Housing in the 80’s and 90’s

There has been much discussion on this blog about what did (or didn’t) happen with the housing market in Greater Victoria during the 1980’s and 1990’s. As a teenager, I witnessed firsthand the “housing crash” in Victoria the early 1980’s. In 1980, my parents separated and a year later they decided to sell the “family” home located on Ten Mile Point. I remember the agent from Realty World valiantly holding open houses and nobody showing up. After sitting on the market for more than a year and only two showings, my parents agreed to take the house off the market and they worked out a payment plan for my father to slowly buy my mother’s “half” of the house.

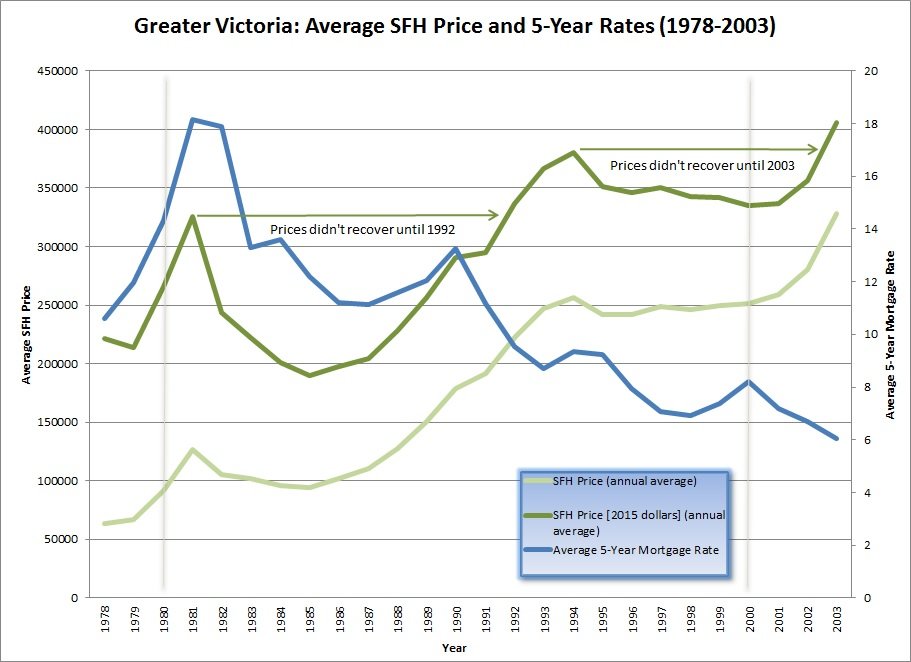

Between 1978 and 1981, the 5-year fixed mortgage rate jumped from 10.59% to 18.15% (a 71% increase), such that the sales volume plummeted extraordinarily low. Only a few people could afford such high interest rates, so it’s no wonder that single family housing (SFH) prices plummeted down from an average high of $126,776 in 1981 to $93,865 in 1985. However, the actual inflation rate at that time was extraordinarily high, such that if evaluated in constant 2015 dollars: the average SFH price in 1981 was $325,776 dropping to $189,518 in 1985 – a staggering 42% drop! I remember walking through a nearby subdivision called Wedgewood Point Estates, where I witnessed many homes built and purchased in the late 1970’s up for sale again. The new owners just couldn’t keep up with the mortgage payments and I remember that close to 1 in 3 houses in that neighbourhood (of $250K+ houses) being up for sale. Some owners went bankrupt when they couldn’t sell their high-end luxury homes.

By 1985 the 5-year interest rates had dropped to a more moderate 11.5%. I remember wishing I had the $7500 to make a down-payment on a decent starter home selling for $69,000. With making just $5.50/hour – home ownership just wasn’t in my cards at that time! SFH prices eventually recovered to the “peak” they reached in 1981, but it wasn’t until 1992 (eleven years later) – after accounting for annual inflation. During the 1990’s, fixed mortgage rates dropped almost in half from 13.24% in 1990 to 6.90% in 1998. As rates dropped, prices went up and peaked in 1994. Even as mortgage rates continued to drop, prices continued to slide down a bit – after accounting for inflation. It wasn’t until 2003 (nine years later) that SFH prices matched their peak in 1994.

It’s interesting to note that during the high-interest years in the 1980’s that the average selling price and mortgage rates were directly proportional. After the housing bubble burst in 1981 and interest rates started to drop, and so did SFH prices. I’m sure that this had more to do with risk-averse consumers trying to keep their financial heads above water rather than with the fundamentals of budgeting (where dropping interest rates and rising prices = the same monthly payment). By 1990, markets and wages were stabilizing such that the SFH prices and interest rates started to become inversely proportional. Mortgage rates dropped by a third from 13.24% in 1990 to 8.7% in 1993. Average SFH prices (in constant 2015 dollars) rose almost a third from $290,660 in 1990 to $380,004 in 1994. With a stagnating BC economy in the mid-1990’s, the pattern flipped back to directly proportional with prices continuing to slowly erode in spite of further drops in the 5-year mortgage rate. Starting in about 2000, the inversely proportional pattern reemerged – with mortgages rates dropping and prices climbing. With the exception of the 40-year amortization introduced during 2006-08, just before the Great Recession – the inversely proportional pattern has persisted for the past 15 years (covered in more detail in my Housing Prices Follow Mortgage Rates? blog post).

History seems to suggest that when the economy is suffering that both mortgage rates and prices will drop in tandem, but the dropping rates always trigger an eventual rise in prices until the next crisis emerges. What’s clear is that there have been some great times for buying (such as 1986, 2001) and some great times to sell (1981, 1994). Inflation-adjusted peak to recovery (same SFH price) patterns seem to occur about every 10 years (1981 to 1992, 1994 to 2003), with inflation-adjusted peak to peak every 13 years or so (1981, 1994, 2008) or so.

However, the ultra-low rates introduced in response to the Great Recession may have changed the narrative. As shown in my Affordability (Part 1) blog post, the monthly payment required to buy an average SFH in Victoria peaked in 2008. Does this suggest prices will climb to similar levels by 2018 (10 years) with another peak in 2021 (13 years)? With mortgages leveraged so much more than any other time in the past 50 years, and the levels of household debt breaking new records each year – I truly think that we have arrived a new paradigm. As an investment broker would say: “Past performance does not guarantee future results.“

– – – – – – –

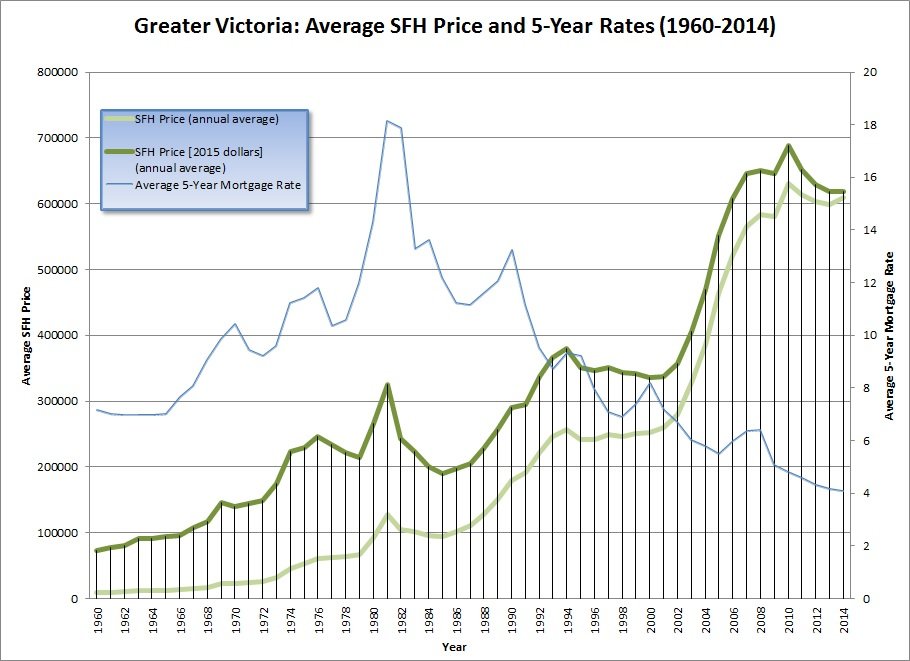

[Edit:] From the comments, it seems that there is a keen interest in comparing prices are rates from other time periods as well. So, here is the “definitive” chart of the Average SFH Prices and 5-Year Mortgage Rate from 1960 through 2014 … Enjoy!

You are all fools. The market cannot be understood.

Dr. Copper up 6% today is a nice signal for our economy. Get ready for the great rate & RE doubling of 2015-2023 (my opinion, not investment advice 😉 )

Nope. Amortization or accelerated payments are not the same as payback period.

Payback time is what you set for yourself as a determinate of whether to buy or not to buy.

If you set yourself a limit of no more than 15 years. Then you will not buy a home that has a payback period greater than 15 years.

https://youtu.be/U2aH4xH5Fz0

Vacant lots are not appealing to first time house owners unless they want to live in tents.

You’re looking at a small market segment consisting of builders and upper income households wanting to spend a million or more for a new home.

Someone looking to build a home specifically for that area for their own use will pay over market value for the vacant site. That they paid over market value matters little to them as they are not intending to sell at completion. Unlike builders who want to make a profit at completion.

The market value of the land is best determined through a residual land technique. If you spend 1.1 million to build a home that is only worth 1.0 million then you paid $100,000 too much for the lot.

As for the correction, prices dipped then they recovered and a bit more.

In October 2012, the house at 2640 Roseberry sold at $367,000 and was supposed to be a tear down. It’s still there. Today it’s close neighbor sells at $405,000. Back then the median price for a home in the city was $560,000. Last month the median was $660,000.

So tell me which is the stronger market – vacant lots or detached homes?

$507,000 for a 4,146 sq/ft lot. Keep in mind that a common city lot is 50 x 110 = 5,500 sq/ft so this is quite a bit smaller than the run of a mill city lot.

Vacant land values/teardowns in the core were the only market segment that according to my close observations did not correct from 2011 to 2014 while everything else including SFH, condos, building lots outside of the core (Westshore/Penninsula) all saw a small correction.

At the peak of the market in 2010 you could still buy a nice full size lot in the Oaklands/Fernwood area for around $340,000 – good luck with that now. A lot on Roseberry just went for $405,000 in a bidding war.

I had a math error – there were 11,383 bankruptcies AND consumer proposals in BC last year. There were only about 6500 bankruptcies. If 10.9% were seniors we are talking about 708 seniors *(my math was wrong).

The sale price of 1264 Faithful will give you a good idea of land values in Fairfield. They tore down that sucker fast! They must be finished the new house even. I don’t think they paid the full ask of $509k. 4100 sqft lot for more than $120 per?

Thanks Marko. Active listings have dropped by 140 (4%) in the past week, but sales seem to be still moving along briskly. My current projection for September is 670 properties, which is a 18.6% increase from September 2014.

When I inherited this blog from @HHV and @Leo, I carefully considered what the purpose of HHV should be. On the “About” page, I noted:

The purpose of this blog is to allow a public forum for:

I think that I’m still following in the steps of @Leo, but I agree that @HHV was waiting for the right time to buy (before moving away to Calgary).

I have no trouble with the concepts of amortization or the effects of accelerated payments, but I do still have trouble understanding what you are getting at unless you are actually talking about a future doom and gloom scenario or some other place than Victoria in a doom or gloom scenario?

This is not really today you are discussing right but some much worse future scenario rather than the same or better? .

Are you are saying:

1. When prices rise (like now) new purchasers no longer can afford to make extra payments and so the amortization extends to, say, 25 years.

– Have you accounted for affordability and whether paying down is a even a good idea given the low interest rates? Maybe a scenario with numbers would help? Seems to me that people are currently paying less per month on their mortgages due to the super low interest rates?

2. When interest rates and/or prices rise people in general become more frugal and avoid purchasing homes and other big ticket items but housing prices don’t fall dollar for dollar.

– This is some bad future situation where rates rise and prices don’t fall? Are you are saying that people will stop buying or the market will crash if that happens?

3. When hard times hit people don’t want to spend as much per month on housing.

– What is a hard time? Is this a general condition that you are predicting for the future sometime? Is this if unemployment figures rise dramatically in Victoria? Again, a scenario with numbers might help.

4. When hard times hit people don’t want to buy a home with a suite because they cost more.

– Have you done the math? Where is the basis for this proposition? Seems to me that suites would become more desirable because it is not purchase price that rules but affordability. What is your monthly payment all in after suite income provided you qualify for the mortgage is the question. In hard times people compromise more to get what they want imo.

5. Rental suite income will decline because vacancy rates will increase in hard times.

– Would there not be a greater demand for rental suites in times where buyers had difficulty with housing purchase affordability? By hard times do you mean when vacancy rates rise? Have you researched historical vacancy rates in Victoria and whether they rise dramatically in a recession? I can’t ever recall a time that it was easy to find a rental home in Victoria or when there was a high vacancy rate. The rate is incredibly low right now: http://vancouverisland.ctvnews.ca/victoria-s-rental-housing-market-is-drying-up-report-says-1.2423542

I think it’s because you read imminent doom into everything that I write.

Maybe you’re confused because you assumed that payback and amortization are the same thing. They aren’t. Payback is when you say that you want to pay off the home in 15 years. Amortization is what the bank uses to determine your payment. You may elect to amortize the mortgage over 25 years but you’ll be making extra payments to pay it off sooner.

In a rising market the payback period starts to extend out to the full amortization because buyers no longer have the ability to make extra payments.

In hard times people become very frugal with their money avoiding big purchases and long term debt. Any rise in the interest rate would not be met with an dollar for dollar fall in house prices. Prospective purchasers would also want less of their take home pay going to a large mortgage and they would want it paid off quickly.

Now you would think that they’d want a suite then to pay off the debt faster. But houses with suites cost more and the rental market for basement suites would be weak too making homes with suites less attractive to purchase.

I don’t understand the need for vacant land transactions. You did this analysis for neighbourhoods in Oak Bay last year I presume using BC Assessment (which attributes value to home and land separately) or sales data. Anyway, maybe it doesn’t really matter unless you really are wanting to compare valuation equalizing for the larger lots and homes as you did for Uplands vs. Gonzales.

You cannot arbitrarily write off suiting costs in anything but new construction. Secondary suites are continually being added in existing older homes. Older homes with suites likely had a premium attached to them on sale or will do when sold. Makes no sense.

The market right now is a sellers market and affordability is pretty good relative to recent years and the fact that homes have historically appreciated faster than inflation. I have a hard time making any sense of your post JJ, although you might have a good point in there somewhere I’m not understanding.

The problem with just looking at the price per square foot rate of land in those two areas is that there just isn’t enough vacant land transactions. You also have the differences in zoning. That while a Fernwood lot is smaller than a Broadmead home it may be possible to build two separately titled properties on the Fernwood lot but not on the Broadmead site.

And to answer why construction costs are not relevant to a 50 year old Fernwood home is that the home has had a basement suite for decades as opposed to new house construction.

Maybe.

My interpretation of the purpose of the blog was to time the market and that HHV and Leo both were looking to understand and motivated to post by understanding when to buy and whether they should wait or buy. Would there be a better time? HHV gave up and bought elsewhere and Leo did time the market pretty well. Both then largely moved on.

A future drop in the market was consistently predicted by the majority here over the last several years, including you and me, until this year when it was clear prices were on the rise.

I seem to recall you stating in 2014 that Canada was in for a black swan event when CMHC would refuse to provide mortgage guarantees and the housing market safety net would disappear.

I agree that the focus of the blog has shifted with DavidL, who has a paid off house, in a good way. I disagree that many here have not been hoping/waiting for a drop in order to buy low. The talk of bubbles dominated this site for a couple of years.

My interest is not in waiting for a drop but in understanding the market which I have always found interesting for reasons that are not entirely clear to me.

As prices are rising people end up having to spend more of their earnings on housing, extend their payback period out to the maximum amortizations and rent out parts of their homes.

During hard times, people are less likely to make expensive purchases financed over long periods. They want to take on as little of debt as possible over short time periods. In other words they want a short payback period. And cash is king again.

They may want to pay off a home in 15 years rather than 25 or 30 years. And they are not willing to buy at the maximum debt to service ratios either. And they don’t want tenants.

Frankly, it the lack of cars and suites that makes Broadmead appealing to me …

I haven’t been waiting for a downturn. And I don’t know why you are?

The blog is more about a discussion on real estate. In this thread it’s about what may or may not be the better purchase given the possibility of an economic downturn.

This thread is about purchasing not waiting for a collapse.

I did pay more to live in a walkable neighbourhood. I have no desire to live in Broadmead. Different demographic I guess and it seems there is a larger segment of the market looking for services and walkability of the core vs. the available housing stock than for large homes/lots in the suburbs.

But is that the same as saying you would pay MORE for a home in Fernwood over Broadmead?

Not everyone has the same criteria. Walkability seems important to you. But a walk score of 95 versus 85 or 75? For someone with physical disabilities and desire for some form of exercise being in a level neighborhood is important. But most of us still drive downtown or to home depot or to the mall or to go for a walk at Beaver Lake.

Unlikely imo. In a market downturn more desirable neighbourhoods tend to retain their value longer. There is no great equalization of values.

As far as the appreciation curve goes, per square foot land and houses in Fernwood could well outpace those in Broadmead. Lots and homes in Broadmead are much larger than Fernwood.

Why is the cost of a suite only a consideration for new builds? It likely will cost $30,000 to suite a 50 year old house – maybe more depending on the wiring/plumbing issues and the permitting process.

In a market downturn purchasers will be spending less on housing as a percentage of income only if there is no accompanying rise in interest rates.

We have been waiting on this board for this downturn for more than seven years now. It hasn’t arrived.

I have no crystal ball. There is always only the deal of the day and your current circumstances.

“Seniors aren’t supposed to go bankrupt?” Really, just because you turn a certain age you get a pass on financial responsibility?

I agree we should support those in need but I disagree that there is some magical age as opposed to a responsibility on all to plan during their working years.

I would go so far as to state that the pension and RRSP exemptions for senior bankruptcies provide a strong incentive to declare bankruptcy for those with significant consumer debt.

The cost of a suite would only be a consideration for new builds. Not 50 year old homes in Fernwood.

Just as a point. If you say one neighborhood or class of property historically is appreciating faster than another. Eventually that neighborhood will surpass the other neighborhood in market prices.

If Fernwood is appreciating faster than Broadmead, then given time Fernwood would become more expensive than Broadmead.

Going out on a limb on this one. But I would say that is not likely to happen.

What is more likely to occur is that during the next housing recession. Neighborhoods like Fernwood which have been appreciating quickly will correct more deeply.

And the neighborhoods will once again be in harmony with each other and you won’t find pockets of insanely priced properties surrounded by lower price properties of similar accommodation.

And in a market downturn prospective purchasers will be spending less as a percentage of their income on housing the need for a basement suite would be reduced. And that would have an effect on demand for homes with suites.

The number of bankruptcies overall is declining in Canada and BC yoy.

The number of senior bankruptcies overall is increasing slightly. The rate of senior bankruptcies remains very low – lower than among those who are not seniors by far.

And, yes, the rate of seniors in Canada is increasing and therefore we would expect this to show in all areas statistically – including bankruptcy percentages.

Bankruptcy rates amongst seniors have; however, been increasing faster than the demographics would indicate since 1987 so there are some other factors at play than increasing numbers alone. Access to consumer credit is one.

That said, there were 11,383 bankruptcies in BC last year. If 10.9% were seniors we are talking about 124 people – most of them not likely to be homeowners to start with. Seems like a lot of fuss about a very uncommon event given that there are 551,820 seniors in British Columbia.

All this talk about bankruptcy is pretty much fear-mongering drama imo. Living in poverty should get more attention as it is far more widespread. Poverty rates among the elderly have been declining in Canada. Again it is First Nations people who are in the worst shape here. 50% of FN children live in poverty.

http://www.conferenceboard.ca/hcp/details/society/elderly-poverty.aspx

https://www.policyalternatives.ca/publications/commentary/first-nations-poverty-and-canadian-economy

As for stats, you can find them yourself as bankruptcies are public information and stats collected and published online by both the federal and provincial government – google it. Senior bankruptcies are 10.9% of all bankruptcies although seniors are 15% of the population. By 2041 seniors are expected to be 25% of the population.

Something to think about as this has all sorts of implications for the posters here including how the exemption from bankruptcies for RRSPs and pension plans might play out.

http://www.ic.gc.ca/eic/site/bsf-osb.nsf/eng/h_br03355.html

http://www.elections.ca/content.aspx?section=res&dir=rec/part/sen&document=index&lang=e

http://bankruptcy-canada.com/bankruptcy/causes-of-bankruptcy/

Seniors aren’t supposed to be going bankrupt. It shows they aren’t getting smarter with their wealth growth with the amount of financial education out there , they are getting more flagrant. Numbers should be declining not growing or keeping pace. This sets up for an even nastier situation when the market inevitably corrects. Declining or negative equity is the death knell.

That’s correct, having sold a number of homes this year in the Oaklands area without suites there has been rapid appreciation on those homes as well.

I think area is a huge factor versus trying to analyze suites/vs no suites demographics of an area. All things being equal (which they are not in real life) in terms of finished space/lot size/etc., I personally would pay a premium in the Oaklands/Fernwood area over Broadmead just because of the walkability and more specifically walkability to downtown.

Tue Sep 8, 2015 8:35am:

Sep Sep

2015 2014

Net Unconditional Sales: 137 565

New Listings: 192 1,099

Active Listings: 3,547 4,253

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

Maybe. Some people don’t want a suite at all. I have no idea what the percentages are or whether homes without suites are not appreciating as quickly. As I have a home with a suite I would like it if they were appreciating faster but I’m not sure that is correct. Marko would have a better idea I guess.

There is, as I said above, not enough data to know. Homes with suites are valued higher because they cost money to build. Whether their rate of appreciation is higher is unknown until you have data to analyze.

What Marko is saying (I think) is that there are many houses without suites in Fernwood/Oaklands that have experienced the same rapid appreciation as the houses with suites. This would seem to go against your theory, although I don’t have enough information to know one way or the other really.

What clearly has affected appreciation rates is neighbourhood/location. Oak Bay has appreciated faster than Langford. Waterfront has historically appreciated faster than non-waterfront.

Weren’t you the one that posted a while back that building a secondary suite is not a good idea because you won’t even recoup the costs on resale? How does this now accord with the theory that houses with suites appreciate faster?

Not enough data on secondary suites and appreciation rates to tell. I would think that with the new changes to CMHC financing that if your suite is legal your rate of appreciation could be greater than that of a home without a non-conforming suite..

Fernwoods/Oaklands is experiencing the effects of gentrification imo. Secondary suites are a much less likely explanation for the higher than Broadmead appreciation rates.

As prices rise fewer can afford a home with a suite. That puts greater demand on homes with suites. Increasing demand is one of the causes of higher prices.

That’s a different question and nothing to do with what I’m discussing. I take it by your obfuscation you do agree with me then that homes with suites have been appreciating more than homes without suites..

I’m not sure that homes with suites have been appreciating at a higher rate but I am sure that a suite costs money to build and adds value to a home. I think we’d need more analysis to see if there has been a higher rate of appreciation on base value which seems possible but unlikely.

Parking is an issue. I agree that causing difficulties for neighbours with parking should be avoided.

This may be something that stops people from trying to legalize suites. On small lots it might not be possible to add an additional parking space.

One solution to congestion is turning streets into resident-only parking with a permit system like many cities have already done.

Red herring.

Your statement has little relationship with secondary suites as the risk of faulty wiring fires does not rise with the number of illegal suites – and what other “death trap” risk might you be referring to other than electrical wiring – faulty plumbing isn’t going to kill you as far as I know.

If you really want to protect against faulty wiring in homes legislate a requirement for homeowners to hire someone to inspect and certify wiring in homes greater than 25 years old. The wiring risk applies to all occupants of such homes whether there is a suite or not. For the 5% risk this represents in relation to all house fires our government has not seen fit to create a legislative solution. Probably would be very unpopular with taxpayers as likely more than 80% of homes older than 25 years have wiring issues..

Insurer’s have; however, responded by refusing to insure knob and tube wired homes.

I’d say that if the city or province wishes to ensure that secondary suites are properly permitted they need to create a more user-friendly system and an incentive, such as a grant or tax incentive. As far as risk to human health goes, I don’t see a pressing social issue that must be addressed here other than a lack of affordable housing which non-conforming secondary suites provide some relief from.

“Despite the hoods used in the comparison, my premise is that homes with suites have been appreciating at a higher rate than homes without suites.

Are you disagreeing with that premise?”

How do you explain 700 – 900 sq/ft one level homes in the Oaklands area selling this year $30,000 – $40,000 than they were selling for a few years ago?

Street parking is visually unappealing. In my opinion, it has made some areas of Victoria look shoddy. But at the same time house prices in these hoods have gone up substantially as more people can afford to buy a home with a suite. For those that have lived in those areas for a long time that has been good for their personal wealth.

Myself, I would rather pay less for a home and not have to deal with clogged streets and parking issues. However, for a significant portion of the buying public that isn’t an option. They have to pay more for a house in an area with parking issues because they need the suite income to pay the mortgage.

If that sounds strange to you – it should. Since most of us believe that the more you pay for a home, the better the neighborhood.

Take two pictures of the same house. One with the streets bare of cars and one with the streets clogged with parking. Ask someone which picture represents the hood they would prefer to live in?

Then tell them that the hood with clogged streets will have people pay $50,000 to $100,000 more. Not because of demographics, not because of location – because of suites.

Despite the hoods used in the comparison, my premise is that homes with suites have been appreciating at a higher rate than homes without suites.

Are you disagreeing with that premise?

Then we should wait for someone to die or become injured before making changes?

But there already is a cooling off period of some sort. How many days typically do you suggest for clients to remove subject removals. 5 days? 10 days? I’m saying make that mandatory.

You lose the power of the unconditional offer or does it make the playing field level for all agents representing prospective buyers?

It allow lenders to complete their due diligence effectively and it discourages what I consider unethical high pressure sales tactics. Practices that present the real estate industry in a bad light to the public.

Overall we are down in BC

http://www.ic.gc.ca/eic/site/bsf-osb.nsf/eng/h_br03445.html

correct me if I’m wrong but they are quoting that the number of seniors going bankrupt is increasing not that the percentage of seniors going bankrupt is increasing? If the numbers of senior is growing as expected with the population curve then wouldn’t it be expected that the percentage of seniors going bankrupt would also increase even if the total population bankruptcies were decreasing?

As per seniors going bankrupt, your numbers from where ever you got them from are irrelevant if the overall numbers of debt potential bankruptcies are rising. Fact is seniors are retiring with more debt than ever.

“Another driving force is that more seniors are retiring in the red. According to Statistics Canada’s most recent numbers, in 2012, 42.5 per cent of people aged 65 and over still had debt. That’s a stunning increase of 55 per cent since 1999.”

“The differential in rising prices between Oaklands/Fernwood and Broadmead is more likely explained, imo, by proximity to core and the changing demographics of the Oaklands/Fernwood area than anything else.”

Despite Just Jack’s extensive analysis I am going to have to agree with your opinion on this.

Interesting comments and discussion on suites…

Over the past 10 years, I’ve seen a big increase in rental suites in some Victoria neighbourhoods. My biggest concern is the issue with street parking. Legal suites require a parking spot on the property. I’ve seen so many streets (including my own) where owners have added illegal suites resulting in the sides of the street getting clogged up with parked cars, making it harder to drive, bicycle or even walk (when no sidewalks).

I don’t recall any fatalities in Victoria involving a single parent and their child due to living in a death trap substandard suite?

I do agree that a single parent on SA should not have to live in a death trap and, without downplaying the hardships of SA or the lack of affordable housing here, I do not believe this is a requirement in Victoria for single parents.

There are co-ops and subsidize housing and other options and organizations that can help. There are far fewer resources for single people on welfare.

As for fires, substandard suites are not even a listed risk factor for the average of 32 deaths/year in residential fires in BC and the 1.5 fatalities due to electrical wiring issues (5%). The predominant wiring risk indicators are houses over 25 years old with less than 100amp service and/or knob and tube wiring. If you want to ensure you are a low electrical wiring fire risk get your electrical inspected if your house is older than 25 years whether or not there is a suite.

The average age for a fire fatality is 52 years old and risk factors are:

– being male (1.5 times higher risk)

– smoking (highest risk factor – 30% of deaths and 33% of fires)

– careless cooking and candle use cause another 20% of fires

– substance abuse (alcohol/drugs a contributing factor in 39% of deaths)

– mobile home/trailer as residence (25% of fire deaths)

– being over 65

– non-functional smoke alarms

– physical disability

– Aboriginal identity

– living in the North

– living on-Reserve

If you are really concerned about single parents who are living in hazardous housing conditions you should be focusing on First Nations reserve lands. Statistically speaking, the rate of deaths from house fires on-Reserve is 10X greater than for other Canadians overall and 4X greater in BC.

(BC Coroner’s Report on House Fires in BC 2007-2011)

He cites the source in his reply. “Saanich Secondary Suite Study”. I presume it is the one linked here: http://www.saanich.ca/living/community/suite.html

Just a few comments:

1. We have no idea which homes have suites if they are not permitted or otherwise statistically recorded. There are more seconary suites advertised for rent in Broadmead than Oaklands right now. The differential in rising prices between Oaklands/Fernwood and Broadmead is more likely explained, imo, by proximity to core and the changing demographics of the Oaklands/Fernwood area than anything else.

2. Suite income is income and does contribute to median incomes. Not reporting such income is tax evasion.

3. The rate of bankruptcy and creditor protection agreements among seniors in Canada is .2% – and .5% overall. There has been a slight increase over the past few years in the rate amongst seniors, and an overall decrease, but the rate is still extremely low. Most bankruptcies among seniors are caused by health issues that cause them to retire earlier than expected. It is likely, imo, that strategic bankruptcies are rising amongst this group as RRSPs are protected from bankruptcy and it makes no financial sense for this cohort to cash them in to pay debt if they have no ability to replace these funds.

4. There is no evidence that all unpermitted suites are “death traps” or that most of them are not compliant with the code. I’m not sure why the building code would not be followed? I would not rent a place that I had concerns about ie. a bedroom without an egress window for example and I don’t think I’ve even seen this when I looked at rentals.

Also, the rate of deaths per 1000 that originate in a basement suite vs. the main residence area of a SFH is the same in BC (google “Fires in the Basement of Single Detached Residences in BC for a study by the University of the Fraser Valley).

My view is all suites should be property permitted but that municipalities should make this easier. It seems that Victoria is creating obstacles and making the process laborious – why would so very few people choose to legalize otherwise? A legal suite makes your home more saleable particularly given the new CMHC rules on secondary suite income. Not every city does the same.

I legalized an existing suite in the Okanagan and it was quite simple and very quick under their grandfathering provisions and everyone was really pleasant to deal with. All I needed to do was submit the application with a to scale drawing, the permit fee and install interconnected fire alarms as everything else was already compliant as I’d installed soundproofing (fire barrier) in the ceiling already. That said, house insurance is harder and more expensive to get for a home with a suite whether legal or not. In Victoria having a legal multi-family does mean you’ll pay extra garbage and water fees too.

5. A ten-day cooling off period for real estate is unnecessary imo. Conditional offers provide enough of an out.

Is that 98% or 99.3%? Source?

Personally I am very pro building high quality suites. I spent a lot of money on my suite in terms of safety, sound dampaning, security, etc -> https://www.youtube.com/watch?v=cNA9_srqils

My suite has its own alarm system partition for security and a bunch of other high-end upgrades. Huge opening windows on the walk-out portion, etc.

The real life reality is you can’t do what I did with my new custom home on the 8936 homes in Saanich.

“Beware realtors who openly show contempt for laws designed to protect the safety of renters.”

So you believe that laws which create for 99.3% non-compliance are an effective way of dealing with renter safety?

This type of system would be brutal for the seller. I probably would think twice about listing a personal property if the buyer had a ten day cool off period. It is extremely unfair to the seller. It would also only benefit a small percentage of buying consumers.

You can’t have a functioning marketplace without irrational consumers. The cost of protecting the 10% of irrational consumers who will bid irrationally in an “auction environment,” is too great for the overall market.

The way I look at it is if I am smart with my money, I work hard, I do my research and understand calculated risks I as the buyer deserve the right to bid unconditionally on a home if I really want that home.

Why should I be penalized by having to compete with other offers as would be the situation if there was a 10 day cool off period? My unconditional offer would be no better than any other offer.

The system would penalize a lot of people for the sake of protecting a few irrational ones.

“Since 2010, a total of 98 secondary suites permits have been issued: 64 in existing homes; and 34 in new homes.” Source: Saanich Secondary Suite Study

So for existing suites 64/9000 = 0.7% have a permit in place in Saanich.

I am 100% safety, but the bureaucracy that goes on at various muncipal halls is a huge component in the cost of obtaining a permit that has nothing to do with safety or common sense.

I just finished building a house and there is a lot of crap that has zero to do with home construction and safety. Did the $500 I paid the HPO office to give me a letter that states “Marko Juras is an owner builder,” have anything to do with safety? Did the $7,000 cheque I gave the municaplity for my permit improve safety? Nope, nither did a ton of other bureaucracy based expenses.

Same concept applies for a suite permit. Will a survey of the property that may be required to obtain a permit for the suite improve safety? Will forcing an owner to upgrade a 1/2” water line to a 1” line because someone decided that was policy improve safety?

I would rather have 50% of the suites permited under a common sense plan to improve safety than to have owners avoid permits like the plague and hence have 99.3% of suite unpermitted.

When 99.3% of suite have no permit something isn’t working.

In terms of fines of non-compliance where does one start. Fine 8936 suite in Saanich alone?

Are you suggesting renters are republicans?

The measure of a society is how it treats the less fortunate. A single parent on social assistance should not have to live in a death trap.

In a perfect world we wouldn’t need to regulate landlords as they would be responsible.

Unfortunately there are a few landlords that ruin things for every one else.

If you’re a renter you prefer less laws & regulations to keep rents down. Choose to rent a place without an escape route, win a darwin award 😉

“Like 98% plus of suites don’t have a permit…….the process to obtain a permit is ridiculous; therefore, no one bothers with it. Buyers also aren’t willing to pay a substantial enough premium for a permitted suite vs un-permitted so between that and the expensive process very little incentive for anyone to actually obtain a permit.”

Beware realtors who openly show contempt for laws designed to protect the safety of renters.

The permit is for public safety such as windows in the bedrooms for fire escape, electrical, fireplaces etc. Sure it may seem arduous and expensive to comply with the bylaws but so are civil cases for contributing to injury or wrongful death from renting your home without meeting minimum regulations for safety.

Tenants have a right to live in homes that meet minimum health and safety regulations. Fines for non compliance should be substantial and not simply disconnecting a stove.

Anyone doing what you suggest would be a crack pot. Placing offers on multiple properties and then walking away. Any selling agent would have vetted them before hand. The likelihood of this every happening is negligible. Besides this doesn’t limit an agent from taking back up offers where the cooling off period can run concurrently with the first offer.

The crackpot could do this today without a ten day cooling off period. Just by making every offer subject to suitable financing. Any person doing such a thing would be known among agents quickly and the agents would inform his client of that fact suggesting not to accept the crackpot’s offer.

The benefits to the consumer far outweigh any inconvenience to the seller or the agent. This adds stability to the marketplace by reducing some of the hard sell tactics or intentionally creating an auction environment to purposely over sell a property.

If agents fail to self regulate themselves then legislation is needed to protect the public.

“Even with the recent bylaw change, the vast majority of Saanich owners with suites have not obtained permits, and thus the suites remain illegal.”

Like 98% plus of suites don’t have a permit…….the process to obtain a permit is ridiculous; therefore, no one bothers with it. Buyers also aren’t willing to pay a substantial enough premium for a permitted suite vs un-permitted so between that and the expensive process very little incentive for anyone to actually obtain a permit.

“That’s why we need a mandatory 10 day cooling off period in all real estate transactions. That gives the purchaser ten days for them and those that need to process the mortgage enough time to do their due diligence.”

Do you know how many unethical buyers would take advantage of this? Just make an offer on everything, lock is up for 10 days so no one else can touch it, ponder it, walk away on the 10th day because they couldn’t secure “favorable financing,” real reason they found another property or got cold feet. No consequences for the buyer, the seller lost 10 days and other interested parties.

It think the current setup is as fair as it can be. If you really want a house in a bidding war take a risk and offer an unconditional offer; however, no one is forcing you to take that risk.

If you have a problem with bidding wars/unconditional offers find a house where the seller will accept 10 days for conditions. Not sure if it can be any more fair?

Labour day…how appropriate. Here is a look at how much our municipalities spent PER PERSON in 2014. We are all paying one way or another…taxes, levies, fees etc…

Op/Cap Budget Pop Avg/Person

Langford $39,000,000 29,228 $1,334.34

Oak Bay $32,000,000 18,000 $1,777.78

Saanich $250,000,000 110,000 $2,272.73

Esquimalt $38,800,000 16,209 $2,393.73

Victoria $292,500,000 80,017 $3,655.47

Just legalize secondary suites. So simple…make the municipal inspectors earn their keep.

The effect on how prices change between homes with and without suites is difficult to quantify. The only reason I picked those two areas is because one is highly regulated by bylaws and those that live in the hood against suites. And the other hood is really lax when it comes to suites being the most suite saturated neighborhood of Victoria because of the zoning.

In my opinion, suites are one of the reasons why our price to income ratios can be higher than other cities that have a much lower ratio of basement suites. Since the suite income is not added onto the median household income.

Vancouver has the most suites than any other city by far in Canada. Estimates are that 43% of the houses in Vancouver have suites. Other cities like Montreal are only at 15 to 20%. That will skew any comparison of price to income ratios to other cities in Canada or the world.

And I have also have found that during the up cycle of the real estate market purchasers pay increasing more for homes with suites than houses without. Buyers rely more and more on that suite income. During the down cycle that premium is lost. That would mean neighborhoods like Fernwood and Oakland would experience a larger fall in prices relative to other hoods in a down cycle. And so would cities like Vancouver.

During an up cycle homes with suites are the better investment for price appreciation. The opposite in the down cycle.

The lender has a lot of work to do with income verification, credit checks and appraisals to be ordered. To accomplish their due diligence takes time. When someone writes an offer subject to financing and the vendor adds a 24 hour clause that effectively negates the financing clause.

The purchaser has to remove their clause before all of the due diligence is completed or risk losing the home. This adds greatly to the stress of buying a home.

And it wouldn’t add up to 20 days. The ten day cooling off period begins from the date the offer is accepted for both the house you are selling and buying. And that doesn’t mean the agent can’t take back up offers either. Or that a purchaser can’t extend the subject removal date to more than 10 days but by law you wouldn’t be able to have less than 10 days.

The ten day cooling off period may help to curtail real estate auctions or reduce under listing houses to create an auction. With all the marketing ploys these days, prospective purchasers need protection. It’s just too one sided.

I can’t speak for @JustJack, but perhaps he picked Fernwood/Oaklands neighbourhood as it has seen the largest price gains over the past few years? Comparing Broadmead with adjacent neighbourhoods such as Royal Oak or Cordova Bay might be a more fair comparison.

Incidentally, Saanich has only allowed legal suites north or McKenzie Avenue since October 2014. Suites in Broadmead and outside the urban containment boundary remain illegal.

http://www.saanich.ca/images/living/community/suite/north/ScheduleG.jpg

For decades, the municipality has “turned a blind eye” on illegal suites and only investigated when a neighbour complains. Even with the recent bylaw change, the vast majority of Saanich owners with suites have not obtained permits, and thus the suites remain illegal.

http://www.saanich.ca/living/community/suite.html

I like the idea, but can see some problems occupying when the purchase of house B is contingent on the sale of house A. It like having to wait two weeks for a cashed cheque to clear … Alternatively, how about a minimum 72-hour clause?

I’ve heard of “24-hour clauses and no subject-to offers” in simmering markets in Vancouver and Toronto – but is this common in Victoria?

I couldn’t help but notice another leaker in a 70’s built apartment on Quadra St. with it’s rain coat on one side of the building. The Lord Harley I believe was the name. All that quality 70’s construction is once again showing it’s age. Good thing it’s only renters there who won’t get dinged for the usual 70K debt bomb but may have to move out.

I wonder what the story is on that other 70’s built block on Shelbourne across from Sears ?Looks like people had to move out of there for over a year now. Toxic mold maybe ? Windows were all boarded up for a long time in some of the suites.

Good point Jack. Which is why agents who cater to foreigners should be all be independently investigated. As per the Province article, so many shady agents and lawyers aren’t reporting the transactions and should be tossed in jail if the buyers are proven to be laundering. How can someone flushing $450 million thru Vancouver over a few years not get noticed by the agents and lawyers ? No wonder no one trusts them like a used car salesman.

“Kim Marsh, a private money-laundering investigator and former RCMP international crime unit boss who tracks dirty money in Vancouver property for Chinese institutions that want to recover laundered assets, told The Province he currently has at least seven large cash transaction investigations open, compared to the two reports made since 2012 by Vancouver realtors. One file involves four expensive homes purchased for a Chinese buyer in Richmond through a Chinese lawyer within eight weeks, in 2014.”

“Why weren’t they reported?” Marsh said.

“For Vancouver realtors to only file seven reports to Fintrac since 2012, that is suspicious,” said Ross Kay, a former realtor who now is a real estate consultant in Ontario.

Just Jack – those were interesting statistics comparing Oakland (neighbourhood that allows in-law suites) prices to Broadmead (neighbourhood that does not allow in-law suites) prices over time. My cursory glance of those figures tells me that it looks like on a % basis Oakland did better than Broadmead over the long run?

Of course, maybe it isn’t because of the presence/absence of suites but because each neighbourhood represents a very different type of market. That is, an Oakland potential buyer would not be looking at Broadmead houses when shopping for a house or vice versa. Just on price alone, Broadmead and Oakland seem to be very different neighbourhoods.

As such, maybe the difference is not because of suites but because one area has average/below average priced homes and the other has above average priced homes?

Maybe the better comparison would be Gordon Head vs. Broadmead or Rockland vs. Broadmead? I think those neighbourhoods are closer in price range and market type. I am not including the Oak Bay neighbourhoods as I don’t know what their policy is on suites. I’m pretty sure that Gordon Head (Saanich) and Rockland (Victoria) allow suites but Broadmead (Saanich) does not.

What would these comparisons give us?

This could be of practical value as potential buyers might wish to know which neighbourhood within the same market gives better price appreciation over time.

Thank you.

The Art world is a major source of money laundering too. One way that a few European countries have done to lower the level of money laundering is to have purchases over $135,000 done by credit card. That leaves a paper trail. Money launders don’t like paper trails.

In real estate that would mean the end of cash transactions from numbered Bahama accounts. The buyer of the property would have to be identified with the transaction processed through a third party such as the Bank of China. Law firms would have to comply with this requirement or face penalties that may include expulsion from the Law Society. It should be no problem if you’re legitimate. Big problems if you’re a Red Army captain laundering 3.5 million dollars in a condo in Vancouver. Beijing may want to have a word with you when you get back.

There is little doubt that real estate has changed dramatically over the last several decades. It isn’t a level and fair playing field for the buyer. From 24 hour clauses to no subject offers today’s buyers have little protection.

That’s why we need a mandatory 10 day cooling off period in all real estate transactions. That gives the purchaser ten days for them and those that need to process the mortgage enough time to do their due diligence.

The purchaser has the right to cancel the purchase within 10 days of receiving the signed purchase agreement without penalty.

The Canadian and Chinese governments have signed the agreement to split the gains of money laundering. Canada gets 20% and China gets 80%.

Things have just gotten…

https://youtu.be/krD4hdGvGHM

“…many people have become “fixated” on concerns about high household debts, but the borrowing is more than offset by balanced asset growth.

“Canadian balance sheets are in very good shape – even better than prior to the financial crisis,”

The thing is, if asset prices collapse, the debt will not.

Is this the soon-to-be-seen headlines in Vancouver and Victoria ? If 70% own and the rest can’t afford or are avoiding the inevitable, then whose left ? You can’t keep trading houses to each other forever. Ignorance is bliss.

“We’ve Run Out Of Buyers” – Half Of Homes In New York Are Now Losing Value

“A steady rise in U.S. home prices since the bottom of the market combined with weak income growth has made housing less affordable, especially in big cities. Credit remains tight and demand is now being driven primarily by buyers dependent on mortgages, as foreign buyers and investors pull back from the market. ”

“What happens in any bull asset bubble such as what we’ve seen is you run out of buyers,” said Chris Whalen, senior managing director at Kroll Bond Rating Agency Inc. and an advisor to Weiss. “It’s hard to get deals done if the bottom third can’t get a mortgage.”

http://www.zerohedge.com/news/2015-09-04/weve-run-out-buyers-half-homes-new-york-are-now-losing-value

Denying the debt elephant in the room is based on ignorance and/or ulterior motives. If your in the lending business as you seem to be Michael it would make sense to keep sucking in the few remaining sheep.

As I posted before, the debt bomb is already hitting seniors and is not some statistical assumption, people are getting inevitable medical situations that cut off their incomes and suck their savings dry extremely fast. The fuse is lit.

“Judy Southon never imagined it would come to this. She and her husband Vic had good jobs, raised a son and were homeowners. But after a run of bad luck, the 67-year-old wound up deep in debt and had to declare bankruptcy.”

“The stress of the financial burden plus the stress of caregiving was huge,” she says.

Victoria isn’t a perfect little world where everyone is rolling in dollars when they own a house or condo. Shit happens.

http://www.cbc.ca/news/business/seniors-going-bankrupt-in-soaring-numbers-1.3129176

“I felt a great disturbance in the Force…”

https://youtu.be/EKu7TYWNxqA

Ka-ching, ka-ching, ka-ching!…

—-

Average wealth hits $589,511 as assets grow, borrowing slows

G&M, Aug 25, 2015

“…many people have become “fixated” on concerns about high household debts, but the borrowing is more than offset by balanced asset growth.

“Canadian balance sheets are in very good shape – even better than prior to the financial crisis,”

—-

Join us on the dark side young skyHawker, and together we can rule the galaxy 😉

Tick, tick, tick….

http://static5.businessinsider.com/image/54aea0136da8118f2ae2093d-986-726/screen%20shot%202015-01-08%20at%2010.14.22%20am.png

That’s a good point David (and Leo above^) and thanks for the nomination.

“Maybe there is a simpler explanation … there is no obvious connection between housing prices and mortgage rates because it is demand that influences housing prices.”

Great point David. The “demand” is caused by cheap/free money that has never existed in our generation until the last 10 years. Before Michael was in diapers, many of us who grew up in the 60’s to 80’s/90’s know that easy credit was a rarity without a lot of cash behind you. HELOC’s were non-existent until the mid 90’s (and only to those with major equity), and credit card applications never arrived in the mail every day because they found out you had a minimum wage job like they do today.

When the market eventually heads south it will be much worse than the last blip as you never had so much debt racked up in past housing booms. This is where Michael is totally missing the boat with his cherry picked designer charts. Household debt is a time bomb waiting to explode.

The Mexican border wall makes a bit more sense than Scot Walker`s proposal for a wall along the Canadian border, unless there`s a flood of Mexicans into the US from Canada that I was not aware of.

Two presidential attempts, that`s not uncommon, from Nixon to Hillary.

Three wives. Well in today`s climate, it would be better if at least one of them had been a man, I suppose, but Reagan had two wives, so three is surely acceptable now.

As for the bankruptcies, well that was just being `smart`!

But, yeah I didn`t say we`d see a Trump presidency, although it`s possible, I was predicting only the emergence of Trumponomics, which would be just the thing under a different name to get Joe Biden`s campaign off to a flying a start when they take Hillary into custody..

From your annotated chart, it looks like since 1990 (the past 25 years) that at least half the time that when rates have dropped, that prices have increased or at least stayed flat. Saying that: “every time rates rise, prices rise”, when at best – there is a 50% correlation, is like saying: “every time I flip a coin, it’s heads up”.

Maybe there is a simpler explanation … there is no obvious connection between housing prices and mortgage rates because it is demand that influences housing prices.

BTW Michael, I nominate you for the chief chart annotator position.

All I’m really trying to do Leo is help liberate some of the myth…that if rates rise, prices must always fall.

OK I am on board with that. Rates rising means the economy is doing well (also why I don’t think there’s a chance in hell that rates will rise anytime soon) so people have jobs and buy. The increase in affordability from dropping rates is also a strong factor in getting people to buy. Overall if rates creep back up over the next decade or two it will put a drag on home appreciation performance.

I gotta give credit to @Leo S for collating all the original data (a huge task)! I’ve just been updating it and figuring out new ways to interpret things.

Again, I’m only trying to shed some light on the belief that when rates rise prices must fall. So I pose this quick question to fellow bloggers out there using your Victoria chart (I whited out the real price line so it’s easier to see nominal, hope you don’t mind David)…

Do you see periods where prices and mtg rates rise together?

http://i.cubeupload.com/3XbLeG.png

…or pretty much every time since 1960 that rates rise, prices rise.

Nice! Great chart David. I nominate you chief chartist.

It‘s nice to see data all the way back to 1960. As you know I believe we share most in common to ~’87 (second choice ~1950ish) but I guess we’ll know soon enough as price will tell the story.

Sorry, I meant easier to see with monthly data which is why I use Van… or somewhat smaller intervals than annual averages. I’m not denying the differences of Van, but they typically lead us by about a year. They bottomed ’12, we bottomed ’13. I’ve heard Calgary/Edmonton work the same, with Edmonton being the govt town, so it usually feels the shifts from the economic heart with a lag.

I thought I would look at a neighborhood that does not allow basements suites versus the one where it seems suites have become mandatory for home ownership

Broadmead

Year Sale Price, Median

2006 $678,500

2007 $727,500

2008 $770,000

2009 $727,500

2010 $720,000

2011 $740,000

2012 $742,500

2013 $695,000

2014 $702,850

Fernwood/Oaklands

Year Sale Price, Median

2006 $386,000

2007 $435,000

2008 $450,000

2009 $460,000

2010 $508,000

2011 $492,500

2012 $465,000

2013 $483,000

2014 $523,700

To me, Broadmead seems to be the more stable market. When you have a lot of money invested stability is a good thing. I suspect that during the next housing recession Broadmead will weather the storm better than Fernwood/Oaklands. I suppose it’s understandable that when you are relying on a stranger keeping their job to make your mortgage payment that would effect prices in a downturn in those hoods dominated with suites.

Yup, agreed that we cannot predict the future. Also agreed that the the West has become stagnated (and unsustainable). The US would likely benefit from an economically protectionist stance, but with Donald Trump at the helm?!

One wall along the border

Two presidential attempts

Three wives

Four bankruptcies

– – –

I feel like this is Sesame Street!

The US Federal Reserve has the option to raise rates on September 17th, October 28th or December 16th.

Pop Quiz Cheat Sheet (my predictions)

The Fed will make the first of a series of small rate increases on October 28th. By December, the 5-year mortgage rate in Canada will climb 0.25%. The BOC will increasing the variable rate by 0.25% during the first quarter of 2016. These small interest rate changes will not affect Victoria housing prices.

Other factors, such as an increase in available listings or perceived economic stability (stock market, etc.) will have a greater effect. Also, the housing market seems to be showing fragmentation with the cost too high for entry-level ($400 to $500K) homes while sales in the the mid range ($600 to $800) are going strong. If the low end houses don’t sell, eventually the mid range will slide down. It seems to me that this is already happening in some neighbourhoods (like Broadmead) where “mortgage helper” suites are not permitted.

Interesting article, but it leaves out some significant economic factors. Back in the 1980’s, people typically had much less consumer debt (credits cards, car loans, HELOCS, etc.) than now. The ability to pay a monthly mortgage is not just based on income, price and interest rates – it’s based on the entire dept load of the mortgage holder.

http://3.bp.blogspot.com/-Wx8kJs2lIGI/T4Wf2WgwB5I/AAAAAAAADQ0/psnUjKmyuR8/s1600/Ratio+of+household+debt+to+income+bank+of+canada.jpg

http://i.huffpost.com/gen/2469452/thumbs/o-CONSUMER-DEBT-570.jpg

@Michael

I knew that you would like that suggestion ;-),

Consider that there is another pattern in Victoria real estate where every 16 years there is a great buying opportunity, with low prices and low mortgage rates = low monthly mortgage payment. This has been witnessed in 1986 and 2002. This would suggest that the next great buying opportunity is in 2018. However, if prices will recover to 2008 levels in 2018 (peak to recovery) – these two patterns will be in conflict. They both can’t be right!

Although historical analysis can be an interesting distraction – I don’t think that there is any virtue in predicting the future based on historical patterns. We are at the mercy of economic factors far beyond our control …

@Michael

I’ve updated the original post to include the “definitive” chart of the Greater Victoria Average SFH Prices and 5-Year Mortgage Rate from 1960 through 2014 … Enjoy!

BC the full-time jobs winner again in Aug. at 16,900.

Alberta only had a 8,200 gain. Quebec lost 4,600 full-time.

Pop quiz – If the Fed raises rates this month signalling US (& thereby BC) economic strength, are house prices going to go up or down? 😉 Just having some fun, sheesh.

Uh … That’s exactly what I did with the chart in my original post. It also includes the inflation adjusted (2015) prices. I know that you are fond of using Vancouver prices and charts, but as others have mentioned – prices trends across “the pond” are often quite different – such as now.

Van fell ’10-’12 too like Vic, but I agree the US sunbelt competition for second homes hurt Vic more and for longer.

All I’m really trying to do Leo is help liberate some of the myth…that if rates rise, prices must always fall. If you study it, the odds actually favour the opposite. For instance if you search, there are other people who have done some digging on the relationship.

——

“Over the past thirty years, increases in Canadian mortgage rates have not tended to trigger a decrease in houses prices. In fact, more often than not the reverse is true. Before I get into the numbers, let me start by citing my sources. I took the average five-year residential mortgage lending rate (from Statistics Canada) and compared it to the average selling price of a Canadian home (provided in a report by the Canadian Real Estate Association), on a month-by-month basis from January, 1980, up to June, 2010. I used the five-year fixed-mortgage rate because it is by far the most common term chosen by Canadians, and I went back to 1980 because that was as far back as the CREA stats went. The only tweak I made to the data was to compare interest rate changes to house prices two months hence, because I reasoned that higher rates would immediately impact offers to purchase, which take about two months to become transactions. Here is what I found:

Over this period, totaling 365 months, there were 156 instances where the five-year residential mortgage rate increased over the prior month, and in 97 of these cases,

house prices increased two months later. That means that 62% of the time, increasing mortgage rates corresponded with higher pricing.”

Or take Robert Shiller who at very least has studied it enough to state there’s no noticeable correlation.

I don’t think charts reveal the future of RE any more than they do of the stock market. If there is any chance of assessing future economic developments it must arise from an understanding of technological, social and geopolitical developments and their impact on domestic political and economic processes.

If you look at the economic history of the world over the last two decades you see that the West has almost stagnated, while becoming dependent for what little economic growth it has achieved on population growth through immigration, the FIRE economy (finance, real estate and insurance) plus social media, retailing cheap Chinese stuff, and healthcare for an aging population. At the same time we have embarked on a struggle for global domination with countries such as China, Indonesia, India, Brazil, etc. all of which have fast growing industrial economies and increasingly well armed military establishments, plus Russia, the only country able to reduce the United States (and Canada) to radioactive ash.

I don’t see this as sustainable, which suggests to me that it won’t be sustained, but that instead the West will adopt something like Donald Trump’s economic program to rev up the American (and other Western economies) through a revival of manufacturing, abandonment of PC crap in education, controls on immigration, especially in the STEM sector so as to reward and encourage more smart young people in the West to study hard subjects as a basis for a career in science and technology, not as training for a career with Star Bucks.

If that is correct, we will certainly see a sharp rise in industrial investment, rising labor demand, rising wages, rising inflation and rising interest rates, which could drive RE prices back (in real terms) to where they were decades ago.

Keep in mind the Bank of Canada started a rate rising cycle in late ’01 right when prices started to jump.

5 year fixed didn’t move right from your chart. It bounced around the same level and didn’t actually increase until right before the end of the bull run (06/07)

The Toronto crash in the early 90s is very important for understanding the only anomaly in that chart.

That chart is nothing but anomalies. What about the period before where prices were shooting up and rates dropping?

Look back at my Vic/Van price chart and you can see they are very correlated in price direction

So how do you explain prices since 2008? Vancouver has skyrocketed while Victoria has done a whole lot of nothing.

What you’re doing is a great example of cherry picking. You have a theory and are mashing the data to fit, pointing out the parts where it agrees with your theory and ignoring the rest or trying to explain it away.

Keep in mind the Bank of Canada started a rate rising cycle in late ’01 right when prices started to jump.

The Toronto crash in the early 90s is very important for understanding the only anomaly in that chart.

Look back at my Vic/Van price chart and you can see they are very correlated in price direction (not so much in magnitude). The only difference is Van usually leads Vic by about a year.

You have to read my title again, I never said “rising rates correlate with rising prices”. You can clearly see that prices also start to curl upwards while rates are still falling.

And I’d be careful in your thinking “falling rates for 30 years and rising prices for the same period” as the opposite was true from the 1940s to 1981 which witnessed 30 some years of rising rates and rising prices (the period we’re now entering).

The Globe looked at this @ the end of June:

http://www.theglobeandmail.com/globe-investor/personal-finance/mortgages/comparing-canadas-housing-market-with-the-high-rates-of-1981/article25169755/

Draw your own conclusions.

The period 2000-2007 is a good example of flat rates and huge rise in prices which you’ve somehow highlighted as an example fitting your theory even though it doesn’t.

And then explaining away the early nineties as “due to the Toronto crash” just shows that the theory has no weight. Vancouver and Victoria have been totally uncorrelated in the past 8 years, so it makes no sense for the market across the country to steer ours.

You keep posting this and saying that rising rates correlate with rising prices, and yet the chart shows nothing of the sort. Sometimes prices rise with rising rates, sometimes they rise with falling rates and vice versa. There is no clear correlation in any direction aside from the global trend of falling rates for 30 years and rising prices for the same period.

“Does this suggest prices will climb to similar levels by 2018 (10 years) with another peak in 2021 (13 years)?”

Interesting. Not a bad guess. My guess is somewhere around there… maybe as far as 2023 for the next peak.

The relationship is easier to see when you overlay prices with mortgage rates.

http://i.cubeupload.com/1SuaLa.png