2015 Year In Review

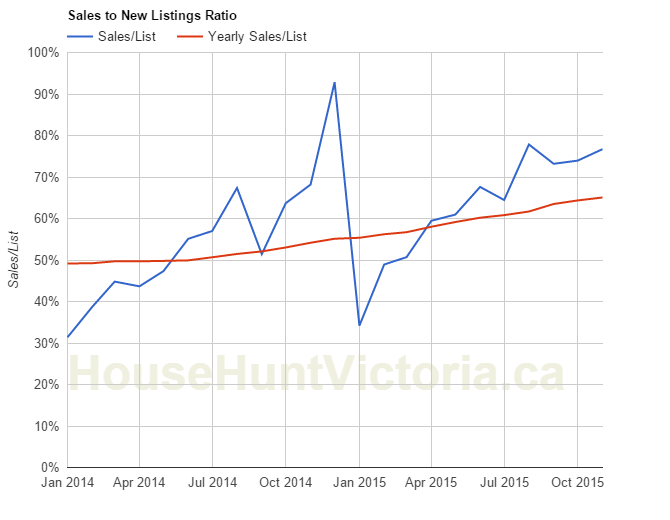

2015 was a big year for Victoria real estate. The pace of market improvement went on steadily in 2015, with annual sales to list moving up 10% from 55% to 65%. To put that into context, last time we saw the ratio this high was 2006.

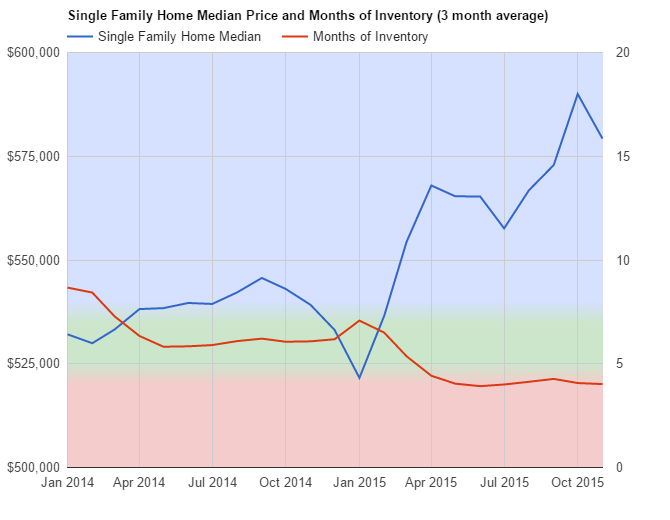

After two years of steadily improving market conditions we hit a transition point and prices lurched upward to start the year. For the first time since 2010 we also drifted into hot market territory.

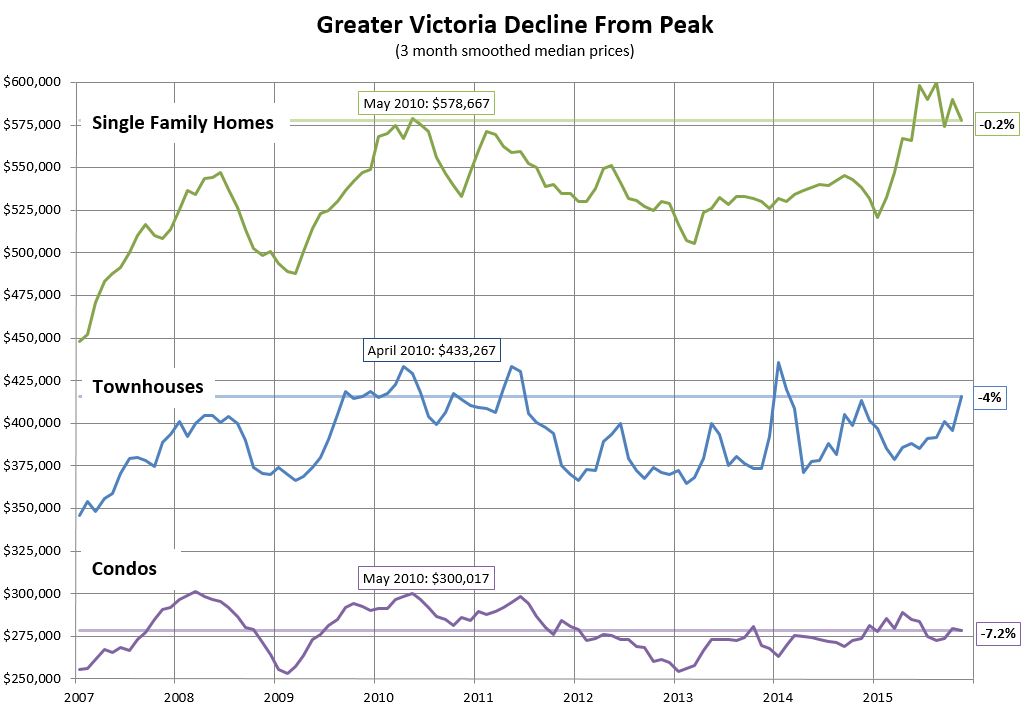

The increase in prices meant that the decline from peak chart is quickly becoming obsolete. Single family homes have regained their peak values at least in nominal terms. Townhouses aren’t far behind, and only condos are still significantly down at 7% below peak values.

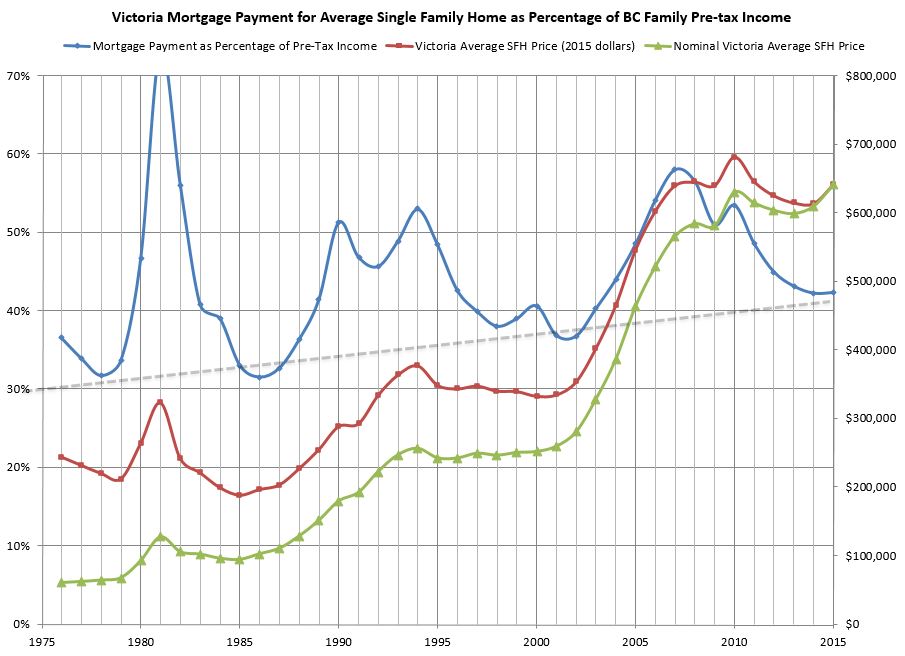

Taking a look at affordability, the price gains in 2015 were tempered by a drop in the average 5 year mortgage rate, and some income gains. It took about the same percentage of the average income to pay the mortgage the average Victoria home this year as last. However it does appear we are rounding out a bottom here. It also seems that each bottom comes in higher than the one before (grey line), which makes some sense, given that in a densifying city, detached homes will become less affordable over time as they are replaced with condos.

What does 2016 have in store for us? Well we’ll be reviewing our 2015 predictions in a couple weeks (hint: we all sucked) but I suspect it’s going to be a lively one for the Victoria market.

Marko’s Monday stats update also indicates December numbers will be better than expected.

| December 2015 |

Dec

2014

|

||||

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 124 | 244 | 356 | 436 |

389

|

| New Listings | 125 | 261 | 374 | 429 |

419

|

| Active Listings | 2797 | 2734 | 2631 | 2552 |

3210

|

| Sales to New Listings |

99%

|

93% | 95% | 102% |

93%

|

| Sales Projection | — | 479 | 451 | 501 | |

| Months of Inventory |

8.3 |

||||

Manualized improvements would include barns, decks, sheds, pools. Sometimes there are some unusual improvements like enclosed gazebos with a spa and sauna. BC Assessment may not have any costs on those items.

Anyone that may have built a barn, installed an inground pool, tennis court etc. recently should take a good look at their assessments. A pool or tennis court might cost $50,000 or $100,000 or a lot more but the market does not pay full price for these improvements even if they were built just last week. In some cases an improvement such as a pool might limit your buyers and lower your market value.

There are not many buyers that want a 50,000 square foot indoor riding rink. a 10 stall barn, hot walkers, olympic size indoor pool, tennis court with outdoor lighting, a second home and a 4,000 square foot workshop all on 15 acres of rocky hillside land in the Highlands. That’s a really small target market of buyers and that would be reflected in a property that sells well under replacement costs. One property that I looked at a few years back cost $14,000,000 to build, was assessed at $11,000,000 and sold for 5.75 million.

Another note is that just because your assessments went up or down does not mean you will pay more or less taxes this year. City hall is busy reviewing the assessment roll to adjust the tax rates for the different classes of properties to meet their budget.

But because Victoria is one of the most over staffed cities per capita in Canada don’t expect your taxes to go down even if your assessments went down. If the city departments have any surplus they will spend it before the end of the fiscal year on things like one $1500 ergonomic chair.

You only get lower taxes by handing out pink slips not by buying better apps. You might get savings by privatizing the garbage pick up or the sanitary department. But then, just like UBER you may have to pay a surge charge the next time you use the toilet. Or you can just wait.

The question that you have to ask yourself is… Would you sell your home for the assessed value. If your answer is that your home is worth more, then you are not likely to win an appeal.

Unless you have something distinctly odd about your home such as a basement entry home with only one bedroom on the main living level when other homes like yours have three. One main floor bedroom really limits the buyers for properties in middle income neighborhoods and will have an effect on value. How much of an effect is dependent on market conditions.

Your appeal will be heard by a board of ordinary citizens that may or may not have extensive experience in real estate. That’s meant to allow you to argue your assessment with your peers. The next step up when you appeal the appeal requires more technical arguments.

In the initial appeal process I’ve heard people argue that the tree in their front yard reduces their sunshine and the board reduces their assessment for that year. The just means that the appeal board can make errors – but the assessment authority will reassess the property the next year and your back to where you were before. Hopefully you didn’t cut the tree down.

I argued my case to the council last year and didn’t get any deduction on the land. But they did agree to reduce the house by roughly just under $25K. This year my land has increase around 20k and my house has increased by 25K. It’s like pay back from fighting them last year! How rude!

I have done absolutely nothing to the house since I argued it last year and they assume I have made improvements to my house of 35%.

House: $97K reduced to $77K (2014). Now up again to $103K (2015). Where are these knuckleheads getting this calculation?!?

According to http://evaluebc.bcassessment.ca my neighbors (basically same type of home and land) get a total of an average of $20K increase. Where as my total is $45K. Explain that one to me?????????

Since I have gone through the appeal process, I have more education on what they want to fight them. Get (in writing) estimates. I am going to get estimates on my flour, on my mossy roof shingles and gutters and down spouts, and I already have a estimate on my crooked sliding door that has a 2 inch opening at the bottom to let in outside air, and any other potential improvements I may or may not get done this year.

Among the many descriptions of property on the assessments there is one stating “non-manualized structures”. What might that be? It doesn’t show in their handy glossary.

Assessment up by 5.1% in Fairfield. on top of 8.6% last year. Ugh – taxes

I suspect BC Assessment has reviewed how construction costs have increased in your area. That makes the higher replacement cost as if your home was built today offset any increase in depreciation. The lot value being just the residual value left.

The basic formula goes like this. Replacement Cost New less depreciation from all source gives you a depreciated cost. The market value of your property less the depreciated cost is the land value.

So you can have BC Assessment show an increase in the building value and a decrease in the land value. As long as the total of the land and building is accurate the break down between land and improvements just has to be reasonable.

@David L

I noticed the same thing re: a proportionately higher increase in “improvements” relative to the “land” portion — for both my properties, but moreso my principal residence in Brentwood Bay. After years of minor decreases (not sure of the %s offhand, but low) in the improvements portion, this year my BB house and those of several neighbours have $35 – 55K increases to improvements, and it’s not like everyone has been doing major renovations. It must be something in the mass appraisal algorhytm…

Well Curious Cat your property may have been over assessed in 2008 and BC Assessment has reviewed your property file. And I say that meaning that while you bought the property for around that price, the property should have been assessed lower relative to what other properties like yours were assessed at. The assessed value has to be fair and equitable.

If the median Sales to Assessment Ratio is 110 percent. That means if you had bought your home for $400,0000 on July 1 and it was assessed at $400,000 then you were likely over assessed as similar properties to yours were assessed at around $365,000.

It isn’t that reliable to use the assessments as a gauge of how individual properties are performing. This is mass appraising, so the best one can say is that in general the market has increased. And that puts us back to the problem should we use the average, the median, or an HPI?. Should we benchmark groups of homes with similar physical characteristics and types of ownership or should it just be the market as a whole.

It isn’t as simplistic as Tony Joe states. Each assessor may have a portfolio of 20,000 properties that she/he has to evaluate each year. That may mean a complete interior inspection or just walking around the house and peaking through the windows and checking his/her observations against last years records and reviewing the assessment roll. This is really time consuming and they would prefer if you did some of this work for them. This is a different type of appraising known as Mass Appraisal. It isn’t individual appraisals of every one of the 1.9 million properties in BC.

All that data collected is fed into a computer system that evaluates the property and the assessor checks that value for reasonableness. If there has been a building permit issued that usually means an assessor will take a look at your property. You might not be home and they will try to do as much as they can to determine a reliable and reasonable value from the outside.

The assessed values are all about fairness. If you feel that your property has been assessed unfairly you should appeal the assessment. This will allow BC Assessment to correct any errors they may have.

And remember, the Bundle of Rights associated with fee simple home ownership allows the assessor to enter onto your property without your permission. The government has the right of taxation and that allows the assessor to access your property. If you don’t allow reasonable access then the assessor might assume gold plated faucets and imported Italian marble floors.

Here is one example where I show the assessment range for properties similar in house and lot size within a 1 kilometer radius of the property being appraised. In this case the property being appraised required immediate repairs and in my opinion was over assessed.

“SALES TO ASSESSMENT RATIO

The Sales to Assessment Ratio for similar properties, as described above, ranged from a low of 97% to a high of 128% for recently renovated homes with the median or typical home selling at 108% of its government assessed value. The subject is currently assessed at $634,000. The current market value at $600,000 or 95% lays outside of this range. In my opinion the 2016 property assessments should be appealed for fairness relative to the current assessed values of recent similar sales.”

There is no firm rule that homes are worth XX percent more than their assessed value. The main factor is when was the last time the assessor went through your home or the one you want to buy. And that could have been decades ago.

Another example was a character home in Oak Bay that was over assessed by $70,000. The home while in need of repairs still had a value of over $800,000 despite needing $200,000 in repairs. (It was a big house). For the last ten years this property was over assessed with the owner paying more in taxes than what was fair and equitable.

Interesting thing about the separate valuation of the land and the building. BC assessment will not accept an argument based on one component, such as the land, being too high. They will only consider the property as a whole.

In contrast there is the building. I had an hour long discussion with a home owner that built his home in 1965 for $25,000 and wanted to appeal the house improvement value shown as $200,000 today. His argument being how can the house by itself be worth $125,000 when it only cost $25,000 to build? He couldn’t or wouldn’t understand how the building that is getting older and needing more and more repairs is being assessed every year for more and more.

Then there is the water/sewer lines, driveways, fences and landscaping. Are they land? Or are they improvements?

I also noticed a change in the assessments this year when it comes to condominiums, BC Assessment is not showing a break down between land and improvements for these strata properties. I suspect the same will happen in the future for detached homes too. The separate allocation between land and improvements are for taxation purposes only and are not to be miss-understood to mean that each component is worth XX amount by itself. Clearly the improvements only have value, in situ, when they are attached to the land.

https://www.youtube.com/watch?v=v95KK0XtD7M

Just Jack, do you agree with this realtor’s statement: “They apply the market increases or decreases over the year to determine the assessed values.”

My house was purchased for $435,000 August 2008. The assessed value on July 31, 2008 was 438,400 as shown on my 2009 property assessment. Now it’s 420,000. So according to this realtor, the market has then decreased by 4.2% (420,000/438,400) in my area and my house would be worth 416,750 if it was in the same condition as when I bought it? And here I thought the market had improved.

Do buyers consider BC’s property assessment values?

Personal anecdotes: I have a friend that tried to list her property for 18% above assessment and got an offer at 14.8% above (which she would have accepted but it fell through as buyers changed their mind) and one 12.5% above, which she didn’t accept. She will re-list in February.

A friend of a friend has been trying to sell her property for over a year. The first attempt was 32.8% above assessment (Househunting – yes it was $200k over assessed values!) and was listed for 3-4 months without an offer or price reduction. The second attempt just a couple months later, they relisted at 29% above assessment. She removed it from the market after receiving no offers and will attempt again in the spring from what I’ve heard.

The first house had multiple showings every week and a total of 3 offers, and the second house had barely any showings, despite being on the market much longer. So from experience this last year, are houses being sold for around 10-15% above BC assessment?

And at least for these two sellers, they were unable to cash in on the “hot” market. I know also two other houses that were listed and not sold. The first was my neighbour and the second was a friend’s parents house but I don’t know if those were taken off the market for other reasons other than not being able to get a specific price.

“After looking at the market here for a while, I’m estimating that it’s roughly 30-45% over-priced, depending on location of course.”

Agree with the comment here. I personally don’t begrudge any seller in the Vic market who are able to sell for top dollar, it is what it is. My sentiment is the same though, that the asking prices are 30% – 45% above the value of the houses being listed, more for those listing +200k above the assessed values.

2015 was a good year for the Sellers. Hoping for a more balanced market in 2016.

@JustJack

Last year I appealed my 2014 assessment and was able to reduce the assessed value by about $15K. This only works out ~$80 is saved property tax – but the savings apply to each subsequent year. All I needed to provided were comparable neighbouring properties to convince the appraiser to lower the assessment.

Interestingly for 2015, my assessment has gone up by about 5% while my neighbours are averaging 10%. My house is located on one of the larger lots on my street, so the increase in my “land” value was similar with my neighbours (7%), but my “improvements” (house) increased by only $1000. Most neighbours saw a 10 to 20% increase in the value of their “improvements”. I can’t help but wonder if my appeal last year had a carry-over effect.

Also, for many years on my street of late-1970’s houses – the “land” has increased while “improvements” have slowly decreased. This is the first year that I can recall that the “improvements” (house) values have significantly increased.

I went through 1286 Filmer. I’d bid on it if I didn’t have quite so much on the go right now. If you could get it for 410 and reno for I figure about 60, I think there’s around 100 profit. The problem of course is I suspect it will go for ~450 or more.

Here is an interesting article about Harmony in Duncan, trying to decide if she should keep her condo as a rental investment even though it is cash flow negative, or sell it.

http://www.moneysense.ca/property/rent/is-a-rental-property-a-good-investment/

The last two appraisals I’ve advised my clients to appeal the 2016 assessments as they are not fair and equitable relative to similar properties that have sold. Part of the regulations governing appraisals is that the appraiser should comment on the fairness of the property assessments and taxes.

Rarely does a home owner have their property appraised in order to appeal their assessments. Since the cost of the appraisal is more than the tax savings for that year. However, since the cost of housing has become so expensive the tax appeal could save them more than the cost of the appraisal. With housing at a million dollars and more in some areas it is worth fighting unfair assessments.

As for the square footage not being the same as the assessment authority. You can measure the exterior of your home at the foundation line and add in any projections that you can stand in such as a bay window or hutch to determine the main living level. For two storey homes where the bedrooms are above the main living area you should measure the exterior less the internal stairway.

For your basement or the level below the main living and kitchen floor you should measure again at the foundation line and subtract the unfinished areas.

You should not include any unheated areas such as a sundeck that has been enclosed or an enclosed condominium’s balcony since this area is not considered habitable all year round since you’re measuring “livable floor area” LFA.

If you own a townhouse then the measurements are taken to the middle of the common walls with your neighbor.

If you own a condominium then the measurements are taken from the interior wall to interior wall or paint surface to paint surface.

As a home owner you can go to City Hall and ask to see your home plans (if they have them). Or you can go to the land registry and pay to see and print a copy of your strata plans. Make sure you bring your legal description with you to make it easier to find your strata lot on the plans.

Once you have your plans and your measurements check them against what the BC Assessment is using. You can to this by going to their office and ask to see the information on your home. Not always are the measurements the same.

As for the measurements from the listing. They are not considered good evidence as they are frequently taken from previous listings. Only in the last few years have estate agents employed companies to make accurate measurements according to CREA guidelines. As in everything when buying a home, if the size of the home is important to you it is up to YOU to verify the information as correct before making the offer. For those that find their home is not what it was advertised when they bought it – well you’re just SOL unless you included a statement about the house size in your offer.

Yeah, that was Filmer. The location seems ok though. I think it’s “as is” because it may be a foreclosure. Like any place, one really needs to walk through and do their due diligence regardless if there’s pictures or not.

After looking at the market here for a while, I’m estimating that it’s roughly 30-45% over-priced, depending on location of course.

Bizznitch – where was that? 1286 Filmer Rd? The listing says “as is, where is” and in need of renos but there are no interior photos. I guess a lot of people may not have bothered if the listing was more upfront about the condition by posting inside pictures.

Mine only went up 2.8%, but what I do find interesting is that BC Assessment decided that me and my neighbours all have finished basements this year. They must have looked at google, and if they saw a garage door, dinged us as 2/3rd finished square footage and if there is no garage, then it’s all finished. (House design is standard 1930s foursquare with 2 beds 1 bath main floor overtop a garage and basement.) And they also changed the upstairs square footage for me from 1006 to 979. Where do they get these numbers from?? When I bought the house it was advertised as 1070sqft. For the record, my husband and I just put down flooring ourselves last year for 390 sq ft, and we still only have a drop ceiling on 300 sq ft. The other 90sq ft is still in the box, we just haven’t gotten around to putting it up. It’s really not worth it for us to finish any more square footage as the ceiling height doesn’t make it worth it in my opinion. It varies from 6’6″ in the unfinished parts to 6’10” in the finished area. My husband and I are both shorter (5’6″) so it doesn’t bother us, but I have had taller men needing to duck their heads under the 6″ beams and that detracts from the value. (I know when I’ve had to duck in a basement during a showing I immediately crossed that house off my list!)

I see e-value has a link called “Are the property details correct?”, however I need to wait for the paper assessment with my confidential pin in order to fill out the form.

Went to look at one place this weekend, priced at just over $400k. The whole kitchen ceiling was sitting on the floor of the kitchen (looks like the roof is gone). People were lining up to view this place. The mould in this place was just incredible. This is insane.

Mon Jan 4, 2016 8:20am:

Dec Dec

2015 2014

Net Unconditional Sales: 465 389

New Listings: 451 419

Active Listings: 2,517 3,210

Please Note

Left Column: stats for the entire month from this year

Right Column: stats for the entire month from last year

Fairfield house went up by 15% over last year? Not sure I believe this is anything more than a tax cash grab….

Found this analysis of rental returns quite interesting with an honest look at the tradeoff of time vs money. http://affordanything.com/2015/12/06/how-much-can-you-earn-from-a-rental-property

We ended up using a guy that works for CIBC who I met on canadianmortgagetrends (No really I wasn’t there trying to pick up mortgage brokers!). Despite being at CIBC the deal he came up with was very competitive to the overall market so I was happy with him.

The way he explained it, is find a broker that does volume and don’t waste his time. If it’s quick and easy then they will be willing to cut down their commission to get you a better rate.

Thoughts on choosing a mortgage broker? Recommendations welcome.

Our lease is up, and it looks like this may be the year we become homeowners again.

New assessments up on eValueBC http://evaluebc.bcassessment.ca/

That and the Saanich GIS service http://saanich.ca/services/gis/ and you can spy on all the things!

Some new year humour…

https://twitter.com/vanflippers/status/681988747953487872

…funnier yet, it sold!

I own three of the FANG stocks. Never could stomach buying Amazon though. It has tonight me a lot though. Like fundamentals are meaningless. Sentiment is everything….

I dunno Hawk, 2015 had a lot of crashes in the market…

Firecology,

I’ll short some and go long as well when the signals present themselves. The market is short term sighted these days and you must stay nimble.

Hawk – so I guess you’re shorting all sorts of RE and US/Can stocks? Cause you sound awfully certain of your predictions. Otherwise, why not?

And to reiterate – Happy New Year Vic housing geeks!

PS. I was contemplating buying a Tesla this year to help save the planet but I’ve changed my mind. Earthquakes and fire sales may be the big headlines this year.

http://artofgears.com/2016/01/01/tesla-model-s-burns-to-the-ground-at-norway-supercharger/

This coming year reminds me of beginning of 2008. Signs were there that debt and asset bubbles were popping up all over the place but everyone stuck their head in the sand proclaiming “it will never happen”.

Canada is at the extreme debt levels of all time and this year will be the year it all comes home to roost and the air begins to be let out of real estate bubble in my humble opinion. How fast is the big question.

My best investment,(one of just a few), was a pot stock that’s up 250% so that sums up the Canadian stock market which is one of, if not the the worst financial market in the world the past couple of years. Cash preservation was the name of the game in 2015.

The US stock market that went nowhere on an annual basis looks ripe for a correction. Only a handful of trendy stocks AKA the FANG stocks are keeping investors interested. If they go south then look out below.

Oil will continue down or stay flat at best, as the high yield debt bomb will explode due to all those US and Canadian oil companies that have to pay the piper and/or go under. All those $60-$70 break even projects will be toast.

US housing is showing signs of slowing down in sales which could have some influence on the panic buyers in BC. Note that Genworth Canada stock is down 20% the last 2 months so the first time buyer/ high risk borrower is showing signs of being pushed out the market.

All and all, a very gloomy outlook from my end but what did you expect ? Being a realist isn’t fun nor popular sometimes, but someone has to do it. 😉

Happy New Year !

I monitor this blog as I’m assessing the best exit timing to pull the trigger on listing a rental property (SFD near Swan Lake). I have followed the discussion re using a realtor, doing a mere posting with interrest. I thought the comments/opinions a few weeks ago re: the core being so hot that a property could sell itself quite thought provoking, and as a result was able to negotiate a lower commission with my long-time realtor, as I’m just not ready/prepared to do a mere posting due to workload and other pressures. Like CuriousCat I’m also interested in tax implications/discussions. I appreciate the candour, experienced commentary and insights that are shared on this blog. I also have a tiny crush on Marko, but that’s not what keeps me coming back.

I’m buying heavily into Canadian oil companies because I think it’s completely capitulated. Everyone says this is complete lunacy just like they did when I was buying Canadian banks in 2008 and made a killing.

On the topic of real estate I’d say the only question is how high will it go in 2016? I’d say by March we’ll know and I’d say it will be a truly bear killing year.

Yep. Overall a decent year. 1/3 Canadian equities, 1/3 US equities, 1/3 International equities. Overall return on the year: 7.73%.

Obviously Canada sucked but the others balanced it out.

Well 2015 certainly made me feel more vulnerable financially. Glad I’m well diversified. SDRL and DDD are big drops. The likes of 2000 and 2008. ETSY and Bombardier also big ouches. Overall I’m up on the year. I even dabbled with some ETFs earlier in the year but bailed out of them when things started going south. Fear of the unknown…

I’m a hobbit. I go on adventures but I always return to the shire…

Personal finance and taxes (or the lack thereof) is another big interest of mine. Seems to me they are integrally linked with real estate. Please chime in!

Thanks Dasmo. You ever coming back over here or are you a permanent expat now?

Much respect for the auto graph work you have pulled together here Leo. Impressed and appreciative of it. Oh…. And happy new year House market nerds!!!

As for commenting, I usually only get sucked in when people ask for feedback on topics that I feel I have knowledge or personal experience in. I’ve never owned a rental property and my house doesn’t have a suite. My personal experiences are renting for 3 years than buying a pre-construction downtown condo Jan 2004 and moving in Dec 2004, moving up to a newly-built townhouse in Langford June 2006 (selling price of condo was 43% higher than purchase), and then finally to our SF 1940 home in the “core” in 2008 (selling the townhouse for 12.5% higher). The market started to tank right around that time as an identical townhouse in our complex sold for $10k higher just 2 months earlier. I don’t think we tried to “time” anything, circumstances precipitated each purchase and I consider us lucky that we came out ahead.

So if the topic turns to problems encountered in older homes, or personal finances, or taxes, then expect to hear more from me. Otherwise, I lurk.

I’ve been reading this blog for about 2 years now and rarely comment. Like Caveat Emptor, we bought our SFH Aug 2008. I don’t plan on selling for years. I don’t consider my house an investment, but lets not kind ourselves – it has a $ value and I’d love to know what that is. I’m not trying to time the market, so why do I read every post and comment? I guess I find you guys interesting and like my name suggests, I’m curious!

I work in the finance sector and so the topic of money, investments, assets, debt, mortgages, just fascinates me in general. I’d love to have a valuation of my home, because I’m a little OCD in my personal finances, so following the market is my way of guessing where I’m at. I love the insights provided by JustJack, Marko, tend to agree with Hawk (guess I’m a bear?) but smirk at Michael’s never-ending optimism that things can only go up!up!UP!

Also my bestfriend is selling her 5th home in 11 years, (she’s probably Garth Turner’s worst nightmare, putting all her eggs in the same basket) and so her interest in real estate has rubbed off on me, but probably more so I can be the voice of reason. 😉

Fireecology1 – What is your definition of investment? Does investment mean that at some point you intend to sell for a profit? If so then staying informed would seem to fall into either of the timing an entry or timing an exit categories.

AskWhy – Or just interested in staying informed on issues affecting what will be the largest single investment many of us will ever make?

Suggestion for future poll: “What is your motivation for reading and/or commenting on this blog?”

I think it would be interesting (and hopefully others do too) to better understand why people read/comment on this blog. I can think of a few probable reasons; trying to time an entry, trying to time an exit, or work in a related industry (e.g. broker). Thoughts?

Now that took cojones while the world was melting down. Remember prairieboy from Victoria’s Truth? They bought in spring 2009. Also a good time in retrospect.

My housing predictions have all been off. I’m glad in retrospect that my wife convinced me that we should buy in fall 2008. If it had been up to me I’d probably still be waiting for the “right time to buy”.