour and buy some Exxon, great company & dividend.

Katyusha, best timing is tomorrow. If you wait too long the 50% renters (newcomers) in this city will start to give you competition.

How’s Tectoria doing Mike ? Not too good by the looks of it. Broke the 200 DMA.

http://stockcharts.com/h-sc/ui?s=$NDX

Low inventory…and getting lower…excellent news 😉

I look forward to adding a fantastic 3 bedroom, 2 bathroom Swan Lake property to the market this Spring. What is the best timing — early March, March, early April?….

Mike, the end of boomers is 56 range.The peak group is in early to mid 60’s and are now planning their move in next few years.

XOM was up 25% and you said no ? Just like FM at 10 now under 5. What about your other 20 stocks sucking wind ? Must be painful.My junior gold play is up 70% so far. 🙂

Nan,

Dow down 1000 points in past five days, the only market anyone made money on in past 2 years. China markets crashing 7% in 15 mins then halted… twice. Head in the sand or what, lol.

With listings this low, if you have a dump of house this is the time to sell it before listings begin to climb in the Spring.

Hawk? More like chicken little!

It has already started, they’re selling TO & Van and starting their migration to our retirement mecca 🙂

That trend will accelerate for at least the next 10 years alongside the millennial acceleration. The peak boomer is only 56yrs young this year.

Yet another Soros 2008 crisis… (yawn)

Oh well, nice to see BC’s main resources natgas & precious metals way up. Gotta look at the bright side…lol…even if my exxon is now only up 14% from my august addition.

Isn’t the low inventory due to rising sales/list ratio?

The selling pressure from the boomers will kick in long before ten years from now, especially with world markets in crisis. The boomers have the most to lose as any losses from here on are pure cash that is their retirement dough. Inventory will shoot up fast once prices show topping out or declining which should be this spring/summer.

It’s 2008 all over again I believe, with no more Fed and BOC life jackets to save the markets this time. Soros agrees. Poloz says we “just have to ride it out”. How reassuring.

George Soros Sees Crisis in Global Markets That Echoes 2008

http://www.bloomberg.com/news/articles/2016-01-07/global-markets-at-the-beginning-of-a-crisis-george-soros-says

The “peak” number of millenials turning 36 (born in 1990) is still ten years away, however it’s the growth or acceleration of more and more millenials turning home-buying age from now until the year 2026 (peak) that matters.

Once we reach 2026 would be the time to sell, as from that point on the number of millenials turning 36 will decelerate, flatten or possibly even decline (dependent on immigration policies, etc).

Is that not a the usual indication of a market top: with sellers holding off for the market to go higher, while the supply of buyers offering crazy high prices dries up causing prices to dip, which prompts everyone with plans to sell to list before prices crash, which causes prices to crash as a deluge of new listings coincides with growing buyer resistance in a declining market.

How so?

By your own admission, peak millennials are still ten years from the first-time buyer’s average age. What’s more, the average age of the first time buyer is still rising:

First time home buyers in Canada are getting older: poll

A more reasonable interpretation is surely that we can expect only limited first-time buyer demand for years to come.

Any idea/wild speculation on why the level of inventory is so low? Of course, this is when we (for family/work reasons) need to start looking at the Victoria market. 🙁

With the first of the millennials turning 36 this year (born 1980) and the peak millennial turning only 26 (born 1990), we’re in for an incredible 10 years of home buying.

Not to mention the influx of millionaire retirees.

Some interesting statistics from the article, “Rich at any age” :

20s – 36% have an RRSP, 42% are living in the parental home (up from 27% in 1981)

30s – avg age of First-time homebuyers is 36, avg age Cdns start saving for retirement is 32

40s – avg age Cdns pay off their mtg is 48, 36% believe how they manage their finances impacts their children

50s – 45% have saved less than 100k, 24% expect their home to be their primary source of retirement income (!)

60s – 70% admit they didn’t choose the day they retired, 40% of Cdn millionaires are >65

70s – 72% own their homes, 83% find that paying for at-home care as needed is the most appealing living arrangement.

As correctly pointed out by someone on VV only 1 home in Gordon Head currently under 700k and it is on Shelbourne. This inventory crunch is crazy.

While paying down your mortgage quickly is never a bad strategy, it shouldn’t come at the expense of retirement savings. Provided you’re making minimum mortgage payments and you don’t have an amortization that takes you into retirement, not putting some of your extra cash flow into RRSP or TFSA investments can be considered risky—because you don’t know which will have the bigger impact down the road. Keep in mind that prioritizing a mortgage for 10 years is a great feeling, but you’ll have also missed out on a decade of compounding. All of this isn’t to say, however, that you should drag out mortgage payments for as long as you can—even if rates are very low right now. Inevitably, they will increase in the future, meaning when you renew you could see your monthly payments jump up. But if you can take a few years off the mortgage by increasing payments and still put away something for your golden years, by all means go for it. Only those contending with big mortgages need to make crushing that debt their No. 1 priority. Your 50s should be focused on saving for retirement and you don’t want anything competing with that. (excerpts from MoneySense articles)

“At these rates it’s stupid to pay down your mortgage but I’m doing it anyway.”

Makes more sense on a principal residence. On an investment property at these rates plus interest tax deductible doesn’t make any sense, other than psychological.

There are 1,723 residential listings of all kinds in all areas. The months of inventory become more meaningful if you look at the break down by type and location.

923 houses

490 condominiums

184 townhomes

126 other

Houses

210 Core

297 Western Communities

87 Peninsula

329 other

Condos

351 Core

87 Western Communites

40 Peninsula

12 other

Last month there were 104 house sales in the core. That makes the months of inventory 2

Condos in the core there were 97 sales that makes the MOI at 3.6

5 to 7 months of inventory usually means a balanced market between buyer and seller. These figures show the market strongly in favor of sellers with buyer have little to negotiate.

The only thing keeping prices from increasing, in some price ranges, is that buyers are not able to get more financing. And that inability is affecting about half the buyers today. They are maxed out at today’s interest rates.

Raising the interest rate slightly would likely only lower the number of sales and bring the market back into a balanced position. If the BoC raised the rate marginally, I don’t think we would see lower prices. Higher unemployment but not lower house prices.

Higher unemployment in the construction trades would be good for home owners wanting to make improvements or repairs to their properties. Roofers, landscapers, etc. will have to lower their profit and wages.

@Marko

Crazy. “There are currently 4.2 months of inventory (MOI) which is very low for this time of year.” “very low” means between the 10th and 25th percentiles for December MOI.

I’m OK Bearkilla. My mortgage is 2.39% right now. I wanted to stick with my bank and that’s the lowest they would go….

Too bad for you Dasmo, I got 2.00 % back in December and my mortgage wasn’t due until February. One phone call did it. At these rates it’s stupid to pay down your mortgage but I’m doing it anyway.

There are 38 houses listed for sale in Victoria today. In Langford there are 119 houses listed.

Even Sidney with a vastly smaller housing base and population has a better ratio of homes per capita for sale at 17.

I pity those looking to buy a house these days.

But when the butcher shops’ shelves are nearly empty some will pay top price for maggot infested meat.

I spoke with one Alberta oil patch worker recently laid off. Freshly back from the oil patch with a wad of cash to spend and eagerly looking for a rental house. The plan was to rent out the main and basement and he would live in the garage.

How bad does it have to get before buyers say no!? They shoot horses, don’t they?

I don’t know if I would call them “loser”. What I posted in the past where some properties that I thought were good deals for the purchasers. I haven’t done that for awhile as I haven’t come across any properties in the core that I would call good purchases for the buyer.

I

Residential – 1733

Commercial – 784

Remember when the government freaked out about 2.99% saying that was irresponsibly low?

Canada’s largest bank is raising mortgage rates. RBC (RY.TO 0.00%) will boost discounted rates on its two-year fixed-mortgage 0.10 percent to 2.39 percent.

Hardly a “boost”. This type of fluctuation is happening all the time. I was looking a lot at rate hub for my mortgage renewal since you can renew up to 6 months early. .1% is nothing and does no indicate a trend. HSBC is offering a five year fixed at 2.8% right now. That is cheap money still. http://www.ratehub.ca/best-mortgage-rates/5-year/fixed?scenario=purchase

For those with assessment issues – recall that the assessment reflects estimated value as of July 2015. Given the strong late part of the year, I’d guess most will get a larger jump next year. Yes, this assumes a noticeable jump in prices in spring 2016.

Consider this a prediction.

Not sure if it’s just me, but the ‘Practical house value calculator’ doesn’t seem to work. (No ‘calculate’ button or similar; no obvious way to make it run the estimate).

RBC jacks up mortgage rates. May be minuscule but it’s the fact it’s the first time upward in years… AKA a trend change.

http://www.bnn.ca/News/2016/01/05/RBC-boosts-mortgage-rates.aspx

@Marko Could you post the residential inventory for december please?

What happened to the “buy zone” in 1998 Mike ? Looks to me like it has another 10 cents to go.

The sellers in Fernwood are making some money while they can. Who would pay 700K to live over the back yard fence from Bay St ? Yikes.

Can you post some loser lists too Marko ? Jack has posted quite a few in the past.

1480 Walnut went today for $675,000………purchased in 2012 for $580,000.

Near a turn on the canuckbuck? (36yr view)

http://i.imgur.com/DkFC2DB.png

I wonder if V Madrona went to a savvy American. I have a cousin from lalaland who’s thinking of buying something here. I told him he’ll look like the Warren Buffett of RE by 2020.

No big deal in the rich man’s game of Flip This Shack. The original owner who spent upwards of $20 million building it then took eight years to sell it. Started out in 2005 at $18.5 million then jacked it to $19.25 in 2011 when sanity set in. What’s a $12 million haircut in the big scheme of things right ? Next guy will probably pay $5 million.

I still don’t grasp what the obsession with assessments is….whenever I get out of my car to show a house I note the assessment number because I know my buyer will ask me.

Great gauge of the overall market, completely useless on a per property basis. I’ve been through both my immediate neighbours’ homes and just looked up their assessments, and mine, and the assessments are substantially off actual market value on two of three properties. One is somewhat close.

Villa Madrona just re-sold for $8,000,000. Purchased in 2013 for $6,600,000.