June Sales Sizzle

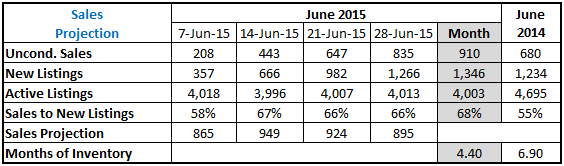

June real estate sales have surpassed all expectations. With 910 sales and just 4,003 active listings, the sales to new listings ratio was at 4.40 – the lack available properties favoured the seller over the buyer. Sales were the highest since June 2009 (with 956 sales). New listings also rose and were the highest they’ve been since June 2012 (at 1449) while active listings were substantially lower than normal – at their lowest level since June 2009 (at 3789 listings). The sales to new listings ratio of 68% was the highest since 2005, meaning that June was a great time to sell!

Here are the numbers for the entire month (with an new adaptive sales projection algorithm that I’m testing):

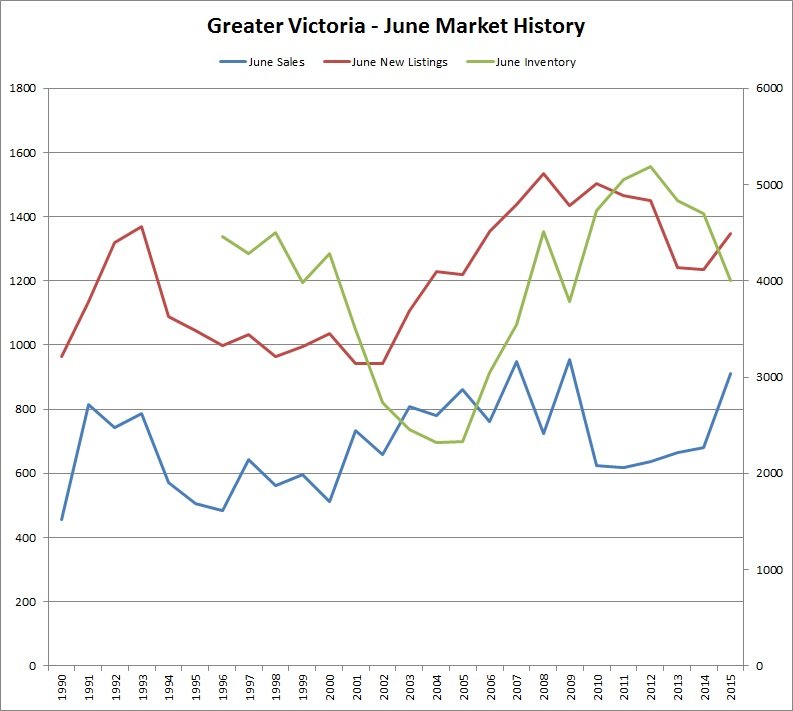

How does this June compare with previous years?

How does this June compare with previous years?

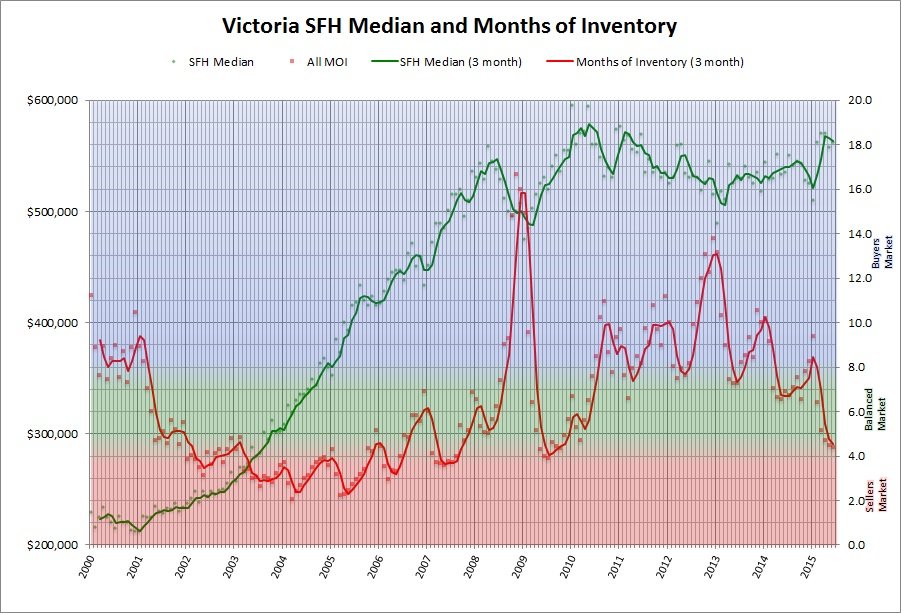

The Victoria Real Estate Board (VREB) has published their monthly statistics with further sales information and analysis. The 3-month average median price has been surging since the beginning of the year, while the 3-month average inventory continues to drop:

The Victoria Real Estate Board (VREB) has published their monthly statistics with further sales information and analysis. The 3-month average median price has been surging since the beginning of the year, while the 3-month average inventory continues to drop:

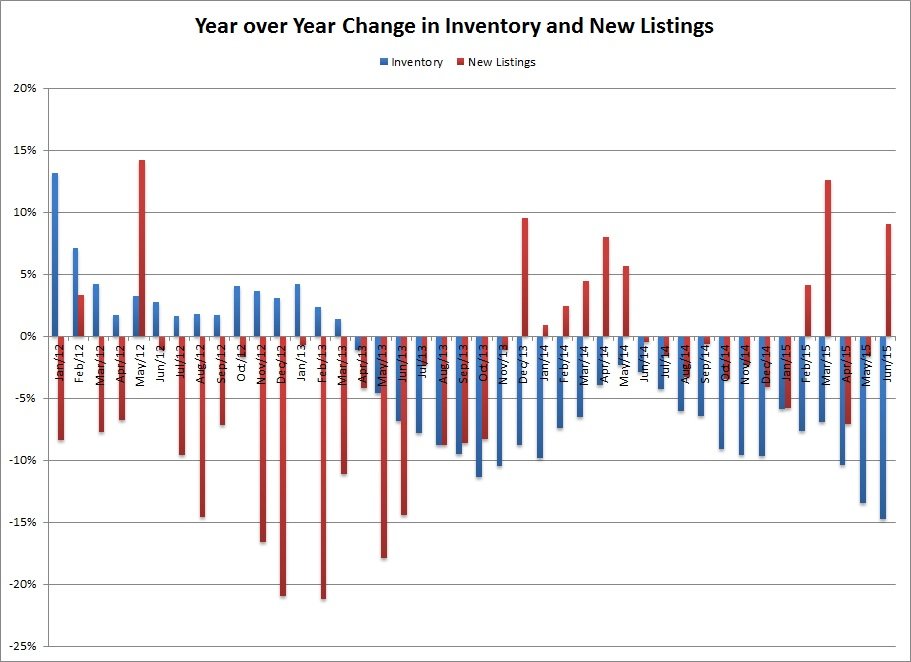

So how does this all stack up? New listings have been increasing steadily since April while the inventory (active listings) have been dropping. Not only is it a sellers market – there’s not much to choose from.

So how does this all stack up? New listings have been increasing steadily since April while the inventory (active listings) have been dropping. Not only is it a sellers market – there’s not much to choose from.

Finally … in behavioural economics, there is the concept of illusory correlation. An example would be to suggest that the sizzling sales in June 2015 match the sizzling hot weather. 😉 Truth is, in spite of slightly lower interest rates – I’m at a loss to figure out why the sales have been so high for the past few months. What is your theory?

Finally … in behavioural economics, there is the concept of illusory correlation. An example would be to suggest that the sizzling sales in June 2015 match the sizzling hot weather. 😉 Truth is, in spite of slightly lower interest rates – I’m at a loss to figure out why the sales have been so high for the past few months. What is your theory?

As someone who is still stuck in Vancouver for a while longer (I work in the film industry, incidentally) I would totally agree with your assessment.

The “world class city” rhetoric from City Hall and the media drives me mad. Vancouver is still a small town, with increasing big city problems (traffic, air quality, general shitty attitude of residents and stupid cost of living). As someone who likes to travel to NY and Europe, I can attest to the fact that this town is still lacking the cultural appeal of the world’s great cities. It will be decades before we have a chance to catch up on that front.

To boot, there is little real money here; few high paying jobs, many of which are transient/fickle in nature (film/tv, IT, gaming, tech, etc).

Thanks for the right word JJ. It is the perfect example of a speculation bubble. Speculation is only one dimension to our housing market. It seems a given that Van’s market has a bigger speculation component than Victoria’s that’s for sure. Vancouver prices make my head explode. Totally do not understand it’s prices yet they continue to climb.

Thanks, Marko. If the rate of sales keeps up, my sales projection for July is 878 – a 29% increase over last year. Time will tell …

I agree, Tulip mania was a pure speculation market. Housing rarely becomes a bubble as the market has a propensity to correct before it reaches that stage. The local buyers simply can’t pay anymore because they have reached the limits of financing and the market corrects.

However, the government has been vamping and re-vamping the normal cycle of real estate and not letting it correct. That’s really screwing with people’s financial futures.

Now Vancouver….. Holy dog crap!

When Vancouver topples that has a good chance of putting all of BC in a recession.

@Michael

Nobody’s going to accuse you of not being optimistic about the future!

Homes in Broadmead start in the mid $600K’s and go up from there (see MLS 351969). The Broadmead neighbourhood has a surprising number of ranchers and homes with a large amount of sq. ft. on the main floor. Granted that most Broadmead homes are not close to stores and amenities, so it is a “car culture” neighbourhood. On the other hand, the population density is fairly low in Broadmead as there is a covenant bannning rental suites.

Gorge Tillicum has some nice quaint streets, but also a few sketchy areas and issues with a transient population. With homes selling for the same amount, I would choose the Glanford neighbourhood instead.

It also depends on how fast new listings are being added. New listings might be added at a pace that would satiate demand without changing the months of inventory. Last month the core had 337 new listings for houses compared to 260 house sales. Adding 1.3 new listings for every home to sell. That seems low. I would say you would need between 1.5 to 2.5 new listings for every sale to account for properties that are vendor priced too high and cancelled listing for personal events that might cause a vendor to pull their listing from the market.

Another thing that might be happening when prices get too high for buyers to qualify with their incomes is that prospective purchasers buy less of a property than they want. Steak gets too expensive and they buy hamburger. They don’t stop buying they just substitute.

As far as I know it’s completely impossible for there be a tight sellers market with no increase in prices. With low MOI prices always increase. If buyers are really tapped out then they will stop buying and MOI will increase.

The Tulip bubble reference is really useless… No one needs tulips where everyone needs shelter…. Our best recent example of a housing crash is the financial crisis and that was a complex organic criminally engineered quagmire. Nothing simple about it. Plus it found its bottom and has rebounded pretty quick. (Not without casualties). The tulip bubble was just pure bubble P

plain and simple. You can only be use it to illustrate that one dynamic not as a comparison to our housing market…

Monday, July 6, 2015 9:00am

MTD July

2015 2014

Net Unconditional Sales: 97 681

New Listings: 181 1,195

Active Listings: 3,908 4,570

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last yea

Prices are definitely up on single family homes in the core, I wouldn’t quite call it “barely a budge.”

Your 2015 Assessments that estimated the value of your property as at July 1, 2014 would have been mailed to you in January 2015.

You forgot the Tulip Bulb Crash on your chart when everyone thought they would never be able to buy another tulip….AKA The Greater Fool.

Can someone remind me when 2015 assessments become available?

The fuse may be lit…on the printing presses going into overdrive…things are about to BOOM.

I too am hoping for an ‘87 style stock crash so we can really get this property party started 😉

I wouldn’t say “30 year plus…never seen in the history of the world” by looking at 730 years of interest rates.

http://static2.businessinsider.com/image/52a2379569bedd087d5aaef7-1200-600/figure-4.png

You might want to read some history books Michael. Interest rates peaked at 20% in 1980/81 and proceeded to where we are today near zero. That’s all you need to know. This is a 30 year plus credit expansion never seen in the history of the world.

HELOC’s and credit cards weren’t in the picture back in the 80’s and 90’s and creation of the 40 year mortgage by Harper is what turned a boom into a frenzy. Ignoring that important point of personal debt beyond the mortgage creates total flaws in your hyping of prices to $1 million in five years.

If Harper hadn’t tried to save his political ass by flipping all the risky mortgages he created from the banks onto CMHC and the taxpayer, our market would have, and should have, tanked like the US did to clean out the excess. Next time it will with no more lifeboats to save the debt burdened, especially those with negative equity.

When the new government is voted in, there will be a wake up call if the global situation doesn’t do it sooner.

Jack,

Your point about barely a budge in prices in the last 120 days to me is most telling. With sales hitting levels not seen in 6 years the prices should be shooting skyward as this talk of over paying, multiple bidders etc on every house that isn’t a crack shack. But it isn’t. That’s a telling sign to me, as in the stock market where a top is in place and distribution in occurring.

The biggest catalyst risk to me is still the credit market. The several articles I have read this weekend putting out the facts that there are serious liquidity issues in the bond markets globally. When you have liquidity issues in the bond market, you are screwed, and we would see an instant clamp down on easy street’s free money give away the past decade or more.

One can deny it won’t happen but when the commie Chinese government declares a “war on stocks” and throws $19 billion to try and contain a crashing stock market, as well as letting margin players put their margined real estate up as collateral,how can one not see a potential house of cards in slow mo here ? Toss in the Greece No Vote today and the fuse may be lit.

> A million in 5 years is only about 10% per year

Bet you $1000 that won’t happen.

We could only get to a million in 5 years if prospective purchasers could come up with massively larger down payments. The size of the down payment relates to the price you sold your last home at. Since our prices have been flat for so long there just isn’t the built up equity to get to that million dollar price.

Otherwise we would need massive inflation in wages and goods. I don’t think anyone is suggesting that is going to happen.

In contrast, I see the municipalities increasing costs to the home owners in taxes and fees. Some body has to pay for those bike lanes. The same with gas, electricity and other monthly charges. Another couple hundred bucks a month to live in the average Victoria home.

The year over year median price in the core districts is up from $583,000 to $629,450. At 8 percent, the year over year is a little bit more than everything combined. That’s a very good year over year increase for houses in the core.

However for the last 120 +/- days, the median price in the core has not changed much. In March the median was $625,000. April was $631,200. May was $620,000 and last month was $629,450. So for the last four months we’ve had a zero increase.

Historically for the last five years, market prices have tended to soften during the back six months of the year. Thus we can have flat prices for the rest of the year and yet our year over year median will show and increase.

I bought in 2003. Big difference between then and now. Rates dropped dramatically, Wages went up and the starting point was much lower than now. I would place my bets on closer to 4%…

Hypothetically speaking.

What would happen if the foreign flow of money was drastically reduced? Which could happen if countries like Australia or the USA became more liberal with foreign investors.

I opine that Vancouver’s new condo market would be affected immediately. All cash sales would drop off as there wouldn’t be any straw buyers purchasing 3, 4 of a half dozen units on the behalf of foreign backers through investment brokerage firms.

Sales of starter homes or lots with older homes may slow down considerably. Homes that are bought with cash and kept empty. When someone pays a half million over list price they are not buying to live in the home or to rent it out. They are buying it to park money.

The high end market would drop off as foreign ownership for the best of the best properties moves to different countries in other cities with more liberal policies like San Francisco, Miami or Melbourne.

This could throw Vancouver into a housing recession that may reverberate to towns like Kelowna, Nanaimo and Victoria. Spiking unemployment in the construction trades and related industries. The Vancouver market so dominates the BC economy that if it goes belly up then BC would go into a recession.

You might even see foreign enrollment at universities drop with fewer admission each year.

The positive spin of foreign capital is a functioning economy. The down side is high house prices that have the potential to destroy some households’ financial futures.

If you were the Premier of BC or the Governor of the Bank of Canada which one would you rather happen? But it’s out of their ability to control. If places in California open up to foreign investors, then how can Canada compete?

I suppose we should be glad that the Americans are more paranoid against foreigners than Canada. A foreigner in the American south being anyone without a pick up truck and an NRA bumper sticker.

It’s always hard to see prices taking off after they’ve been flat/down for so many years. I remember how everyone laughed at the thought of prices soaring ahead 20% per year back in 2001 after 9/11, and also in 1987 after one of the worst stock market crashes in history.

People still don’t understand interest rates. Note how the bank rate went from 7% to 14% from 1987 to 1990, and climbed from 2.25 after 9/11 to 4.75 by 2007 and yet in both those periods, prices absolutely soared while interest rates doubled or more.

http://www.bankofcanada.ca/wp-content/uploads/2010/09/selected_historical_v122530.pdf

Why would people flee inflation? I’m confused with your rationale.

http://i.cubeupload.com/xvyYrk.png

10% would be crazy. We would need to see wage growth, rent increases and rates continue to drop…

“A million in 5 years is only about 10% per year.”

Only ? LOL The inflation needed to support that would drive taxes to insane levels and cause people to flee this city in waves like you’ve never seen. Not going to happen.

A million in 5 years is only about 10% per year. Keep in mind we just clocked a 6.4% y-o-y gain in June. Last June (’14), we were barely lifting off the floor at a 1.0% y-o-y pace, and remember that Vancouver is already pacing closer to 20% annual gains. Last 2 cycles (late 80s and ‘02-’06) we were consistently hitting the 15-20% range every year. This time round I’m staying more conservative in the 10-15% range simply because I’m wondering if apartments could steal a bigger piece of the show.

And I don’t believe it will require any more international buyers than did the past two cycles.

“I give us 5 years until we hit a million median here.”

You’re dreaming Michael, and should really back off on those travel mags. Victoria is a nice place but getting extremely congested with no hope of rapid transit etc. Not what international buyers want to move to regardless of the beaches, weather etc, and the stats support that.

https://youtu.be/gbNZb6JAHpU

Maybe part of it is the record number of cruise ships docking in Victoria with boomer-aged folks considering vacation/retirement property (particularly tantalizing now currency-wise). Conde Naste for instance recently ranked Victoria in the top 25 cities in the world, tied with Sydney Australia. They also ranked Vancouver Island as one of the best Island’s in the world. Third year in a row Amazon survey we’re # 1 for most romantic city, but we already knew that.

I still say the biggest factor could simply be record sales and prices in Vancouver this Spring. They know very well how incredible our city is. Their recent sellers know we have better weather, walkability, food, harbour, architecture, natural setting, charm… the difference now is they have millions in their pocket and they can finally have it all.

Why in 2015 would Victoria suddenly be “discovered” now, causing prices to surge? Victoria was incorporated 153 years ago and so far remains hidden from the “top city” winners circle.

That’s why I think Victoria will soon be as unaffordable as the other top cities. I give us 5 years until we hit a million median here.

Vancouver seems to always place top 5 in world. In the latest study only Vienna, Zurich, Auckland, and Munich beat it.

http://news.nationalpost.com/news/canada/beat-it-new-york-vancouver-the-best-place-to-live-in-north-america-according-to-mercer-ranking

If Victoria was big enough to be included, I’m sure it would beat Vancouver.

I’ve done a lot of travelling in Europe and there are definitely some nice places. Last year during my Euro trip I spent a week in Munich, rented a BMW M4, drove it through some nice mountain passes, went to Neuschwanstein Castle…it was a pretty awesome week in Munich and Germany. Could totally see myself living there, then I looked at some real estate prices in Munich, asked my relatives how much some staple professions (nurse, teacher, etc.) made in Munich, and I came to the conclusion I’ve come to in every single other desirable city that I would like to live in Europe. Single family home is completely out of reach of the middle class.

Vienna is probably my favorite city in Europe but expensive…..Paris left a bad taste in my mouth after I forked over 9 euros for a pop in a joint on Champs-Elysees.

Victoria overall is pretty awesome, always stoked to come back and a two income family can still afford a half decent house.

Problem is the local media paints Vancouver as those major cities with all the “world class” BS. The local media aren’t allowed to tell the real truth like the guy Leo posted with the link to the Hongcouver journalist interview. If the media tries to tell any real stories the real estate advertisers threaten to pull their ads which is the media lifeblood. It is just Vancouver, nice place in spots, but not Mecca, nor worthy of those outrageous prices.

https://youtu.be/svImc4XL5UQ

Vancouver is no London, New York or Paris…. It’s Vancouver…. I remember one the of the reasons I moved back here. When I was backpacking around Europe and hanging out with different travellers I would tell them where I was from and they would light up! They would ask me if I had been to all these different places of interest (A lot I had not). After my money ran out and I returned to Ottawa I sold everything I had left and bought a ticket back to the island…. I love travelling and have been to London, Paris and New York. The only city I would rather live in than Vancouver, if I had a choice, is New York. But then again I’ve never been in the Winter….

“With the market teetering on the brink of disaster right now.”

Scary stuff! lol They even italicized the “right now.”

Quick everyone, run & hide! Disaster is upon us!

(just having some fun 😉 )

The definition of resilient market equals Calgary. Benchmark and median up June’15 over June’14. This feat accomplished while its lifeblood fell from $110 per barrel to under $50 a barrel this past winter… and still sits around $50 today.

I bet Hilliard MacBeth (Alberta-based portfolio manager) hasn’t sold many of his “Bubble Bursts” books. Then again, our northern forests seem to be brimming with bears.

Interesting listening to real estate perma-bulls Ozzie Jurrock and Michael Campbell both question that this could be the top for the Vancouver market. Ozzie also stated anyone who thinks outside money isn’t influencing Vancouver prices has no idea what they are talking about.

80% of clients to one well known agent to the fllthy rich in Vancouver was coming from offshore Asia. Also interesting to hear Ozzie say Vancouver is no London, New York or Paris. Definitely signs the topping zone is in play.

Bill Gross’s call for a run on the shadow banks was pretty scary too. What would that do to the credit markets ?

http://moneytalks.net/article-and-commentary/todays-best-money-making-ideas/bonds/15376-bond-titan-bill-gross-warns-qrun-on-shadow-banksq.html

Maybe if not for the dispensaries. It’s like Amsterdam circa 1980’s. Busy and losts of money moving…

Wouldn’t the pot industry in Vancouver take a big hit as it’s now legal in most nearby US states?

Every cycle downturn has a different reason, Michael, that’s an economic fact with no chart to say when. Who says it won’t happen this time ? Since Vancouver is the money laundering capital of North America it only makes sense the HAM money is drying up like Vancouver Island’s drought as the Australian article I posted has clearly pointed out.

http://www.smh.com.au/business/comment-and-analysis/wall-of-chinese-capital-buying-up-australian-properties-20150628-ghztdf.html

It’s also well known the Chinese police are actively hunting this money trail in Vancouver as well. You kill the Vancouver market you can bet it will filter here.

“Chinese police run secret operations in B.C. to hunt allegedly corrupt officials and laundered money”

“Chinese police agents have been conducting secret operations in Canada — a top destination for allegedly corrupt officials — seeking to “repatriate” suspects and money laundered in real estate.”

“The Province found indications in various data sources of large wealth allegedly misappropriated in China and invested in condo and commercial developments and private residences in and around Vancouver.”

http://news.nationalpost.com/news/canada/chinese-police-run-secret-operations-in-b-c-to-hunt-allegedly-corrupt-officials-and-laundered-money

Put two and two together and your rose colored glasses are a bit too Elton Johnish. Didn’t say it will happen tomorrow but it will happen and you can’t ignore the elephant in the room.

Lol…that’s quite the bear logic. Perhaps a China stock bear is bullish for our property. After all, the last 3 Chinese bears markets saw house prices soar. Why would this latest one be any different?

http://i.cubeupload.com/iTEd0D.png

Once all the flippers realize the markets topped out and prices stall by fall, then the listings will show up. Too many HGTV types playing this market. Swing a sledge hammer and paint brush and you’re a property king.

When the benchmark moves a mere $1500 on record sales in 6 years then the jig is up. Denying it will never happen is a recipe for disaster, just need a catalyst and there are many out there. $2.8 Trillion in China stock market value wiped out in 3 weeks is one of them.

http://www.bloomberg.com/news/articles/2015-07-03/china-s-stocks-plunge-to-three-month-lows-as-bear-market-deepens-ibmyo1o1

This is the one I was referring to. Van is near 80% and yet prices are flying higher. Vic looks to be near 40% (or about twice as affordable).

http://i.cubeupload.com/rdNPLt.png

What I find surprising is Victoria used to be less affordable than Van. Now we’re twice as affordable!

Yup, we are definitely seeing some market fragmentation.

I think we could have those kinds of increases in the very desirable areas (anything south of Pandora)… We don’t have the same pressure. The Green Rush is huge in Van. Same with film right now. Film work has moved to Van from Cali since the dollar is down again. So… I think Fairfield will see upward pressure. Sooke not so much….

So you think the new bridge won’t be done by then?

I’m going to have to look up what they mean by affordability. As I see it, real estate is affordable almost all of the time. When it isn’t affordable prices drop and the market becomes affordable again.

Or to put it another way.

Today you buy an affordable home. 3 years from now when it’s time to refinance the interest rate has increased and your home may now be unaffordable to you and you can no longer make the mortgage payments and you have to sell. However the home may still be affordable to someone buying.

Sure, but I could see the 70yr old broadmeader trading down to a more convenient and secure Fairfield flat and banking a boatload of money to travel in the winter.

Over 20% gain from big Sis…

“The region, which includes suburbs such as Burnaby and Richmond, saw the price for detached houses average $1,442,296 last month, up from $1,200,539 in June, 2014, the Real Estate Board of Greater Vancouver said Friday.”

Anyone else think a 20% is in Victoria’s near future? Our (twice the) affordability sure says it could happen.

There’s still a fair amount of listings in the core …

With one of my PCS accounts, I’m still seeing 376 listings for single family homes with the following criteria:

District: ‘Victoria, Victoria West, Esquimalt, Saanich East, Saanich West’

Property Type: ‘Single Family’

Listing Status: ‘Active’

Current Price: Minimum ‘$300,000’

Current Price: Maximum ‘$650,000’

Bedrooms: Minimum ‘3’

Bathrooms: Minimum ‘2’

You’re right there is only a house boat and a tear down listed for under $600,000 south of Pandora. And for the core districts only 20 percent of the total house listings are under $600,000.

Last month half the houses in the core sold between $290,000 to $630,000. And today only 36% of the houses listed for sale in the core are asking under $630,000. It’s a strong sellers market.

Yet when you look at re-sales of the same homes, prices don’t seem to have changed significantly from the last five years.

Such as a house in the Mt. Tolmie hood that sold in May 2010 at $612,500 and just re-sold at $590,000. With the current demand and short supply prices should have been skyrocketing for the last several months.

You shouldn’t be able to find a listing in Victoria that is under a court order to sell. Because with higher prices the owner should have been able to sell their homes before the bank received conduct of sale. Yet there are several listed for sale in the core.

Does that make it a good time to buy?

If Victoria was to get a significant injection of new money, interest rates were to be reduced or credit was made easier to obtain, I think that might lead to higher prices.

Or, if the Governor of the Bank of Canada together with CMHC deliberately targeted first time home buyers that might stimulate sales. What is happening today is so atypical of how a normal market functions that there could be some hidden machinations going on.

@Dasmo

5 years investment window, longer if the economics

25% down on 400$K to 500$K property

Rate of Return targeted on initial investment: 18%-20%/yr

The Sub $600k market isn’t seeing a lot of action because there isn’t a lot of listings. There is almost nothing south of Pandora under that price….

If prices are rising steadily, and at a reasonable rate, then a crash is less likely.

Vancouver and Toronto, I opine are exceptions as that market may be heavily dominated by speculation and not on the benefits of being a home owner occupant. There seems to be considerable injection of foreign capital that may be fueling prices in these cities. The flight of foreign capital, through investment brokers, to developers and onto new projects that stimulate local economies to higher home prices.

In Victoria, our prices may have been flat because we didn’t get the large injection of new money into the market from investors. Our market being dominated by local purchasers. That may be a reason why our prices seem to be capped and are unlikely to rise even in a market with incredibly short supply. The incomes of Victorians simply can’t be stretched much further to allow for bigger mortgages and significantly higher house prices.

Ab asino lanam

You can’t get wool from a donkey

If prices are rising steadily and at a reasonable rate then a crash is less likely.

Vancouver and Toronto, I think, are exceptions as I opine that that market is heavily dominated by speculation and not the benefits of being a home owner occupant. There seems to be considerable injection of foreign capital that is fueling prices in these cities. The flight of foreign capital into cities, through investment brokers, to developers thereby stimulating the local economies to higher home prices.

In Victoria, are prices may have been flat because we didn’t get the large injection of fresh money into our market from outside buyers or investors. Our market being dominated by local purchasers. That may be a reason why our prices seem to be capped and are unlikely to rise even in a market with incredibly short supply. The incomes of Victorian’s simply can’t be stretched much further to allow house prices to significantly rise.

Ab asino lanam

You can’t get wool from a donkey

But would someone looking at buying a two bedroom condo in Fairfield consider a Broadmead home as an alternative?

In my opinion, these areas and types of properties appeal to two distinct target markets and wouldn’t have a direct influence on each other.

Investment-wise, I’m starting to think the way to go next 20 years is ranchers or flats.

http://static1.squarespace.com/static/52012782e4b0707e7a30fda8/t/54766e8fe4b0d56c373f8199/1417047696888/Vic2.PNG

When you consider a Broadmead staircased special averages a million, while Cook St flats go for a quarter of that, I would think the price gap will soon start to narrow.

Definitely stick with Fairfield, James Bay, OB, in that order. Seniors will want high walk scores, shopping, medical, low crime rate, entertainment.

Genworth has been downtrending the past 8 months, looks like the bears are winning and the smart money left big money on the table. What it did 3 years ago means nothing, what it’s doing recently is what’s important.

How short is your investment window if the Johnson Street bridge is a negative?

People are buying imo because prices are going up. Prices are going up because people started to buy. A flat market can’t last forever. And there was no crash. People who had been waiting to buy saw interest rates continue to drop along with small price increases. This triggered more people to enter the market imo which triggered greater prices increases which triggered more people to enter the market for fear of paying more next year.

While prices were flat there was still the possibility of a crash in buyers’ minds and less incentive/urgency to purchase. If I was sitting on the fence about buying today I’d be worried about how much prices will go up over this next year and I’d be ready to buy now.

If a buyer cannot afford to live in Oak Bay, Fairfield or GH or areas where the average price is over $600K, what area is most desirable from an investment perspective:

a/ Saanich East – Royal Oak

b/ Saanich East – Mount Doug

c/ Saanich Core – Gorge Tillicum

d/ Victoria Core – Oaklands

e/ Victoria Core – Fernwood

f/ Esquimalt

g/ View Royal

h/ Saanich West – Glanford

Non scientific, but Gorge Tillicum looks most attractive IMO as most homes are in the 500s and close to town and close to shopping and theater. Esquimalt comes in a close second, but they do have a nasty problem called the Johnston street bridge.

1) Balanced Market 5.0-7.0 MOI

2) June 2015 (Core) 2.1 MOI

Taking a look at it from a “listings” perspective, we would need the 3.0-5.0 months of DOUBLE the normal amount of NEW listings just to get back to balance market. I just don’t see that happening. If sales keeps on being fueled by the factors aforementioned by other posters, we could be in for a “brisk” market for sellers until next summer-2016.

It would not be unrealistic, all conditions being the same, low interest rate environment, high prices in other parts of the country etc…:

1) SFH Prices (Core) up another 5-7% in the next 12 months

HPI easily over 150

2) More action in $600K-$800K market, JJ pointed out it is already up 20%

3) Less action in sub $600K market, just because there will be less listings

4) AND highest price appreciation for CORE areas not called OB, Fairfield, and GH.

5) 2016 BC Assessments are not going to be showing lower numbers either

Unfortunately the price of entry to home ownership keeps on going up, and at least for the next 12 months, IMO, it is going to stay that way or get even worse.

Bears sweat? Better tell the biologists! 😉

I think the hot weather is just downright depressing for all those bears out there. Their coats are all hot and sweaty and their only solace is to crawl back down to the basement suite and resume hibernation. Another year waiting for a crash. Better luck next time bear.

Canada Guaranty and Genworth Financial would be two to short. Maybe HSBC too.

Of course what the bears should have done, after seeing a few of these on the magazine racks, was to start scouting out properties to buy in Victoria and you would now be in a great position to reap capital gains for many years to come.

Plenty of bears have been shorting Canada for 3 years since magazine covers like this one.

An example Globe & Mail from Nov 2012

“housing bears have been telling investors that shorting Genworth’s shares (i.e., placing a financial bet that their price will fall) could be one of the best ways to gamble on the possibility that the market is poised for a dive.”

Right after that article Genworth shares began soaring (go figure) and have since doubled. The renewed interest in shorting by the bears will mean the smart money does opposite, to effectively take their money again.

You haven’t made the money until you sell and that $30K would only pay off the agents and be breaking even.

Not sure where you’re getting the 3 years from as I have only heard of the big US hedge funds shorting Canada since around Christmas and they have done OK if they have been timing part of their bets. Genworth US got smoked from $18 down to 7, and Genworth Canada down from $40 to $28 in April low. Those are big profit percentages for hedge funds. I’m sure they have a longer term outlook than six months though, as last time around they were loaded up a year or more in advance.

The only way that I can think of to “short” real estate is to short those publicly traded companies that are directly related to real estate. Perhaps a real estate company, or a bank or a construction company. An industry that is very reliant on housing sales.

Maybe you could hedge real estate by not closing for a long time. Developers will do this with a long completion date. Buy at today’s prices with a closing date a year from now. If the property goes up in value, the buyer made money and might be able to flip their option to purchase to another buyer. If the property goes down in value, then depending on the size of the deposit the developer could walk away from the deal betting that the seller wouldn’t sue. Best to do this if you live in another country because it’s too expensive for the seller to sue you across borders. Or the purchaser could submit a lower offer to purchase with a take it or “try and sue me” attitude. This works best when the buyer knows that the seller has committed to purchasing another home and is under pressure to close on their deal.

When you lose money – it’s gone and you’re not going to get in back. When you “lose” equity you haven’t lost anything until you sell. All that you’re losing is the ability to finance a larger debt at a lower interest rate than if the loan was not secured by real estate.

I find that some people might get the two confused. My neighbor told me that he bought a new $80,000 car with cash. What he did was use the equity in his home to buy the car. He financed a depreciating asset at a low interest rate of 3% over 25 years. Instead of a car loan over 5 years at 9%. To him equity was the same as cash only because the interest rate is so low. If the cost of borrowing was 10 percent instead of 3 then he most likely would not have bought the car.

The benchmark was up 4.6% y-o-y across the board in Victoria. That’s about $25,000-30,000 tax free money for those who bought a typical house a year ago, and things are looking like it will be much higher by next year. The amount of money people have lost who have been shorting Canada past 3 years…sigh… when will they learn?

http://i.cubeupload.com/1Gqs2x.png

Let’s try to be a bit more selective and look at where 58 percent of the 444 house sales in June were located. And that’s in the core districts of Saanich, Esquimalt, View Royal, Victoria and Oak Bay. Less than 20 minutes driving time from the downtown core during non peak hours.

Sale prices ranged from a low of $290,000 for a small starter home along a heavily traveled road in Esquimalt to a high of 2.5 million for an Equestrian farm on 59 acres in Cordova Bay. Half of the homes selling for under $630,000 with a median days on market of 21 DOM. 36% of the house sales in the core were “Quick Sales” Listed and sold in under 30 days. Selling between 88 to 146% of their assessed values.

There are about 554 houses listed for sale today in the core. That’s 2.14 months of inventory. (MOI)

During June another 337 homes were listed. That’s a New Listings to Sales Ratio (NLS) of 1.3 new listings added for every home that sold. New inventory is coming to the market but it’s more of a trickle than a flood.

Generally, between 5 to 7 MOI, a NLS between 1.5 to 2.5 and a DOM between 30 to 90 days is a balanced market between buyers and sellers with stable prices. Good selection and no great pressure to make an offer.

But with 2.14 MOI, a NLS of 1.3 and a DOM of under 30 days the marketplace definitely favors sellers. Selection is low and the guy behind you, in line to buy the home is waving his cheque book in the air.

When you look at year to date sales activity by price range the homes in the $600,000 to $800,000 have had the biggest increase in sales by some 25% When it comes to the detached housing in the core, the “move up buyers” appear to be driving the market. The problem is that the starter house market is down by almost 15%.

My guess is that the reason why median prices are not increasing in this strong sellers market is because the move up buyers are having problems selling their starter homes. A first time buyer is faced with the choice of buying a new or near new condo or a war shack needing lots of work. In my opinion, the first time buyer is going condo.

Would one think it’s a good time to max out at the beginning of a possible recession ? I think not when everyone is short Canada.

VREB numbers are out, I question some of their theories but they are salesmen after all. For all the extra buying pressure the benchmark price barely moved month to month. Looks like a topping sales/listings chart.

http://www.theprovince.com/business/Canada+already+recession+says+Bank+America+loonie+hammered/11182990/story.html

“threat of higher rates” at least until this past week that is… 😉

No surprise in my opinion with genY entering FTB, Asian wealth, threat of inflation and higher rates, exchange rates, economy starting to ignite… also I think big city folks with $1.5M+ average homes are figuring out what a cheap retirement paradise Victoria is.

There are actually several dates used when describing when a property sold.

The first is the “Meeting of Minds”? You made an offer and it is accepted. This is the most relevant if you’re determining market value.

Then there is the date the subject clauses are removed. That’s the date the real estate board uses. Usually this is a short time after the Meeting of Minds date.

Then there is the date that the sale closes and is registered at the Land Office. Usually that has more to do with private sales and commercial properties because there is little chance of you finding out the previous two dates. This could be months later from when the offer was originally accepted.

Both the dates of when the subjects clauses are removed and the sale closes are shown in the daily hot sheets. You’ll see the same property come up twice on the hot sheets. Once when the clauses are removed and then again when it closes. However, it’s only the date the clauses are removed that is used by board for stats.

That ones for you Introvert 😉

I think the reverse is true. As evidenced by when I bought. Rates were low (2.99%) prices were lower but people weren’t buying. It was nice to take my time and even renegotiate after the inspection (gasp!). Now there is nothing as in zilch as in 0 that fit’s my same parameters on the MLS. I I still think we need some wage growth to really fuel price increases. I know in Van the film industry is booming again. That along with the green rush is fuelling the fire their I believe. We might see some spin off here….

Would the reverse be true: a lack of sales inspires a lack of sales? If so, what changes the trend? What would cause the current market to cool?

Quick question — we bought a house in June with a closing date in August. I assume that counts towards June’s numbers?

It’s simple. Sales beget sales…