Two years on, still runner up loser

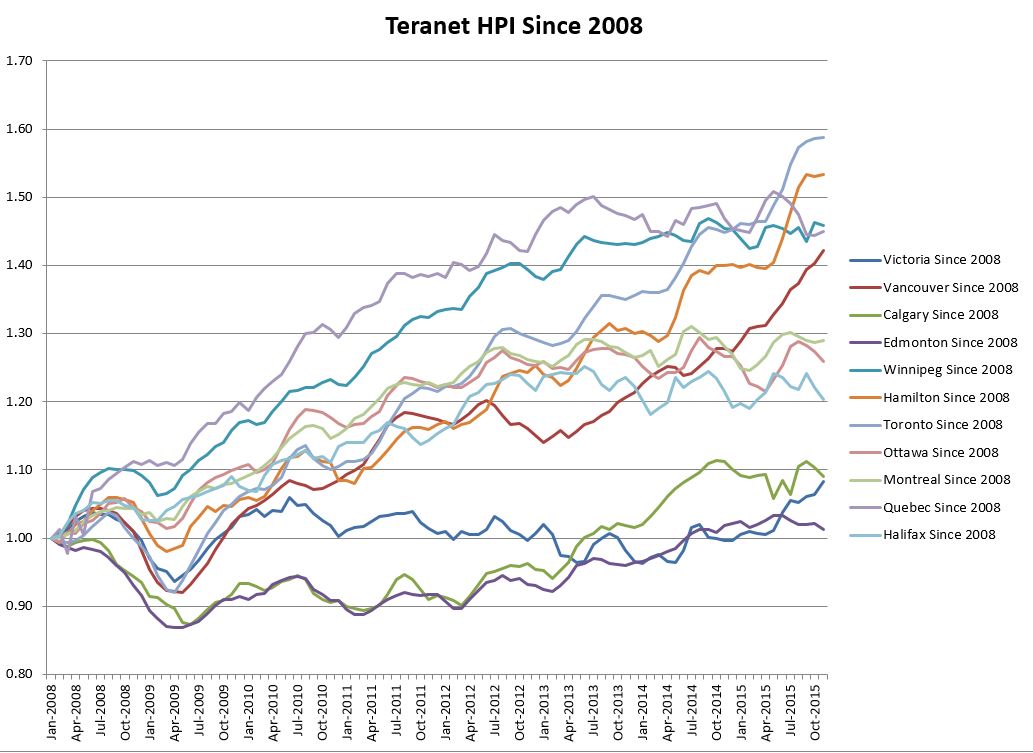

Two years ago I compared the appreciation rates of the major markets across the country to Victoria’s since 2008. At the time we were just shy of the worst market in the country. Only Edmonton was weaker, and they were headed up while we were headed down.

In the meantime many things have happened. The market here picked up, and oil has gone from something worth steaming out of a bunch of sand to something not worth bending down for. And the result is.. a whole lot of no change. We are still the second weakest market in the country over the last 7 years. It does seem imminent that we will overtake Calgary soon though.

The substitution effect in real estate is the theory that as prices rise in one location consumers will replace more expensive homes with less costly alternatives.

The tricky bit is trying to decide what are alternatives? Vancouver and Victoria may seem at first glance as alternatives but are they? If you’re working in Vancouver how viable is it to move to Victoria for less expensive housing when all you have to do is move to the Fraser Valley or Maple Ridge and keep your job, friends and family ties intact.

How about comparing Sooke to Oak Bay? Again that may not be a good alternative as these areas tend to attract different income levels. Although retirees facing a substantial decrease in their income will move down the income ladder.

How about Saanich East and Langford. Both are attractive to families of similar age and income levels and moving between the two hoods isn’t going to disrupt your job, families or friends.

Saanich East has a larger population and considerably more houses than Langford. Yet so far this month Langford has MORE house sales than Saanich East. As house prices in Saanich East continue to rise the number of sales in Langford increases. And that’s what you expect to happen if two areas are substitutes for each other. The price difference between the two is large enough to shift prospective purchasers’ preferences for the two locations.

Pairing up similar houses with different locations is a bit more of an art than a science. Two examples are two new homes having 2,450 finished square feet each. One in the Thetis Heights area of Langford and the other in the Camosun area of Saanich. These properties respectively sold at $608,000 and $849,000. Roughly a quarter of a million dollar difference between the two hoods for similar accommodation.

$250,000 -hmmmmm that’s worth thinking about.

Victoria Real Estate Board

Mon, Dec 21, 2015 8:30am:

Dec Dec

2015 2014

Net Unconditional Sales: 356 389

New Listings: 374 419

Active Listings: 2,631 3,210

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

Active inventory is starting to become tight……we had almost 4,000 active listing to end 2012!

That’s the sizzle JJ talks about. Bear mountain had a lot of it…

Initially condos at Bear Mountain sold for more than what single family homes in the Oaklands area were going for at that time.

I ran out of luck this year. I predicted 7000 sales for this year back in January and I’ll be at least 15% off…..didn’t see what happened this year coming whatsoever.

There was a time when a developer could sell at prices above what would be supportable in the marketplace. When there was a shortage of new condos and a long list of investors. The trick was to sell out the new condos before re-sales in the complex began to compete with the developer’s unsold units.

It was all about selling the sizzle with lots of media coverage, long line ups, reports of full price offers and selling out in a day.

And it might have worked for the Oak Bay Hotel too. If the world economy hadn’t tanked and the momentum was lost for projects like the Oak Bay Hotel. Or if they had gotten their marketing started before Bear Mountain’s Westin Hotel there may have been enough non knowledgeable buyers to keep the project afloat. Unfortunately construction delays did the project in and some bad forecasting of unit prices didn’t help either. Then there were the partial ownerships.

I went to a meeting on selling partial ownerships to finance the construction of hotels and it seemed that everyone in the audience was nodding their head in agreement with the speaker. No one asked questions but simply applauded this new paradigm of investment. It was such a new idea for Victoria that initially you could find enough investors. But the market became saturated very quickly and sales died off. It was gimmick marketing.

There are many examples of gimmick marketing like care-a-minimums, Dockside Green, swimming pools and exercise tracks on roofs. Developers can develop enough sizzle to sell them out. But the initial buyers loose on the re-sale when their isn’t a publicity team pushing the product anymore.

If sooke road was better it may have worked out but right now the access is just too sketchy

I’ll try my luck again in the next down cycle. 🙂

Yeah I think marko has consistently made the best yearly predictions and Dasmo has been right about the overall market for the longest

“Thinking that units would sell for much more he likely over spent on construction in order to appeal to a small select target market. ”

Does this not ring true for the Oak Bay Beach Hotel too Jack ? Not every multi-millionaire wants a time share in the land of the rich and ancient it appears.

Glad to see your new years resolution Mike, I’ll do the same. Deal. Bulls and bears will always have differing opinions and next year should be interesting.

BTW, I see the TC did do coverage on the Sooke collapse, just didn’t see it front page.

Where the Sooke developer made his mistake was over estimating the value of a water view in Sooke. He likely relied on some poorly researched advice and allowed his ego to cloud his judgement. Thinking that units would sell for much more he likely over spent on construction in order to appeal to a small select target market. He was trying to sell Sable coats to those that only wanted dyed Rabbit.

Don’t expect to get any deals on those Sooke condos. They’ll likely be sold in packages to investors rather than sold one at a time to the public. Eventually the individual units will trickle quietly back onto the market in the future.

In BC we just don’t do the auctions like the Americans. Where the highest price gets the unit. If there is an auction, the units will all have a reserve bids that are usually set too high for local market conditions.

Another tactic is to have all the units used as rentals and then try to have the property tax billed reduced. I’ve spoken with BC Assessment in the past about this and they said that properties are valued at their highest and best use and that would be as individual units and not one large apartment building. Then there is the GST payable.

So how much is a condo with a Sooke water view worth when there are no condo sales in the area to do a comparison?

Thanks so much LeoVictoria for your contributions to the intriguing world of real estate. You’re still my market-timing hero, although I know you’re very modest about how you did it.

Thanks to everyone who posts here, it’s great to have such diverse views. It’s fun to predict where we’re headed… although I was looking back and it looks like Marko is the one to beat for accuracy past few years. Who knows, maybe Hawk will take the trophy one of these years. I have a resolution of not being such a cotton-headed ninnymuggins with my fellow bloggers in 2016 😉

If you do any DD on Robert Kyosaki, it’s evident he runs some very shady seminars and some think even worse. But if you want to follow advice from guru’s like him who go bankrupt on a regular basis, then it’s your money.

http://ethanvanderbuilt.com/2014/01/20/robert-kiyosaki-scam-artist-yes-opinion/

Looks like this has become a blog where we’ll paste links back and forth so here is mine

https://ca.finance.yahoo.com/blogs/insight/financial-guru-tells-millennials-that-if-they-save–they-re–losers-212314341.html?noRedirect=1

ICYMI from a couple days ago. Wonder why the TC never covered this ?

http://www.cheknews.ca/high-profile-sooke-development-mariners-village-project-sinks-into-receivership-126753/

Thank you LeoVictoria.

This kind of thing is one reason I chose to ditch Calgary for Victoria:

Amid snowy weather, 234 crashes reported across Calgary

http://calgaryherald.com/news/local-news/four-people-hospitalized-following-two-separate-highway-crashes

Just heard a piece about this on CBC driving back from Vancouver. http://www.huffingtonpost.ca/2015/04/15/vancouver-real-estate-donthave1million_n_7066450.html

https://twitter.com/search?f=realtime&q=%23donthave1million&src=typd

Top 3 commenters:

Hawk

Just Jack

Michael

Thank you all for contributing to the blog

@LeoM Your comment was deleted. No personal attacks.

I think I may have meant Willis pt road…the one that sold for ~10 millon.

You have to remember LeoM, Hawk is a disciple of GT… who’s a bit of a potty mouth.

HAM = hot Asian money.

Like the folks who just bought the two million something house behind us. Really nice people, incidentally.

Hot Asian Money, Hot Albertan Money (like the buyer of Wilkinson rd), Hot Arabian money, Alaskan, Azerbaijanian…. 😉

What does HAM mean?

Hawk uses the term every day, very often in a negative context. Will someone please explain it to me. I tried Google. I tried the the Urban Slang Dictionary. I’ve tried Oxford. Can’t find any reference to HAM other than a pork roast.

Help!!

Last two,(now 3) posts I wasn’t planning on Mike, but who actually counts posts to begin with ? If one can’t handle the content, such as a new trend with price reductions,then just bury your head and move on. If you want to debate then debate. Implying someone is a racist for using a common term used in all media is disgusting.

The repeat sales analysis has been around for a long time. Teranet did not invent anything new. I actually had to build repeat sales charts as a junior appraiser in Vancouver that were printed in house for our clients. I did the same when I moved to Victoria and these charts were published in the Times Colonist. That meant looking up the assessment records for all of the sales that occurred in the month and entering their historical sales into a spreadsheet, averaging the month before and after, then plotting them on a scatter diagram for the line of best fit. So it’s ironic that you should say I should know better when I was the person that actually was doing the analysis.

Teranet could be doing a much better job. This is basic mind numbing, repetitive, articling student work. It’s fine if we were still living in the 1990’s. The HPI for example is a much improved hedonic calculation than Teranet publishes. Each has its limitations. What is needed is the ability to project a price forward 90 days rather than always looking back in time.

If you want the best of all worlds you would set up an HPI for your specific property then every month or so you could see how your property is performing in the marketplace and not some hypothetical benchmark home. Depending on buyers and sellers motivation the analysis would be able to project, within 2 percent, what your property would sell for in the next 90 days.

The key to its accuracy is that it needs a well skilled analyst to make decisions that an algorithm is not able to make.

And yes, since I use similar HPI calculations on a daily basis, I have read all 17 pages – several times. The difference between you and I is that when I read it I know what calculations they are referring to and how to apply them to residential properties. Most of it is simple regression analysis. First year math stuff that anyone can be taught. Or just buy yourself a $30 calculator.

Apologies Jack, my last comment could be perceived as a little rude. Wasn’t intended, I just found it a little suspect from your previous comments whether you’ve ever really tried to understand how they work… not a big deal, very few people in property businesses do.

I only have 5 comments Hawk, you now have 7…but who’s counting 😉

BTW LeoM,

Mike, Jack and myself have an even amount of posts today so not sure what your problem is, sounds personal. If you’re out of joint because the the HAM could stop buying soon from a credit crisis, then maybe chill out with a beer and give your agent a call for a pep talk. 😉

Now I’m a racist LeoM ? I thought personal attacks weren’t allowed on here LeoVictoria ?

If you don’t like my posts on new information potentially effecting house prices then skip them and go back to your rocking chair. It’s a changing world out there by the day and not all puppies and sunshine. Last time I looked this was not called the Homeowners and Agent’s House Pumper Blog, it’s for debate on both sides is it not ?

Jack, you should really read up on how Teranet works (and other HPIs for that matter).

http://www.housepriceindex.ca/documents/MethodologyEN.pdf

Do yourself a favour, as an appraiser, and read all 17 pages of their methodology. It would help if you’re a math major, but I’m sure you will still gain a better understanding of how they achieve such accurate results.

The HPI was invented to show month to month changes in the market when there is little data. The HPI relies heavily on the past under the assumption that there will not be any significant changes in buyers preferences from month to month. However October blew that theory out of the water when we had an abnormal number of million dollar plus home sales in the core.

The best data is when the median, mean and mode are close to each other and the graph of home prices is highly symmetric. That means a lot of data is needed which just doesn’t happen in the winter months in Victoria. That means a lot more guess work by the programmer deriving the HPI

The other problem with the HPI is that no one can reproduce the same HPI number as it relies on the individual constructing the data to make choices. Unlike the median or average where everyone comes up with the same number every time.

The HPI isn’t measuring the general housing market. It is measuring a hypothetically constructed home of a certain size, age and other characteristics through time. That benchmark home will not be the same in Victoria, Toronto, Vancouver or San Francisco.

As an example. Look up the HPI when you bought your home and compare that HPI to today to determine a factor. Apply that factor to your original purchase price and you’ll find the factored number may be significantly off from current market value. Because the HPI wasn’t designed for that purpose – you just assumed that it was.

I’ll be the one to point out neither the median nor the mean is a good way to compare markets that have this kind of “two hump” aka Bactrian distribution. The only sensible way is to look at the expensive markets (Vancouver and SF) separately from the rest

That’s because you assumed that 519 paired sales meant 519 individual properties that sold in November. That isn’t what Teranet wrote and that isn’t what Teranet means. You just assumed it.

Teranet gets its numbers from BC Assessment records that give the past 3 sales of that one property that sold. Then Teranet infers or extrapolates the November numbers from a line that best fits the properties historic data. I doubt that they had any paired sales of the same property that occurred in both October and then November. They had to infer (guesstimate) those numbers based on past performance of the market using a very small data base spread out over a huge area and all types of properties from condos to waterfront. The November numbers are just projections and do not represent actual sales of repeat sales in October and November. For the simple reason that repeat sales of the same property in both October and November likely do not exist.

Now look at the graph of rolling medians and the Teranet numbers. Medians are actual sales and Teranet are projections and you see how Teranet deviates from actual sold data from time to time. It takes Teranet about 2 to 6 months before it get backs on track with actual sales because they need 2 to 6 months worth of repeat sales data.

“Sorry, but the median is not a relevant measure when comparing markets. You need to use the mean, which will confirm what I said.”

Erm – no, complete hogwash. Why do you think the HPI was developed?

Median values show a more accurate view of the market since they are typically less affected by large deviations in the data.

Comparing the average prices in BC and California is pretty damn useless given how much Vancouver stats distort “BC” stats. Even cutting it down to the second highest market gives you an idea of the distortion – $495 median here in Victoria. California has a lesser degree of distortion from San Fran because of its much larger outlying population but median would still be a better estimate of the average homeowner’s house value.

Americans aren’t moving here but, if they were from California they’d, in general, have more money to work with to buy a house if they had a paid off home in California.

https://www.realmarketreports.com/articles-statistics-in-real-estate/166-median-vs-average-values-in-real-estate

http://www.cbc.ca/news/canada/average-house-prices-don-t-tell-the-whole-story-1.1215736

Where are all these high paying jobs at Mike ? Again, please show us the Victoria stats by sector as I don’t see any new hospitals built, or increase in government jobs in areas that justify saying job growth has gone sky high.

All those stats show is that they are jobs but no reference to pay levels. Most new jobs are in the low paying service industry judging by looking at the job boards from time to time over the last year. This leads me to believe most are part time or temporary at best.

Sure no one believes it yet, but they are (the public is always slow to catch on)… Teranet Nov was based on well over 500 sales pairs & over 5000 for Van. That’s enough accuracy for me.

It actually makes perfect sense if you pay attention to job growth, vacancy rate, affordability, etc… we’re now beating Van handily on most metrics.

http://i.imgur.com/FNMKrWx.png

Van should still put in double digit increases for years to come (like the late 80s), but it’s obvious to me that Vic will start to narrow the decades record gap between our prices.

“Sorry but the median is not a relevant measure when comparing markets”.

What a complete load of hog wash.

http://www.altosresearch.com/show-me-the-data/median-price/

And why do you think the benchmark HPI was even developed? I’d argue that trying to compare the averages between California and BC is an almost completely worthless exercise – particularly if your conclusion is that BC houses are cheaper.

You’d be foolish to use the average when we have Vancouver house prices skewing all of BC and San Francisco and San Jose prices skewing California to a much lesser extent given the outlying population differences.

In general, the average, or as you are referring to it, “the mean”, is not a good representation when estimating what the average homeowner in the US and Canada are paying for housing. The measure of centre to use, in a given situation, is the one which best summarises the data.

And given that you are using Victoria as the comparator even if you are using averages, the average house price here in November was $495,000 Canadian so I don’t see any great influx from the states happening on economic grounds anytime soon – or any grounds.

http://www.crea.ca/content/national-average-price-map

http://www.lao.ca.gov/reports/2015/finance/housing-costs/housing-costs.aspx

” Victoria’s +1.76% last month for instance shows we’re now accelerating faster than even Vancouver’s +1.35%.”

Michael what is more likely to have happened is that Teranet got it wrong for Victoria. Which happens frequently when you look back at actual sale prices achieved to the price projections inferred from Teranet.

Teranet numbers are like driving a car by looking through the rear view mirror. You don’t see the bend in the road coming at you. From time to time Teranet’s numbers go off the road.

No one believes that Victoria’s prices are appreciating faster than Vancouver.

If you compare the average house price in Oak Bay to that of Langford you get a difference of

$1,080,301 to $511,070 of $569,000.

If you use the median then it’s

$862,500 to $475,000 of $387,500

So is it the mean or the median that shows the difference in price between the two locations? Are properties in Oak Bay worth $569,000 more than homes in Langford. Or are they worth $387,500 more?

The answer is that neither of them indicate the difference in location since you are attempting to compare dissimilar properties to each other. One an area of new housing and the other an area of character homes.

If you want to determine the difference in home prices from one location like Oak Bay or San Francisco to Langford or Victoria then you have to look at properties at the margin with similar physical attributes.

That would be a starter home in Langford at $300,000 and a starter home in Oak Bay at $550,000. All else being equal. The difference in price between the two areas is $250,000. Not the mean and not the median.

And that drives a stake right into the heart of these newspaper and magazine articles that are trying to compare different cities using median or average house prices. There is no international or national valuation organizations that acknowledges that median income to median price or that price to rent ratios are a valid method of determining under or over valuation in real estate between cities or between periods.

If it doesn’t work when I use the examples of Langford and Oak Bay then why would it work comparing Victoria to San Francisco?

“2732 Dewdney Ave is interesting.On a 50 foot lot, and apparently an entry in the ugliest new house of the year contest — completely out of keeping with neighboring property.”

Noticing a lot of these new boxes with no character being built in Oak Bay /Fairfield all in the $1 million to $1.5 range. Very cold styles and fixtures. Must be having problems selling to have to relist.

I saw a Fairfield house in nice shape drop their price from $720,000 to $660,000 in order to get the sale. That’s a 60K hit on high expectations. Ouch. As my friends agent said to them there is a shift in the winds in the Victoria market.

According the the Canadian Real Estate Association, the average price of a BC home in November 2015 was C$668, 317, whereas, in March 2015, the average price of a California home, according to the California Legislative Analyst’s Office, was US$440,000, or C$619,700 — 8% less than a BC home.

I see that quote thingy doesn’t recognize a second paragraph. The statement:

“No. Some areas of California are cheaper than our most expensive areas such as Vancouver, but BC is a big place and so is California.” was part of Totoro’s remark that I was quoting.

2732 Dewdney Ave is interesting. On a 50 foot lot, and apparently an entry in the ugliest new house of the year contest — completely out of keeping with neighboring property — it was listed a month or two ago at $1.5 million. Now, still unfinished, it has been relisted at $1.575 million. Victoria’s RE market must be really have caught fire. The lot was purchased as one of a pair, for around $600K, so the construction cost is around $290 a foot.

No. Some areas of California are cheaper than our most expensive areas such as Vancouver, but BC is a big place and so is California.

Sorry, but the median is not a relevant measure when comparing markets. You need to use the mean, which will confirm what I said.

Since you’re new in town Mike, Victoria has always been late to the party for decades behind Vancouver in style, culture, music trends, etc…. and always the last to the punch bowl in real estate. Vancouver price rise rate dropping is music to my ears. The HAM must be running out of borrowed money.

As that article interview mentioned, China companies are having to go offshore to borrow money because the taps are turned off in the homeland. That’s huge.

At least the laggard has finally turned leader… Victoria’s +1.76% last month for instance shows we’re now accelerating faster than even Vancouver’s +1.35%. Time to play some catch up. I’m convinced that the next 8yr Teranet period will show Vic living up to our name as ruler & monarch over the entire countryside 😉

Toss in today’s news that China’s economy is not looking good at all according to their beige book report. Not to forget you can’t believe what the Chinese say to begin with and the possibilities of a severe shift in the HAM is a real possibility.

China growth in ‘dangerous’ territory

“At least one group is warning that the situation is likely far worse than official statistics may indicate, saying that growth in the world’s second-largest economy is in “dangerous” territory.”

“A private survey by China Beige Book International showed that a number of metrics it tracks in China — national sales revenue, prices, profits, hiring, borrowing, and business spending — were all weaker in the fourth quarter, compared to the previous period.

To top that off, all sectors from retail to transportation have suffered, with the country’s two most important industries — manufacturing and services — also on the decline. The group also reported that wage growth slowed while labor supply tightened.

“The government may not be in the mood to acknowledge officially that the slowdown has worsened, but … [it] will be hard to hide,” wrote the report’s authors Leland Miller and Craig Charney.”

http://money.cnn.com/2015/12/17/news/economy/china-growth-real-beige-book/

What would happen if the HAM stops coming to Vancouver because they can’t borrow anymore against their bloated real estate or their company’s coffers run low ? That would be a massive catalyst with huge implications.

Since they have left Australia it’s only logical it could happen here and the spin off effect of falling Vancouver prices would hit us like a tsunami just by the psychological effect.

Will the Fed hike spur a credit crunch in Asia?

“With the Federal Reserve raising rates for the first time in nine years, higher borrowing costs might spark a credit crunch in Asia and hurt growth, analysts said.”

“Some analysts, however, are concerned about the potential for credit tightening in the region.

“This is kind of Asia’s Achilles heel,” Rob Subbaraman, Nomura’s chief economist for Asia ex-Japan, said at a press briefing last week. “Asia is more than four times exposed to financial imbalances than the other big emerging-market regions outside Asia.”

He sees risks for a credit crunch in the region as China’s economy slows and the Fed starts increasing rates.

“Market liquidity, we think, could evaporate quite quickly,” Subbaraman said. “I wouldn’t dismiss lightly the risk of an abrupt reversal of Asia’s financial cycle.”

http://www.cnbc.com/2015/12/16/will-fed-interest-rate-hike-spur-a-credit-crunch-in-asia.html

“Thing is, even allowing for the exchange, house prices are higher in BC than in California by about 20%.”

No. Some areas of California are cheaper than our most expensive areas such as Vancouver, but BC is a big place and so is California.

A number of places in California are much more expensive than Vancouver, such as San Francisco and San Jose. Most are more expensive even than the relatively expensive for BC Victoria median of $445,100 Can. ($319,675.37 US).

The median home value in all of California is actually $449,500 US, or $625,735.47 Can. http://www.zillow.com/ca/home-values/

I am hearing a lot of anecdotal evidence from friends about falling prices and job loss in Alberta. I’d be surprised if prices don’t fall more there. There may be some impacts in other areas of Canada too that supplied a lot of the workers. Not sure that Victoria has a significant percentage but I do know many of the workers in mills and industries that have closed down in BC went to Alberta.

Cool chart. If another year or two was added, Vic would be dead last. We bought a property near Ed that pretty much doubled ‘06-’07. Wait, where’s SK…kidding nobody cares about them 😉

http://1.bp.blogspot.com/_dDw9BOFM_C4/R3RrQJPOtfI/AAAAAAAAAFc/fo5fdiG78LE/s400/Edmonton+Average+Price.PNG