A drop in the bucket

It looks like the Bank of Canada (BoC) govenor, Stephen Poloz, has decided that Canada’s economy is faltering and needs further stimulus to stay afloat. With the announced 0.25% decrease in the overnight lending rate, Canada’s mortgage lenders will soon be lowering variable rates. However, the general consensus is that the big banks will likely not pass along the full cut in the key interest rate when adjusting their new prime lending rates. I’m sure that we’ll know more in the next few days.

Pundits have predicted that this rate cut will cause the $CDN to slide further down when compared to the $US, making Canadian exports more competitive. Will this be enough to stimulate the economy, or is it just a drop in the bucket? With the prospect of US interest rates likely being raised in September, they may soon be pressure on Canada to raise interest rates again. The cynic in me says that this kind of bad news will be delayed until after the upcoming federal election.

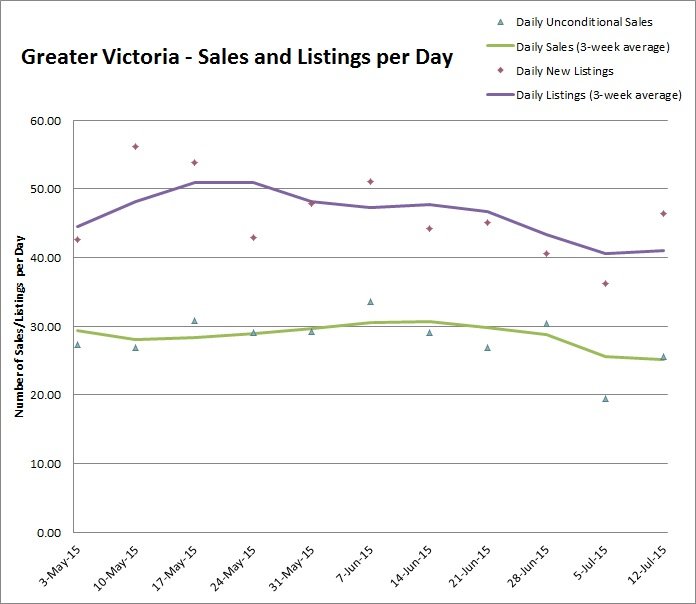

Of course, it will be interesting to see how this might affect housing sales in Victoria. As Just Jack posted a few days ago, it looks like we’ve past the peak in house sales. This chart shows the daily rate of new listings peaked in early May while the daily rate of sales peaked in early June. (Note: Data have been calculated from VREB weekly sales statistics posted by Marko.)

Will this interest rate drop cause an uptick in the daily sales? Time will tell …

Will this interest rate drop cause an uptick in the daily sales? Time will tell …

[…] too soon to see the what effect the recent drop in the prime lending rate may have on housing sales – but it’s fair to say that July 2015 has been an interesting […]

And what type of real estate and where should you have bought?

Ok, I’ll bite. 😛 What are the gains that could be had and when should I have bought?

How are the mid-month stats looking for sale volumes and prices!?

241 house sales in the core for the last 30 days with half of the them selling between $290,000 to $622,500. Median exposure time was 21 days to sell. New listings are being added at the rate of 323 to 241 or 1.34:1 Months of inventory stands at 2.2 Sales activity is up significantly in every price range except for starter homes.

Median price a year ago was $591,750 with a DOM of 37 days.

Condo sales in the core were not as impressive as house sales. 161 condo sales for the mid-month to mid-month period. Half of them selling between $127,500 and $265,000. Median time to find a buyer was slightly over a month at 38 days. New listings are being added at the rate of 252 to 161 or 1.57:1 The months of inventory is now 3.6 The largest increase in sales activity is in the price range with starter homes in the core.

The median price a year ago for a condo in the core was $284,500 with a DOM of 45 days.

It’s unusual to see the median price of a condo to decline given the low MOI, NLS and DOM. I think there may be some cross over between starter homes and condos since they are attractive to prospective buyers looking to buy in this shared price range.

Hopefully at that price it includes the furniture! 😉 I expect that whoever buys it won’t be financing the purchase …

What is the flaw with his analysis?

This is a complete disaster for bears. What a nightmare scenario. That puny “savings” you are putting away every month is not even coming close to the gains had you bought. It just keeps getting worse and worse by the month.

He’s not saying that boomers don’t require a house, just that after 65 you are not a big buyer anymore. Stats show you are a net seller most likely. However I agree that the analysis is a bit too simplistic. Why not do overall population instead of just the buying contingent?

With Ben’s latest analysis, I can at least see why he’s been so far off the mark for so many years.

Ben makes a good point about the rapid increase in housing starts as a multiple of nominal population growth. I think that there is an assumption that retired people are not buying houses. I’ve witnessed quite a “boomers” who’ve bought their dream homes just a few years before retiring and plan to continue paying the mortgage off for another 10 or 15 years. I’ve also seen a few of them underestimate expenses and been required to work part-time or pick up contracts to keeps themselves financially afloat.

For generations, it seems to me that Canadians have considered it a democratic right to be able to retire at 65 and then live on easy street. The reality is that getting old is expensive …

We have more people living into old age. That doesn’t mean any of us are going to live longer than our parents or our parents’ parents. The paradox is that we read that Canadians are living longer but we are also told of the poor eating and exercise habits of Canadians that shorten our lives.

So which is it?

Modern science is keeping us from dying sooner not making us live longer.

Thanks LeoVictoria for the article by Rabidoux. Population growth by itself doesn’t support the explosion of condo construction here or worldwide. But you have to go a little deeper into those numbers.

In my opinion, what seems to have happened is that the cities have drawn labor from the rural areas of the provinces to come to the city and build these condo towers or be indirectly employed in construction. While our population growth has been fairly steady over the last 25 years what has changed is that we are drawing a larger portion of people in the home buying age and less in the retirement age.

This is also a very mobile generation of young workers. Where you lived when you were 25 is most likely not the same place as where you lived when you were 35. A generation of workers that frequently move to where the jobs are located.

When construction slows down and eventually condo construction will stop, then we will see the same generation pick up and move on to greener economic pastures. Then we’ll look back at all the construction that was being built and think how did we not see this coming?

Population growth is important but we need to know the age distribution. A 1 percent growth rate that is mostly retirees is vastly more stable for the long term health of the economy than a 1 percent growth of those under 30.

In Canada we are heading for a real estate cliff that we will reach in our next prolonged recession or economic depression..

Anyone else seeing that Ben’s whole argument seems to assume that when people turn 65 there‘s an estate sale?

“In reality, Canada’s working-age population (15-64 year-olds) is growing at the slowest pace on record, a paltry 0.4 per cent or just one third of the long-term average.”

It makes sense to me why it’s growing at the slowest pace on record. 10 million Boomers started turning 65 in 2010. That doesn’t mean they no longer require a roof over their head. I would estimate an average boomer life expectancy of near 90 years old with ongoing health and medical advancements. If anything the falling ratio Ben’s talking about could be a tailwind for the traditional retirement cities.

1711 sold for $447,500 in 2010 and apparently $300,000ish in 2012 (http://www.greaterfool.ca/2013/09/19/the-f-house/). I agree there have been some renos, but it is a tiny place and it seems like someone made out pretty good three years later.

Interesting article by Ben Rabidoux. House starts relative to population growth now twice what was the normal level in the 80s and 90s. Does raise questions about significant overbuilding.

http://www.theglobeandmail.com/report-on-business/economy/housing/canadas-housing-boom-has-no-demographic-legs-to-stand-on/article25523999/

“Slaughtered” is what I witnessed in the early 1980’s on Wedgewood Point (at that time, a new development on the east side of Ten Mile Point). Many of the homes in that neighborhood were selling for $250K to $350K in the late 1970’s and then interest rates rose to more than 15%. About a third of the new owners declared bankruptcy and I remember many properties vacant for a number of years until new buyers could be found.

I think that we are witnessing a new world order when it comes to international finance and banking. As any investment broker states: “past performance does not guarantee future results”.

I like it.

Here‘s that one in Metchosin I mentioned.

Listed for 24 million in ‘07.

Sold for 6 million early ‘13, or very near that.

Now listed 13.25 million, but who the heck knows what it’s worth today?? Guess we’ll find out of it sells.

http://www.realtor.ca/Residential/Single-Family/15078108/529-Swanwick-Rd-Victoria-British-Columbia-V9C3Y8

I think they should add the CMHC premium as an upfront cost. That would effectively make the minimum down payment about 8.5% and make people think twice about paying the fee

CMHC says most first timers put down less than 10%

The renos should cancel out in Teranet. They also don’t exclude houses that have substantially degraded in condition between sales.

I don’t know if that would make much difference in Vic or Van. Most of the people I know who have bought recently put at least 20% down. Many pay all cash… although I guess my compadres are boomer age. Interest payments aren’t tax deductible in Canada, so it doesn’t make a lot of sense to carry a mortgage.

Agreed, I’m not sure how they would verify…it does seem unlikely that someone scans through photos. I’m just going by part b) in the following excerpt from their methodologies…

“Any property that has been sold at least twice is considered in the calculation of the index, except those that may be related to influences from within the property (endogenous factors): a) non-arms-length sale, b) change of type of property, for example after renovations, c) data error, and d) high turnover frequency.

Yikes …. say it aint so ! 20 year mortgages max and increased down payments ? That would be a major dagger in this bubble.

Ottawa eyes tougher new mortgage rules, larger down payments, to curb Canada’s red hot housing market

http://business.financialpost.com/personal-finance/mortgages-real-estate/ottawa-eyes-tougher-new-mortgage-measures-larger-down-payments-to-curb-hot-housing-market

You have no idea what slaughtered is truly like. Watched many people bite the big one over the years when the markets turned south for real.

A few days ago, Robert McLister wrote A Rate Cut Cuts Both Ways on the at Canadian Mortgage Trends site, suggesting:

I’m Not so sure about that Michael … I’ve previously scanned the document that you linked to.

Teranet suggests that properties with a fast repeat sales turnover ( < 6 months), zoning or "type of property" changes, changes in the physical characteristics (floor area or building footprint?) may be excluded. I sincerely doubt that an analyst scan through photos of each property looking for improvements such as new flooring, lighting, wall coverings, windows, doors, etc. that are typical of a flipped home in Victoria.

Teranet excludes properties that have been renovated in their calculations.

http://housepriceindex.ca/documents/methodologyen.pdf

Areas outside of the “core” municipalities, areas such as Langford, Colwood, Sooke are more affordable. (Driving along Sooke and Otter Point roads yesterday, I saw a lot of “for sale” signs.) Within the “core”, the Saanich West, Victoria West, Esquimalt areas are less expensive. I’m sure other blog readers will share more …

The resale of 1711 Haultain demonstrates the inherent flaws of a repeat sales methodology (such as Teranet). The photos show a lot of recent upgrades to the interior …

Single cases don’t make the market. There are many examples of discounted estate sales, etc. – just as there are examples of big increases. Examining the statistical outliers doesn’t tell you much about the market.

Looking at resale values of a large group of properties (such as the Teranet – National Bank House Price Index) gives a more accurate picture.

LOL That house would be under $100k in Windsor. For $430K you can get a 6 bedroom, 3 washroom SFH with all the fixins. Its because of this that I seriously don’t feel I can afford to move to Victoria. Are there any areas that would be affordable?

1711 Haultain just sold again – for over the aasking of $429,800: http://ivandelano.com/mylistings.html/details-47244853

DavidL, if you want examples of even core Vic houses getting slaughtered (more than 5-10% off), 1711 Haultain sold at the 2013 bottom for about 30% off what it did in 2010. I know there were other core around the 25% mark.

Very true nan, although I have to say I’m somewhat intrigued why this one has been fairly accurate with timing for as far back as we have data (50 years).

http://i.cubeupload.com/T5oeRo.png

There were lots of 25-40% off deals outside the core; Surrey, Langley, Coquitlam, Okanagan, our Island…

Heck, there were many 25-30% off deals even in core Victoria. I’m sure you’re aware that average price graphs don’t reveal the deals to be had at a bottom.

As an example what was that ranch that sold 2013 in Metchosin for something like 75% off what they paid for it a few years before? Imagine how big a grin that buyer has today.

A 5% to 10% drop in SFH in Victoria is slaughtered? Half of BC’s population (also known as Greater Vancouver) saw year-over-year gains between 2010 and 2013:

http://assets.vancitybuzz.com/wp-content/uploads/2015/01/metro-vancouver-real-estate-2014.png

Prices correct for many reasons, and I would suggest that net migration only has minimal effect on market prices in Victoria. Only when a single-industry town either booms or goes goes belly up will it affect prices. People are leaving Fort McMurray, and prices there are declining …

http://business.financialpost.com/personal-finance/mortgages-real-estate/if-you-thought-your-housing-market-was-bad-check-out-fort-mcmurray-the-heart-of-canadas-struggling-oilsands

http://www.fortmcmurraytoday.com/2015/06/18/vacancies-in-april-up-to-223-from-7-last-year

One of the interesting side effects of a government setting low interest rates, is that the interest paid on government debt (i.e your and my public debt) is much lower than when rates “normalize” at 4 to 5%. With the BC Government’s total debt of $63 billion, any increase in interest rates will quickly wipe that $1.68 billion surplus.

I’m sensing some government spending forthcoming in Victoria.

http://www.timescolonist.com/b-c-posts-1-68-billion-surplus-nine-times-forecast-1.2001519

Already happened… ‘10-13 most of BC got slaughtered.

There is nothing written in stone that says that any part of the world operates on any cycle.

It seems that real estate prices are increasingly unaffordable everywhere in the world these days. That is probably an over generalization. However, what is noticeable is that every city from Vancouver to Mumbai, that has significant home construction also has high prices.

The accepted logic is that in order to make housing affordable it is necessary to increase supply. We’ve all been shown the two curves of supply and demand and how they intersect to form price. Increase supply and the equilibrium point drops and that means lower prices.

But what if we have it wrong. Instead of shifting supply we are increasing demand by stimulating the economy with jobs directly and indirectly related to construction. Then the more we build causes higher prices.

It also means more jobs and a net gain in population of workers just at the right age to buy their first house/condo. In this kind of market, the cost of a new home or condo sets market value for all of the pre-owned homes under an economic principle known as the theory of substitution.

A market with rising material and labor costs would also have rising prices too. And those costs are quite uniform across Canada. And that’s why you’ll find new condos in Vancouver, Toronto, Victoria, Kelowna and Nelson priced similarly. New construction cost strongly influences the marketplace.

House prices are different from condos because in the older established cities like Vancouver and Toronto, the cost is prohibitive for a first time home buyer. It’s necessary for a home owner to move up the property ladder with increasingly bigger down payments or from buying and selling condos. Cities with more condo construction will also have higher house prices and greater speculation in the condo market. Buy and sell a couple of condos and you have yourself a house.

This can also work in reverse. A recession in new construction will remove that price floor and you’ll find developers pricing their new homes under pre-owned properties. If the cost of materials and labor continue to fall then the price of a home to be built will be less than one just completed.

If a housing correction is going to happen. Where will we see evidence of it first?

Somewhere, someplace we should see prices correcting. If everyone wants to live here there must be a place they are leaving and prices should be declining there.

Name a city in BC or Canada where this is happening?

Good questions DavidL. Read:The Truth About Who’s Responsible For Our (USA) Massive Budget Deficit

http://www.businessinsider.com/us-budget-deficit-2011-7

Do you feel that citizens in the US blamed Bush or Obama for the housing crisis? Who gets the credit for the eventual recovery?

With irrational exuberance comes the other side of the mountain and can come when one least expects its. The markets operate on 7 year cycles and we’re at the end of the last cycle. We just don’t know what the catalyst will be. A credit crisis ? A much deeper recession ?

“A housing correction is likely to happen this summer”

http://www.bnn.ca/News/2015/7/14/Authors-summer-2015-housing-correction-hunch-looking-more-likely.aspx

Netflix makes up for the Bank flatness. Big pop after hours today! I’m at +125% on my position 🙂

This one’s for the ladies…

http://news.nationalpost.com/news/canada/canadian-politics/where-does-your-city-fall-among-the-best-and-worst-places-for-canadian-women-to-live-among-its-25-biggest-cities

“If you’re a Canadian lady looking to get ahead, your best bet is to live in Victoria, B.C.”

It looks like most of the big 6 are now matching RBC’s 15 basis point move.

Looks like RBC will do at least .15% down to 2.70%

TD – 0% BMO -3% but I ain’t a day trader….

Flat for me so far.

Canadian banks are actually down quite a bit this year.

exactly why I invested in more CAN Banks earlier this year. More mortgages + more spread = more profits….

Watch the banks only pass on .1% !

Funny you bring that up… they sold out of those $100 hot dogs days before the Calgary stampede ended.

Funny you bring that up… they sold out of those $100 hot dogs days before the Calgary stampede ended.

I love to say I told you so 🙂 I have two predictions right for 2015. 1.99% fixed mortgages and the BOC rate cut to .5%!

As much as I detest Harper’s govt, I hope he wins the next election, as the winner will have to pay for Canada’s imminent destruction. When people start losing jobs, & their homes plunge in value, amnesia sets in, & the present govt is ALWAYS blamed

And lost 21,000 part time jobs. I suspect that most of the increase will be in Tech jobs as the lower dollar makes it more profitable for US firms to hire Canadians full time.

Poloz stated, after the first rate decrease in January, that the Bank of Canada was targeting new home buyers. Ideally into buying new condominiums. For real estate that provides the largest stimulus to the economy. Creating a new building with new appliances means new jobs.

In contrast those moving up the property ladder and buying used housing may be increasing their mortgage and debt load but only marginally stimulating the economy.

I can’t point to any studies, but I suspect first time buyers are younger than two decades ago. I know that it is much easier coming up with a 5 percent down payment today. Than a 10 percent down payment did years ago. Even with house prices being double what they are today. When you are targeting the very young then you are pulling demand from the future. Poloz is willing to sacrifice tomorrow’s real estate market to defer the inevitable recession. To keep Canada from sliding into a deeper recession for at least the next 6 months. And I agree with him that it is necessary to sacrifice the few to save the many.

The barrier to home ownership is very low these days and that makes homes “affordable”.

We live in a world of instant gratification and conspicuous consumption. That allows anyone to buy $100 hot dogs, $500 hamburgers and $325,000 condos.

I think it’s necessary for someone to live and work through an extended recession to comprehend how devastating leveraging an asset can be. You can’t explain how devastating it can be to someone – they have to experience it for themselves. It’s incredible how fast one can go from a leveraged millionaire to being bankrupt.

If anything it could over stimulate BC’s economy. For instance BC added 36,300 full-time jobs last month, while all 3 prairie provinces lost full-time jobs… such is the BoC’s challenge in such an economically diverse country with highly mobile workforce. By trying to help slower regions, you fuel others that don‘t require it. IMO all the stars are aligned for our housing market to set Autumn records.