Will traffic improvements affect prices?

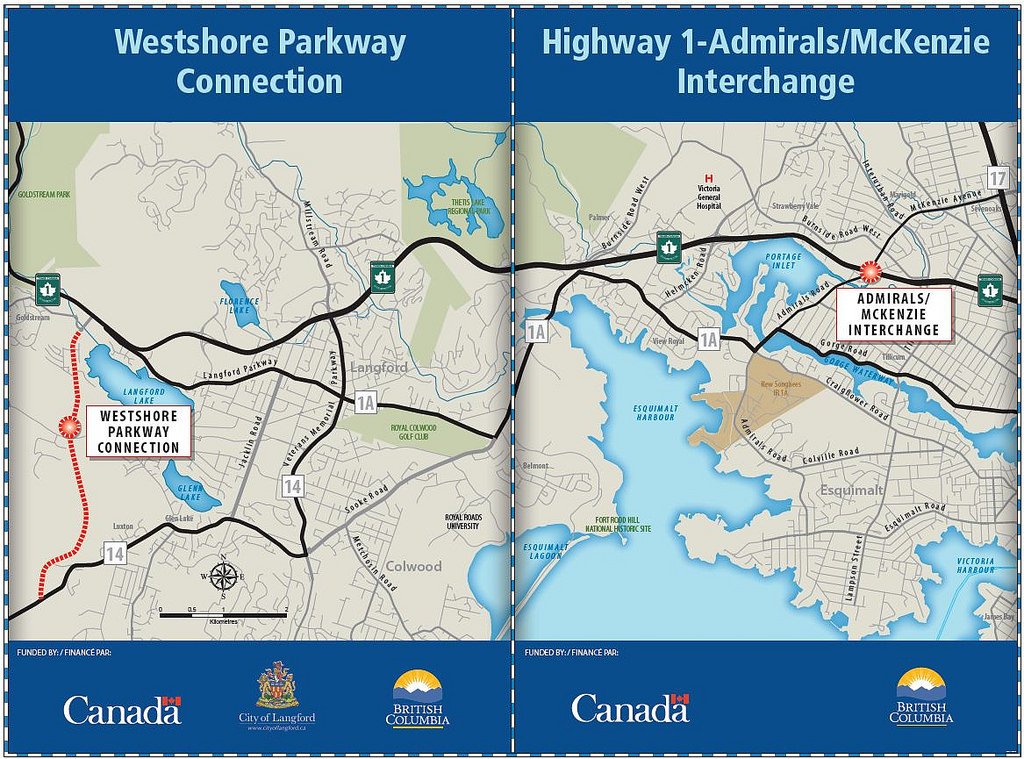

With all the recent discussion in the previous topic about traffic and commuting woes, I thought that it might be worth dedicating a blog post to the recently announced $85-million interchange at the congested McKenzie Avenue and Trans-Canada Highway intersection and the related $7.4 million to the extension of the Westshore Parkway. Here are the locations of the proposed improvements:

Construction is expected to start in late 2016, taking up to 3 years to be completed. It’s obviously going to cause some headaches while being built (particularly McKenzie @ Hwy #1) but should alleviate some of the delays commuting to/from Victoria from Langford or Sooke. Realizing that this is not the only solution to some of Victoria’s traffic and commuting problems, the question is: will these highway/parkway improvements affect property prices? I considered adding a poll to this blog post, but I think that it would oversimplify a rather complex issue. With faster commute times, could newer homes in the western communities become more attractive, raising prices? Would the current premium pricing (and sales demand) for housing in the “core municipalities” decrease, making these homes less expensive? What are your thoughts …

Construction is expected to start in late 2016, taking up to 3 years to be completed. It’s obviously going to cause some headaches while being built (particularly McKenzie @ Hwy #1) but should alleviate some of the delays commuting to/from Victoria from Langford or Sooke. Realizing that this is not the only solution to some of Victoria’s traffic and commuting problems, the question is: will these highway/parkway improvements affect property prices? I considered adding a poll to this blog post, but I think that it would oversimplify a rather complex issue. With faster commute times, could newer homes in the western communities become more attractive, raising prices? Would the current premium pricing (and sales demand) for housing in the “core municipalities” decrease, making these homes less expensive? What are your thoughts …

Fundamentally I’m not arguing that TFSA is often better if you are going for retirement at 65. Although even in that situation the RRSP isn’t so bad as that calculator suggests. You will almost certainly lose the GST and other benefits anyway if you will have a halfway decent income, so it’s not like it will be the RRSP that kills your benefits. You won’t retire solely on your TFSA.

If you really want to do it the other way then that works too. Contribute $10,000 of post tax dollars. Receive a $2970 refund and deposit it in your RRSP. Now you have $12970 in your RRSP and $10,000 in your TFSA. It doesn’t change the math.

You are talking about 10,000 invested in an RRSP vs the equivalent of that not including the refund into a TFSA.

I think you need to hire a financial advisor to walk through this with you because clearly the math isn’t working for you.

The $10,000 is PRE TAX. The calculator is correct. If you contribute $10,000 into your RRSP you get $2970 in tax back. So now you have $10,000 in your RRSP. If you want to contribute that same $10,000 into your TFSA, you first have to pay $2970 in tax. Check it out yourself with a different calculator if you must. https://simpletax.ca/calculator

It’s that simple, your image is wrong.

Sure they are – Bernstein and Malkiel are both referenced but that link is only a summary link I use to quickly make my point – over the long term, stock market returns are very stable. If you diversify your portfolio correctly & understand your strategy, it doesn’t matter if the market is overvalued “today”. You shouldn’t sell because the stock market always goes up over the long term but a disproportionately large amount of the stock market’s volatility is concentrated on a relatively small number of days and it is impossible to forecast which days they will be.

I have seen many similar analyses that prove this out but here’s a recent one by JP Morgan. If you missed only 10 of the best days over the most recent 20 year period to 31Dec14, (0.1% of almost 7300 days), you would reduce your overall return by almost 4%. After missing the 40 best days over the same period, returns were reduced to nothing. Things only get worse factoring in unnecessary transaction costs.

http://www.businessinsider.com/cost-of-missing-10-best-days-in-sp-500-2015-3

If you invest continuously in a diversified manner over a long enough period & keep costs minimal, you will come out ahead of every trading strategy except those that are buoyed by improbable luck. People win the lottery too, it doesn’t mean you should plan to…although:

http://www.cbc.ca/news/business/lottery-win-is-retirement-plan-for-34-of-poll-respondents-1.2517046

The forces I mentioned earlier & the effects of compounding will reliably yield 9-10% per year after inflation over a 30 year period reliably and with minimal risk. This is a figure that 90% of fund managers (and 99% of do it yourselfers) cannot and will not beat over the same period. My question for you is why would anyone bother paying someone for lower returns or waste their lives worrying about it?

Buy, hold & prosper!

Those guys are not in the link you provided. BTW, the Buffet indicator chart shows the market is still way over valued. Yes, Buffett does indeed use charts.

Thanks for actually looking Totoro. It took me 20 minutes to mess around with that! Note I used your identicals as best I could. Withdrawal before 60 and a greatly reduced income (40% buying power) 🙂

So I ran the calculator twice to get the real comparison and made a screen capture to show the inputs and the results. I then composited them in Photoshop to try to make it simple to see. I guess I failed…

It’s very basic. You are talking about 10,000 invested in an RRSP vs the equivalent of that not including the refund into a TFSA. In order for your investment to add up to $10,000 you need to invest $7,710 into your RRSP to get a refund of $2,290. Therefore to compare apples to apple you must use $7,710 as your TFSA investment not their number that is a negative percentage of $10,000.

I explain it on the top of the screenshot… open your mind…

Dasmo is right for Dasmo-identicals, but not for Leos or Totoros. The math is eye-opening though.

I really have no idea what you were trying to illustrate with that screenshot or what you even changed. My proof was better, the calculator has limitations.

Oh- and as far as experts are concerned, my views are also Warenn buffets, John Bogles, Burton Malkiels, William Bernsteins, Jeremy Siegels and Ben Graham’s. Pretty sure they’ve been around for a while and done a few things. (And made a little bit of dough in the process)

“Sorry nan, charts, fundamentals, and timing is what makes people big money in equities, not buy and mold.”

Not only do none of these things matter over the long term, their existence fools people into thinking the matter over the short term. Any success you have using anything other than fundamentals is pure luck and even that is a stretch in today’s trading environment. Fact.

A risk balanced diversified portfolio of low cost etfs will out perform 90% of managed funds over 30+years after costs. This is also fact.

It is also impossible to know who to 10% who will beat the indices over 30 years will be before the 30 years has come to pass. This is also fact.

If you can’t tell, I like facts when constructing an investing strategy. The invesment industry hates it when people do that because they are denied the opportunity to defraud the public with outrageous fees for doing nothing.

With your attitude, I would suspect you probably work in the investment industry and probably need to read the quote in my earlier post again.

in short, the market return is the market return no matter who owns it or how many times it is traded. The key to success is to simply buy and hold low cost index funds and etfs in a manner consistent with your risk tolerance and you will accumulate wealth with certainty and retire eventually.

If you do work in the investment industry, I honestly feel sorry for the impressionable investors that cross your path and buy into your “buy and mold” axiom- so that we are perfectly clear, you are misleading them for your own benefit. Fact.

So tell me then my dear bearish friend, is the time near?

http://i.cubeupload.com/BrCRat.png

“Volatility, HFT, rally, bounces = finance guy water cooler chart talk. In other words, bull$hit. It has been proven thousands of times that stock charts have no predictive ability.”

Sorry nan, charts, fundamentals, and timing is what makes people big money in equities, not buy and mold.

Tell me this oil chart should have be totally ignored. It cost investors like yourself massive money to ignore this chart and just “ride it out for the long term”.

http://stockcharts.com/h-sc/ui?s=$WTIC

I also like to follow real experts with credentials who have been around much longer than 2006, and that’s no bull$hit.

I think a little more explanation might help, Half of the 192 homes sold between $380,000 for a two-bedroom starter house and $658,000 for a larger than typical house of some 3,200 square feet in Saanich East.

The remaining 96 sales cover a price range between $658,000 and $7,288,000.

That the average is considerably more than the median suggests that the data is skewed to the high end by several big prices.

That’s quite a large spread over so few sales. Personally, I would say the sample size is too small resulting in a larger than typical error. When they say the data is accurate within 10 percent 19 times out of 20. This would be the one out of 20.

When folks get older, many are willing to pair spending to guarantee principle<

But when the real return on “safe” investments is less than nothing, principle is not guaranteed. This is not a trivial issue in the case of, say, a widow of 65 who may live another 30 years or more.

In theory I agree but this would need to be managed on a case by case basis. When folks get older, many are willing to pair spending to guarantee principle. In many circumstances, being old often equates to being more “afraid” of risk (on top of being less able to handle it)

Seems likely that changing home sales would skew the average only.

On the other hand 15% up seems quite high. Is that what you are observing Marko – are prices potentially up 15% over last year in the core?

I think it can swing either way. For someone with no interest in real estate or having a suite in their home stocks are a lot better and starting young is easier as you don’t have to qualify for a mortgage and you can start small.

I would argue you have more control over income generation with real estate. You can fix it up, suite it, rent it out, live in it, have room-mates. You can learn markets really well fairly easily.

If you are starting from nothing and have a good job and would otherwise pay rent and can save a down payment I think that leverage works in your favour with buying a home in many markets (maybe not Victoria). The rent vs.buy calculator demonstrates this well.

If you have a lot of cash to invest stocks would have better payback than putting the money in a house. I don’t think appreciation will match the market returns even after factoring in the rent you would have to pay.

And then there is the timing factor for both.

Looking back I don’t think $40,000 invested 20 years ago in an average Saanich West home with a suite worth $267,323 in 1995 would not give you a greater return than the $269,100.00 your $40,000 invested in the market would be worth today presuming a 10% rate of return compounded and no taxation of the income because it was in a RRSP. If it is a taxable account we’d have to adjust the returns.

Assuming the suite income pays for all costs of home ownership while you live there except the mortgage, and you would have had to pay rent anyway cancelling the mortgage cost out if you average rent over the 20 years, your mortgage would be at $125,541.56 and assuming an average 5.5% interest rate on your mortgage over time and the home would be worth at least $560,000 today. This puts you ahead $435,541.56 tax exempt assuming your suite is less than 50% of the floor space.

You will have some transaction costs when you sell, but you also have the option of refinancing and having the suite income pay your housing costs and investing what you would have to pay for rent in the market.

Even if we look at a rental property with a suite purchased 20 years ago you are coming out ahead after paying capital gains tax on the sale. Although stocks are less maintenance and time than owning a house.

Hawk. An investment in equities is an investment in the desire for humanity to make the world a better place.

Humans inventing better things over time is absolute certainty – this creates wealth.

Governments creating inflation in a fiat economy is also an absolute certainty. The ability of those that control the implements of production & intellectual property (i.e. the inventions) to charge more in times of inflation preserves wealth.

The forces of invention and inflation are as immutable as your desire to use a tv remote instead of getting up to change the channel every 2 minutes or the desire of politicians to promise more than they can pay for. An investment in equity over the long term is an investment in the certainty of those two things.

Volatility, HFT, rally, bounces = finance guy water cooler chart talk. In other words, bull$hit. It has been proven thousands of times that stock charts have no predictive ability. Look at the link I sent with the last post – there will always be volatility over the short term. Over the long term (30 years+), there is virtually none.

The best investors I know of all subscribe to my philosophy. Invest based on risk tolerance for the long term, keep costs down, hold your course when things bet bumpy.

But I guess you’re “experts” know better. Upton Sinclair said once that “it is difficult for a man to understand something when his salary depends on him not understanding it”. I would encourage you to think about this quote next time your experts speak up. I think you might be surprised.

OK, on topic… I think traffic improvements will affect prices…in the core. These improvements will have little affect on commute times but will make it a lot easier to get out of town on the weekend and get an SUV load from Costco…. Combine this with the new bridge and cycling infrastructure and the core is going up… Growing horns….

I guess my irrefutable proof that the TFSA beats RRSP has silenced that debate once and for all!

August is shaping up to be a nasty month for home buyers.

Projections for houses in the core this month

Sales 192 which is about the same as for last year at 191

Average price $812,000 up from $658,000 last year (23% YoY)

Median price of $655,000 up from $569,000 last year (YoY 15%)

Days on Market 22 down from 45 last year

New listings 237 up from 222 last year

And the median Sales/Assessment ratio at 111.11 up from 102.85 last year (8% YoY)

I suspect the increase in the median and average is because almost twice as many million plus homes have sold this August as the same time last year. At the same time the volume of sales in the $400,000 to $600,000 range has dropped off substantially.

After the housing crash!

Agreed on everything except the “safe stuff” on retirement. To sustain a reasonable withdrawal rate in today’s environment you need a high equity allocation also in retirement.

When do we get to fight the zombies?

Disagree Nan. Investing today in markets controlled by high frequency traders is a whole new ball game. Yesterday was a day that every seasoned veteran market expert I follow said they had never seen as the volatility was off the charts. Saying come back in 20-30 years and all will be fine is not sound advice.

Looks like the bounce is weak. Not to say it can’t rally but volatility like this will scare away many an investor. Stats show more than half the people never came back to invest after the last crash.

The world isn’t coming to an end Dasmo, but it’s going to be in for a rough ride if China keeps tanking like it seems to look to be. Global credit squeezes will effect even little ole Victoria eventually.

Agree….

You guys and girls are all so funny when it comes to investing. A market crash is meaningless unless you are retiring in less that 10 years and even then by that point you should have most of your stuff in bonds & other safe stuff so that a crash doesn’t kill you.

Scroll to the bottom of this:

http://www.getrichslowly.org/blog/2008/12/16/how-much-does-the-stock-market-actually-return/

Just look at how consistent stock market returns become over a 30 year period.

A diversified portfolio will always outperform residential real estate over every time scale except relatively short ones (less than 10 years) where stock market performance is mediocre and leverage allows the real estate owner to accelerate gains.

A 1,500 point /10% percent fluctuation over the last few days on the Dow is meaningless – in 30 years the index will be at 200,000 (10-12x what it is today)

Buy stocks and get rich, guaranteed as long as you start early enough. Buy real estate, maybe you will get rich if you do it right. Maybe you won’t.

Safe to say the end is near…

so I just showed with numbers how the RRSP is ahead in the scenario you picked and you still don’t like it. Fine I think we’ve beaten it to death.

Come back in a few months. It doesn’t happen in one shot, it takes months to play out like 2008. It’s a massive credit unwinding which takes time. Let’s get serious, free money never lasts forever. This past week was the warning shot.

Wrong again. Apple is up almost 7% premarket. index futures are all up around 4%….

ummm… I think they will leave it alone in sept…

DavidL, Can you delete the mistaken posts above please oh master of the new HHV blog….

OK. Back off topic…

Here you go guys. A public service from Dasmo. I used Leo’s calculator but fan dangled it to show the true calculation of TFSA VS RRSP….

http://i.imgur.com/vzWjEMl.jpg

Of course it works that way. It is comparing a single year deposit. One must assume you will have an income when retired… For you it will be taxable because it will be coming from your same RRSP. Me not so much…

Yep, she’s got 248 posts on Garth’s site. I guess that she didn’t transition well from the old HHV to the new HHV.

I enjoy Garth’s writing style and he makes some good points … but about 5 years ago I talked with him in person after a presentation he made at the Victoria Conference Centre. I asked some tough questions about pros/cons of home ownership. He was evasive and didn’t answer my questions. Maybe he should return to politics?

It looks like the market woes for China did not end on Tuesday …

The Shanghai Composite Index fell 6.4 per cent in the first minutes of trading but later trimmed some of those losses and was down 5.5 per cent at 3,035.83

http://www.cbc.ca/news/business/chinese-stocks-tumble-again-as-other-asian-markets-rebound-1.3202593

Amazingly, the three-day rout has erased nearly $3 trillion in value from stocks globally. Related to housing …

In particular, there is a growing debate among market participants about whether the Federal Reserve will still follow through with plans to push interest rates higher, an action that was expected to begin in September. The market turmoil has led some, including Lawrence H. Summers, a former chief economic adviser to President Obama, to call for the central bank to reconsider those plans.

http://www.nytimes.com/2015/08/25/business/dealbook/daily-stock-market-activity.html

Dirty foreigner.

Why can’t you vote, Leo?

No solid gold bathtubs, I think, but quite large, just over 4000 feet plus 1000 or so subterranean (media room, or whatever) plus triple car garage. The previous sale price was $861K so they paid just under $900k for the lot after tearing down the pre-existent building. So the price for the construction (and landscaping, mostly grass) must be around $275 per square foot.

Isn’t that about right for new construction with cedar siding, steel roof and seven bathrooms (hope they have a maid to do the cleaning) ? But if it is, it suggests that one may get a good deal more for one’s money with a pre-owned home than a new one.

Well if you just bought 3 cheap index funds and didn’t sell them you would have gotten 9.79% average over the last 5 years, 6.56% over the last 10 years, and 7.75% over the last 20 years (http://canadiancouchpotato.com/wp-content/uploads/2015/01/CCP-Model-Portfolios-Vanguard.pdf)

So with zero effort you would have had between 6.5% and 9.8% return depending on what period you want to examine. 9% with some more work and insight isn’t really that whacky of a number.

You know who is welcome? INFO. She is happily doom and glooming over there to her heart’s content under the official title of “Victoria real estate update”. The Victoria market is doing TERRIBLE if you didn’t already know, and there is no chance anything is going anywhere but down down down.

The RRSP + TFSA is insane that’s for sure. For someone earning $100k/year you would need to get higher than a 37% savings rate before you even have to touch a normal taxable account.

Can’t see that that is sustainable from a tax point of view.

> I’d like to point out that TFSAs are a huge cost to our federal government and this cost will only increase

And that’s why I’m voting conservative this fall! Oh wait what’s that green party sign doing on my lawn. Oh yeah and I can’t vote.

20 years accumulation. 75k income. 2% inflation, expect 70% buying power at retirement. 7% growth in the money.

$7,710 in TFSA = $27,517

$7,710 in RRSP = $20,974 (tax rate: 29.7%) no reduced benefits. Or reinvesting the $2290 into the RRSP so $10,000 in RRSP (also with no reduced benefits) is $27,086. So the TFSA is still ahead…

This is where the calculator is limited. It was just the first one I found and doesn’t allow the scenario I started with (contribute $75k into RRSPs and withdraw $75k in one year).

The problem is in the target income field. 70% of $75k is $52,500. The calculator assumes you have $52,500 of income and then you withdraw the amount from the RRSP. Of course this makes no sense as you would end up with $79,586 of income if you did that.

If your target is $52,500 of income then you need to figure out the source of that other income to make it add up.

In other words:

Desired Income = RRSP Withdrawal – Tax + Other Income

$52,500 = $38,697 – Tax + Other Income

The tax you would have to pay depends on the source of that other income. If it’s from your TFSA then you pay only $5,582 in taxes and your $10,000 RRSP investment grew to $33,115, which is well ahead of the TFSA.

If the Other income was taxable then you would owe $8697 in tax on the RRSP withdrawal, so you get $30,000 out of the RRSP, which is still ahead of the TFSA.

The lower your target percent of income is, the better you do with the RRSP, but even at 70% you are ahead.

How is the TSX holding up better than the Dow ? It’s like saying only 10 people got killed in the accident, not 12. There isn’t a bull anywhere to be found except on the load on the end of your shovel.

http://stockcharts.com/h-sc/ui?s=$TSX

Yep, oil’s bottoming alright, only down another 5.5 % to $38. Now the Albertans will never be able to move here. Dang !

http://stockcharts.com/h-sc/ui?s=$WTIC

I hope it has solid gold bathtubs. What a rip, not even waterfront. Market top is clearly in at that price.

Marko,

thankyou.

The market ass kicking today will only now wake people up to the true meaning of the word “risk”. If it can happen in stock markets it can happen in real estate just as easy. The pumperdoodles will be hung out to dry soon as this is all about a “credit crisis” that I have posted several times. Being naive to a credit crisis is about the worst thing you can do.

Watch out for the real estate auditors, they are banging the drums and the money laundering story is just the tip of the ice berg. I expect the BC real estate industry is soon to get their over due wake up call as the lawyers will be off scot free. I imagine Victoria will not be immune to the fall out.

http://www.theprovince.com/business/Federal+audit+takes+money+laundering+real+estate/11311753/story.html

Agreed. Back in the mid-1980s’ a $500,000 individual lifetime capital gains exception was introduced. It was whittled down to $100,000 before being repealed ten years later. Ultimately, the gains exceptions is only available to the disposition of small businesses shares, qualified farm and fishing property. I expect some future cash-strapped government to repeal or cap the TFSA.

I always like to look at both sides of a coin. 😉

If traffic in/out of the core municipalities were improved, I think that there would be less money to be had with flipping older run-down properties. Better quality homes for the same (or less) money would be available outside of the core. I see the prices on good quality homes in the core being affected by affordability factors (interest rates, economic malaise, etc.) rather than by traffic flow.

Wonder how Garth’s balance portfolios are doing. 9% return?

$2,266,000

I don’t seem to get any sales pitches with my self-directed RRSP. Yeah, sure … you go into your bank and they want to sell you mutual funds, GIC’s, etc. Twenty years ago, I didn’t know any better – but after the dotcom crash, I got wise and started managing my own finances.

You can retire early if you have a plan for income after you use up the RRSPs keeping in mind how much CPP you’ll be eligible for – which will be reduced if you retire early btw.

In order to do this you will need to plan to have other investments/savings, carefully calculate your pension entitlements, and likely have a paid-off home or plan to reduce your housing cost to zero.

We won’t have a paid-off home, but we will have rental income that brings our housing cost to zero and pays for about half our expenses.

It is better for us to put money in RRSPs rather than pay off the mortgage prior to stopping work so we maintain a good interest deduction on rental income during the time we withdraw the RRSPs to keep our taxable income low. Last thing you want is too much of the monthly rental income going to principal as the amount applied to principal less other expenses constitutes taxable income but you don’t have access to it until you sell or remortgage.

A rental property also appreciates on the entire leveraged amount and can be sold later to fund a TFSA/ investments, although the gains won’t be capital gains exempt.

Other ideas include anything that makes use of capital gains tax exemptions to create income for after the RRSPs are gone, such as selling an expensive primary residence and buying something cheaper, or selling a qualifying small business and investing the proceeds.

Corporate retained earnings can help fund this as well as you can withdraw them a bit at a time as needed and keep the personal tax rate low, although the tax treatment of investment within a corporation is generally not good.

Or, if you start early you can work until you have a paid off house and investments that give you enough to live on at a 4% withdrawal rate.

Quite a few people are able to save enough to retire in 7-10 years of a career with a working spouse, provided they also keep spending modest. In Victoria we have such high-cost housing that unless you have rental income or downsize it may be harder to meet this.

http://www.milliondollarjourney.com/

http://blog.canadian-dream-free-at-45.com/

http://rootofgood.com/

http://www.mrmoneymustache.com/2012/01/13/the-shockingly-simple-math-behind-early-retirement/

http://www.businessinsider.com/how-i-built-my-familys-net-worth-to-1-million-2015-8

http://www.frugalwoods.com/

Don’t worry, it will be balanced by the RRSP tax windfall…

On the effect of transportation improvements on prices in Western Communities and the core I’d guess the following:

1) No noticeable impact on core prices. The core premium is based on a bunch of factors only one of which is commuting time (and the commuting time differential is not going to change that much.

2) Increased development and marginally increased prices in the Western Communities relative to a base case of no transportation improvements. The effect will be fairly small because the change in travel time is not going to be that great. In addition the growth of the Western Communities will soon have things back to square one in transportation time despite the improvements. That’s not necessarily an argument against making the improvements just a recognition that “spare” commuting capacity tends to get used up quickly.

3) Some negative impact on the core by making it easier to counter commute to go big box shopping in Langwood and Colford. I’d expect this effect to be rather small and perhaps indistinguishable from other pressures on the core.

4) No doubt the projects will be used to hype buying/developing on the West Shore.

While some of us wish to argue the minutiae of TFSAs vs. RRSPs, I’d like to point out that TFSAs are a huge cost to our federal government and this cost will only increase. So go ahead and enjoy the hell out of those TFSAs, everyone, because the government—if it wishes to maintain or even expand current levels of service—will at some point have to raise that money somehow. There is no free lunch.

Marko, If you would let me know what 2760 Lincoln Road sold for, I’d be much obliged.

Thanks.

Federal funds have been committed under the New Building Canada Plan, so this is more than an election promise. Planning work based on the announcement is already being done.

With the TSX holding up better than Dow lately, it’s possible we start getting some rotation. This following outlook for the TSX might be too cheery for some 😉 but it’s a least a plausible path especially if oil is starting to bottom.

http://i.cubeupload.com/eJxHBv.png

Thanks, Marko. With solid sales and low amounts of new and active listings, the sales to new listings ratio has jumped to 79%. It looks like we’ll be at about 5 months of inventory at the end of next week – still in a sellers’ market.

“what does this mean…?”

I’m guessing another rout by November

Oh, I’ve had some falling knives too lately… I was just lucky to have cash to place orders over the weekend. I figured people would stew over the weekend and then panic first thing. It’s still going to be a touchy market at times for the rest of the year, but you got to like today so far. One thing that’s interesting, TSX holding up better than Dow this past week… hmm.

Since June, there has been a “correction” every three of four weeks – each with a bigger drop than the previous correction.

What does this mean for late-September and mid-October (which is historically a very volatile month)?

Wish I had cash this morning. Me thinks you will be happy with PayPal at $30…. Lots of potential for growth or being bought by one of the monsters…. Me I’m down 9% on it so far…

I’m just happy to see green…

Please enlighten me with some math! My figures above were using the calculator based on after tax dollars and reinvested refund. You are assuming you will be able to withdraw your entire RRSP before 60 at 9% tax. I truly want to see that plan because o will change my ways instantly!

I didn’t take away the benefit… So unreceptive….

Mon, Aug 24, 2015 9:00am:

Aug Aug

2015 2014

Net Unconditional Sales: 548 609

New Listings: 695 904

Active Listings: 3,707 4,316

Please Note

Left Column: stats for the entire month from this year

Right Column: stats for the entire month from last year

I’m not a very savvy investor. I invested just before things went down.

I checked my account and I picked up GE just above 20, Paypal at 30 and Celgene at 100. I missed TD by about 10 cents… I hate it when you miss that close!

I’m thinking that was it for the crash. They say the Dow was down 1100 first thing, now only 250.

Argh. I just invested some RRSPs. I think a crash would increase the perception of RE being a safer place to put your money. I think crashes are usually the ideal time to invest in the market though…

I’m hoping for a bigger crash to get peoples focus back to RE.

“What is the correlation with RE prices in Victoria?”

After the Oct ’87 crash, Victoria RE went up 2 and a half times between ’87 and ’94.

The similarities between then and now:

* ’86 oil crash on oversupply

* the loonie went from above par to 70 cent range

* boomer bulge was mid to late-20s, echo bulge now turning similar age

* prairie folk headed for BC

There are a bunch of similarities… can’t remember them all right now.

You seem fixated on one path here despite alternate information which shows some will retire early and can withdraw from a RRSP at a 9% or less tax rate (if, for example, you have kids in university, pay for it with RESP and use the tuition credits transferred and lower the tax further or remove more).

And some people will use the tax refund on the RRSP for re-investment and be in a much lower tax bracket in retirement than now. And they will have a TFSA as well to draw on for emergencies. They work well as emergency funds.

You are proceeding on the premise that a TFSA is always better than a RRSP – it is not – it depends on your current and future tax position and income needs as well as what else you are invested in.

A TFSA a good thing to have in addition to an RRSP for everyone who has enough extra cash to do this – which is not the case for most – and a TFSA may be better than RRSPs for you for sure.

You need to do the math but in my case an RRSP actually works better than a TFSA if I don’t have extra cash to do both – and the calculator above bears this out for me.

People retire early all the time. Some of them really young: https://au.pfinance.yahoo.com/money-manager/smart-saving/article/-/19576522/how-this-man-spent-3000-a-month-and-retired-at-30/

They live off investments, including RRSPs, TFSAs, rental income, retained earnings… and lower the amount withdrawn when pensions are received or when they rent out their house to travel (for example).

And you don’t need a million dollars invested if you have cash flow positive rental property and your home is paid off or rental income is bringing you to the same position.

If your home and vehicle are paid off and you are 50 it is quite possible you and your spouse could live off $40,000 a year in Victoria. There are many ways to plan for later on when the RRSPs are withdrawn, including having a pension.

If you have rental property that is mortgaged the net profits should rise over time as the mortgage gets paid down. You can reduce your RRSP withdrawals at this time, or sell the home and invest the capital to create more income. If you have a business you can invest your retained earnings in the corporation (and pay a lot of tax!) but have them to withdraw later – or sell the business later with the advantage of the capital gains tax exemption.

And you will not pay 30% tax on a $20,000 withdrawal, you’d be in the 9% tax bracket – or a tax bill of $1,810 on a $20,000 withdrawal. The additional withholding tax will be refunded.

This means you would have about $3000 a month net to live on. This is about what the median Victoria family has net after paying for mortgage costs now.

Could argue this both ways. Either people have less money to spend on a house or there is a flight to safety

LOL. Take away the benefit of the RRSP and the TFSA is better! Good discovery dasmo.

> you will also have 30% taken off the top when you do this early withdrawal

There is no penalty for early withdrawals from the RRSP. They withhold tax but you will get that back if the tax isn’t as high as the withholding.

You still don’t get it. You are investing the same amount into both accounts. In order to deposit into your TFSA you need to pay tax first. Simple as that.

I suspect the project is too small to be influenced by a change in government. The new govt will cancel the TFSA increase not cut infrastructure funding.

The new interchange won’t do anything for values, BUT the stock market sure will. For the astute or not astute, the markets are just starting in my opinion to take a huge plunge.

What is the correlation with RE prices in Victoria? Those rich onshore or offshore buyers? Are they going away? Less wealth from equity markets will mean less money to spend on that house.

Sitting on the sidelines and letting this playout might not be a bad strategy.

Since we actually work with after tax money (unless you are self employed like me) This is a true comparison using Leo’s calculator…

20 years accumulation. 75k income. 2% inflation, expect 70% buying power at retirement. 7% growth in the money.

$7,710 in TFSA = $27,517

$7,710 in RRSP = $20,974 (tax rate: 29.7%) no reduced benefits. Or reinvesting the $2290 into the RRSP so $10,000 in RRSP (also with no reduced benefits) is $27,086. So the TFSA is still ahead…

This only gets worse if you are forced to withdraw more. Pray you don’t get sick when you are retired…Or have the resolve not to support you kids… or have any unexpected expenses…All things that will require you either work or withdraw more and thus bumping up your tax bracket again…

How do you guys expect to withdraw your RRSP before your 60 without putting yourself in a higher tax bracket then? Your are going to need at least a million to retire on. More if you are retired by 55 and not having any income anymore. You will also have 30% taken off the top when you do this early withdrawal…

I don’t know. Lots of people operate on budgets and don’t spend more just because they have a tax refund – especially those who are older and closer to retirement. After tax dollars get counted in the calculations in my books.

I do agree TFSAs are way better in many ways and for many people, but not for someone in a high tax bracket who plans to retire prior to receiving government benefits on a much lower income. As Leo pointed out, these people can draw the RRSPs down prior to 60 without affecting benefits.

I’m not a big fan of the mandatory RRSP to RRIF conversion either and plan not to have RRSPs left to convert that will result in a requirement to withdraw any more than the $2000 federal pension tax credit per year.

I thought I miss used my “then”. Now that I read my awkward sentence, I see that I didn’t. I’ll just bank that grammatical apology then..

Sorry for what, Dasmo?

Sorry Introvert…

And let’s see a show of hands… Who here has faithfully reinvested their tax refunds? That’s right, I don’t see a single honest hand in the air….

Now you are talking conspiracy scenarios Leo. I am simply stating what is. I will give you this; if 40% more is saved in an RRSP then a TFSA one would have saved enough money in their RRSP cover their higher deferred tax bill. I’m skeptical not cynical by the way. You could use a dose. They beat it out of you in engineering school…

If I’m not mistaken, the federal portion of the funding for the McKenzie interchange is a campaign promise from the Conservatives. If the Conservatives don’t retain power, the project could well be delayed until someone explains to Tom Mulcair a) where Saanich is located, and b) why we really need an interchange.

No it’s not… Anyway I plug in the lowest income expectation at retirement and the TFSA still beats the RRSP…

You’ll notice the RRSP is actually way ahead after tax. The only reason the TFSA catches up in the end is because of reduced benefits. So you draw the RRSP down before the benefits kick in and you get the best of both worlds.

The Gov will defer tax collected now for the greater tax collected later.

Sure you can take the cynical view. Let’s assume the government created the RRSP as a big tax trap. Well that same government created the TFSA on the promise that you can withdraw money tax free. If you continue your cynical view then they only did that to lure you in. Later they will change their mind and start taxing withdrawals in the future. Or withhold CPP/OAS/GIS based on your TFSA balance.

Maybe. Seems like traffic engineers believe that it will shift the congestion to different spots, but not fix it. Something like a commuter light rail service could increase house values I think, but I don’t think there is the population density to support it for Colwood-Victoria.

“That calculator is confusing in that it assumes income to be in place before the RRSP so a higher tax rate applies to the RRSP withdrawal.” No it’s not… Anyway I plug in the lowest income expectation at retirement and the TFSA still beats the RRSP…

An RRSP is a creation by our government that you buy into. The Gov will defer tax collected now for the greater tax collected later. You are sold with tag lines like “your money grows tax free in your RRSP” totally false…

It’s a construct created and sold… as in you buy into it as you have…a product…

I don’t know of any local roadway improvements that have increased housing values.

If you accept that commute times influence prices in bedroom communities then it is obvious that reducing commute times also influences prices. Of course you wouldn’t know of any because you have no way to measure it, and the impact of any one project is small.

But obviously one bedroom community 30km from Victoria connected by a single lane road will have lower prices than another that has a massive highway. Everything else is just a matter of degree.

An RRSP is as much of a product as a TFSA. In other words, not at all.

DavidL asked whether prices in Victoria’s core would be negatively affected by the new interchange; I’m 99% certain they will not.

Yeah no way would it reduce prices in the core. But it very well could reduce the price premium by some small amount.

The RRSP is %100 a product that is sold… But you are suffering from post-purchase rationalization…

The RRSP is %100 a product that is sold… But you are suffering from Post-purchase rationalizatio…

It uses the classic trick to sell the RRSP. It’s comparing investing 10000 in an RRSP VS $7000 in a TFSA.

1. The RRSP is not a product that can be sold to you. If you think there is trickery being used to sell you an RRSP then you are fundamentally misinformed about what an RRSP is.

2. You have $10,000 pretax dollars to invest. If you choose to put it into an RRSP you can deposit the full $10k. If you put it into a TFSA you can only put in $7000. That isn’t a trick, that is a fundamental defining characteristic of an RRSP.

Even still I put in your 75,000 example and was still ahead by a few thousand with the TFSA.

Not if your RRSP is the income. That calculator is confusing in that it assumes income to be in place before the RRSP so a higher tax rate applies to the RRSP withdrawal.

Anyway RRSP is not without downsides but if you are retiring significantly before 65 it is the preferred vehicle.

Actually your calculator is inaccurate. It uses the classic trick to sell the RRSP. It’s comparing investing 10000 in an RRSP VS $7000 in a TFSA. Even still I put in your 75,000 example and was still ahead by a few thousand with the TFSA. That’s ok, you can believe what your sold….

So in the TFSA example you would have paid $5940 in tax when you could most afford it. VS paying $15,750 in tax when you can least afford it…

This is not accurate. You can compare the two here: https://www.retirementadvisor.ca/retadv/apps/tfsaRrsp/tfsaRrsp_inputs.jsp?toolsSubMenu=preRet

And..

“Withdrawals from an RRSP must be counted as income for tax purposes, so they have the potential to not only bump you into a higher tax bracket, but also leave you open to a “claw back” of benefits. For example, you’ll lose 15 cents of OAS for every dollar your income is above $69,562. If your income’s high enough, you could lose your benefit altogether.

TFSAs don’t create the same problem. Withdrawn funds aren’t added to income, so there’s no risk to your benefits.”

I don’t know of any local roadway improvements that have increased housing values. The McKenzie interchange will be a PITA until complete and after that it seems unlikely to increase values. Making a commute marginally less congested doesn’t last forever on routes serving growing communities and is not the same as living near a subway in a major centre. In major centres proximity to subways or something like the Canada line always increases prices as it brings a dramatic increase in the ease of commuting and removes the worry of traffic congestion from the daily commute. The benefits are there for those with and without cars.

http://www.timescolonist.com/opinion/editorials/editorial-new-interchange-a-good-first-step-1.1419912

TFSA’s mare more flexible but are they always better? How can they be if you are in the 45,8% marginal tax bracket now and you plan to retire early and live off a much lower income drawn from RRSPs – using them up prior to age 60? I would think you are better to focus on the RRSP in this scenario. .

Plus you would disperse your $5940 in taxes over multiple years vs $15,750 all at once… TFSA wins hands down. This is the first account to max without debate. You also have the very large benefit of being able to withdraw at any time. The only penalty being that you can’t repay the account until the following year. You are also not forced to withdraw from the TFSA. IMO the RRSP is only a no brainer if your employer matches payments or you make so much money your TFSA is maxed. Although the later still has it’s drawbacks vs a cash account since capital gains will still be less tax than your average tax rate plus you also have control over the withdraw… Best to hedge your bets. Max out TFSA first, then have both a cash and an RRSP account.

Your 75k was 20k when you deposited it. So in the TFSA example you would have paid $5940 in tax when you could most afford it. VS paying $15,750 in tax when you can least afford it…

OK, Leo. But the answer to the second part of my question—did it decrease house prices in Kitsilano?—is a resounding no. DavidL asked whether prices in Victoria’s core would be negatively affected by the new interchange; I’m 99% certain they will not.

Yes they are. Just saying if you were to withdraw 75k from your RRSP during retirement to live on, you would pay 21% tax (as that would be the average across the 75k), whereas you would have received almost 30% back from the contributions during your earnings years.

Yup, it’s a very good point.

Closer to home, how about the expansion/improvements to the Trans-Canada Highway twenty years ago between McKenzie Ave. (Saanich) and Spencer Rd. (Langford)? The highway was expanded from two to four lanes, allowing a significant increase in traffic volume out the the Western Communities. Property values immediately started increasing (followed by a massive construction boom) after the highway was improved. (Don’t get me wrong – the “boom” was due to demand, prices and interest rates … but if there were only two lanes out to Langford then the construction would have been in West and Central Saanich.)

I’m missing something. Aren’t RRSP withdrawals taxed like any other income? If taxes stayed the same in retirement, you’d still pay 29.70% on all income over $44,701, including RRSP withdrawals, no?

Right, the difference between getting the rebate at marginal rate and paying average rate is quite significant. But I’ve never seen that discussed in comparisons between the TFSA and RRSP

Actually costs will only be double the estimate? 😉

I see what you are saying, but whether you are contributing to an RRSP (such as now) or withdrawing from an RRSP (when retired) – your average tax rate for the same income remains the same (21.26% based on your numbers). The difference is that the RRSP contribution reduces your taxable income at your marginal tax rate.

Of course, inflation plays a big factor too. As long as growth in your RRSP portfolio is outpacing inflation, that $10,000 in 2005 may be worth more than $30,000 in 2035.

Something just occurred to me about RRSPs…. Every article you read talks about that TFSA vs RRSP depends on your current income vs income you expect to draw in retirement as well as current vs future tax rates. In other words, if tax rates stay the same it would make sense to contribute to the RRSP if you expect your income during retirement to be much lower than now.

But isn’t there another factor of the marginal vs average tax rate? If you make $75k in BC your marginal rate is 29.7% and the average rate is 21.26%. So if you contribute $10k to your RRSP you save $2970 in taxes.

Now let’s assume you are withdrawing $75k out of your RRSP in retirement, your income is identical, but now you are paying the average rate of 21.26%. So even though your income is the same you end up ahead. On 75k of contributions you would save $22,275 in tax, and only pay $15,945 when you withdraw $75k, so you’re ahead by $6330/year

The answer is a resounding yes. Just look at what happened to condos around the new Canada Line. Stimulated huge new construction and price increases.

Of course any single bridge or intersection will have a much smaller impact.

The only thing going up will be the costs of the project. $85 million will end up being $170 million haha.

OK, insert any other commuter infrastructure improvement between those two locations, and then answer my question.

There is a toll each time you cross the Port Mann Bridge – so I suspect that this would reduce the desire to commute across it.

DavidL, did the new 10-lane Port Mann Bridge increase house prices in Abbotsford, or decrease house prices in Kitsilano?

I don’t think the interchange will have a noticeable affect prices, other than adding $85 million to all the projects underway in Victoria. Building an 8-lane highway would be a different story, but the interchange will only move back the bottleneck so reduction in travel time will be negligible. Price increases on the westshore will more likely decelerate (relative to the core) until completion in 2019 as construction lengthens travel time.